Weekly Analysis by zForex Research Team - 2 – 6 December, 2024

Markets Shift as Dollar Rally Ends, Currencies Gain

This week, markets reacted to economic data and policy shifts, with the Dollar Index ending a nine-week rally. Major currencies gained against the dollar, driven by inflation dynamics and central bank signals. Commodities like gold and silver declined on easing geopolitical risks, while U.S. Treasury yields and equities saw mixed performances amid nuanced economic trends.

Key points

- Currencies: The Dollar Index ended the week lower, marking its first negative close in nine weeks, driven by positive data flows and President-elect Trump’s appointment of Bessent, which sparked a pullback. The euro, despite weaker German inflation data and rising rate cut expectations, benefitted from Schnabel’s hawkish remarks and the weakening dollar, closing the week higher. Similarly, the British pound strengthened as market expectations for interest rate cuts were tempered by high inflation, leading the GBP/USD pair to close the week on a positive note. In Japan, the Tokyo inflation rate coming in above 2% fueled expectations for a rate hike, causing the yen to appreciate by nearly 3% against the US dollar by the end of the week.

- Commodities: Gold and silver showed similar performance, both finishing the week lower due to easing geopolitical risks and a weaker dollar. As a result, gold closed its first negative month since June.

- Fixed Income: U.S. two-year and ten-year Treasury yields closed the week lower. The ten-year yield fell to approximately 4.21%, while the two-year yield tested 4.20%.

Macro

CB Consumer Confidence (Nov):

The Conference Board Consumer Confidence Index rose to 111.7 in November, up 2.1 points from October. The Present Situation Index climbed to 140.9 (+4.8), while the Expectations Index edged up to 92.3 (+0.4), staying well above the 80 threshold that signals recession risk.

New Home Sales (Oct):

Sales fell 17.3% MoM to 610,000, marking the steepest drop since 2013 due to hurricanes and affordability issues. The median home price rose to $437,300, while inventory increased to a 9.5-month supply.

RBNZ Rate Decision:

The RBNZ cut rates by 50bps to 4.25%, its third consecutive cut, as inflation slowed to 2.2%. Weak economic activity and subdued employment growth prompted expectations for further easing.

Durable Goods Orders (Oct):

New orders rose 0.2% MoM to $286.6 billion, driven by a 0.5% increase in transportation. Business investment fell 0.2%, following a 0.3% rise in September.

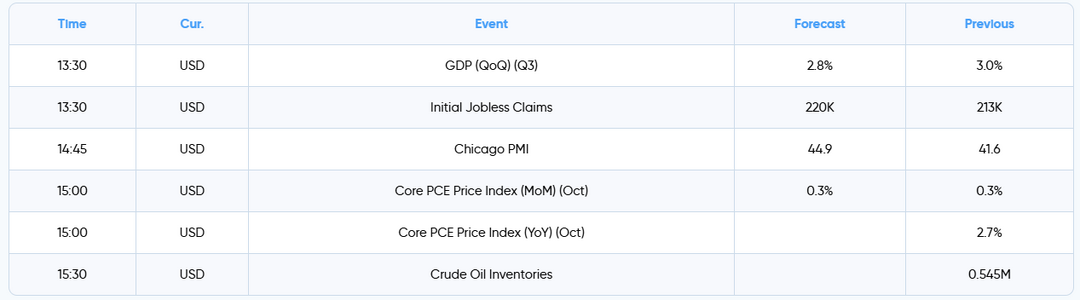

US GDP (Q3):

The economy grew 2.8% annualized, unchanged from initial estimates. Personal spending rose 3.5%, and fixed investment increased 1.7%. Net trade negatively impacted growth by 0.57 percentage points.

Jobless Claims (Nov 23):

Initial claims held steady at 213,000, with the 4-week moving average at 217,000. Continuing claims rose to 1.907 million, the highest since November 2021.

Chicago PMI (Nov):

The index fell to 40.2, indicating contraction for the 12th straight month. Production and employment slowed, while new orders rose slightly above the year-to-date average.

Core PCE Price Index (Oct):

Core PCE rose 2.8% YoY, the largest increase in six months, meeting market expectations.

German CPI (Nov):

Annual inflation rose to 2.2%, the highest in four months, with core inflation reaching 3%.

Eurozone CPI (Nov):

Inflation climbed to 2.3% as smaller energy price declines eased the annual comparison. Core inflation held steady at 2.7%.

Currencies

- Dollar Index: Ended a nine-week rally, driven lower by Trump’s nomination of Scott Bessent as Treasury Secretary, signaling stability and easing drastic policy concerns. PCE data and Fed minutes supporting gradual rate cuts also pressured the index.

- EUR/USD: Gained 150 pips as hawkish remarks from Schnabel and a weaker Dollar Index outweighed weak German inflation data.

- GBP/USD: Strengthened due to tempered BoE rate cut expectations after UK inflation rose to 2.3% in October, coupled with a softer dollar.

- JPY: Tokyo inflation above 2% raised expectations for a BOJ rate hike in December, boosting the yen by 3% this week.

- NZD: Gained despite a 50bps RBNZ rate cut, supported by strong consumer confidence and USD weakness. Tariff threats from Trump added slight pressure.

- CAD: Fell to mid-2024 lows after Trump reaffirmed tariff hikes on Canadian exports, while resilient inflation data limited losses.

- AUD: Strengthened above $0.65, supported by the RBA's hawkish stance on inflation and a weaker US dollar.

Commodities

- Gold and Silver: Both ended the week lower as easing geopolitical tensions and reduced safe-haven demand weighed on prices. Concerns over weak Chinese demand added pressure on silver.

Equities

- Indices: The S&P 500 rose 0.7%, Dow Jones gained 1%, and Nasdaq edged up 0.2%.

- Decliners: Nvidia (-8%), Google (-4.5%), and Tesla (-3.5%) weighed on tech stocks.

- Top Performers: Microsoft (+1.4%), Meta (+1%), Apple (+3%), and Amazon (+1.3%) delivered gains.