You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Best Thread Correlation Trading - Basic Ideas and Strategies

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

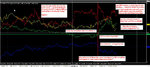

theyre coming again arnt they !!!

this is my trading inexperience showing......i'm not sticking firm to the trades I see coming and only trying to trade on the breaks of S/R.........a little trust maybe and buying on the dips would have got me in earlier without small pippage losses

N

this is my trading inexperience showing......i'm not sticking firm to the trades I see coming and only trying to trade on the breaks of S/R.........a little trust maybe and buying on the dips would have got me in earlier without small pippage losses

N

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

19th Jan Corrie play of the day ?

all explained below.............hindsight is 20/20 vision 😛

E/U moved 100 pips down from here before starting to retrace.......

looking back at thread dunce boy moi was still waiting for this to happen on post 1181.... so it was probably a shade after 9.30 when the fireworks began and breaches were seen

nice........👍

N

all explained below.............hindsight is 20/20 vision 😛

E/U moved 100 pips down from here before starting to retrace.......

looking back at thread dunce boy moi was still waiting for this to happen on post 1181.... so it was probably a shade after 9.30 when the fireworks began and breaches were seen

nice........👍

N

Attachments

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Lord Flasheart

Legendary member

- Messages

- 9,826

- Likes

- 985

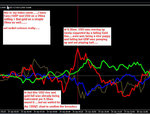

I give you my take on a very basis correlation and strength method i use that can be very accurate with good r/r ratio. i look at the following charts for the strongest and weakest currency. Simply then I sell the weakest against the strongest. I look at gbp/jpy, jpyusd,gbpusd,eurusd,eurgbp,eurjpy.

for example if you looked at those charts at 7.17 you would see £ down against jpy,$ and eur , while the eur was down against jpy but up against the £. This clearly makes the £ the weekest currency and the $ the strongest. So i would sell the gbpusd. I make sure all the charts are trending one way or the other as this gives a clearer picture.

for example if you looked at those charts at 7.17 you would see £ down against jpy,$ and eur , while the eur was down against jpy but up against the £. This clearly makes the £ the weekest currency and the $ the strongest. So i would sell the gbpusd. I make sure all the charts are trending one way or the other as this gives a clearer picture.

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Re: 20th overnight

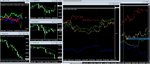

hi all

working hard now...........quick peek though below

hmmm...tag slowly turning down nicely since my comments above....usd could lock into that channel though methinks and golds had a good run up on the 5m 20ma (not shown) so may flatten/fall for a while driving usd up a little..........

Europair have fought back upwards well and heading into resistance territory ?....

i'd lean towards a flat or sell G&E into USD scenario for next 30mins....watch the price action for entries

N

tag up supported by the nikkeis fall (bottom left chart)

usd looks like it may fall as on index corrie (top left) gold fallng cannot push usd up any more......

good trading and be careful out there

N

hi all

working hard now...........quick peek though below

hmmm...tag slowly turning down nicely since my comments above....usd could lock into that channel though methinks and golds had a good run up on the 5m 20ma (not shown) so may flatten/fall for a while driving usd up a little..........

Europair have fought back upwards well and heading into resistance territory ?....

i'd lean towards a flat or sell G&E into USD scenario for next 30mins....watch the price action for entries

N

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

I give you my take on a very basis correlation and strength method i use that can be very accurate with good r/r ratio. i look at the following charts for the strongest and weakest currency. Simply then I sell the weakest against the strongest. I look at gbp/jpy, jpyusd,gbpusd,eurusd,eurgbp,eurjpy.

for example if you looked at those charts at 7.17 you would see £ down against jpy,$ and eur , while the eur was down against jpy but up against the £. This clearly makes the £ the weekest currency and the $ the strongest. So i would sell the gbpusd. I make sure all the charts are trending one way or the other as this gives a clearer picture.

Hi Julian

no disagreements here my friend...👍

you have the 6 pairs needed to view the relative strengths of the 4 currencies we focus on here for short term/scalping calls

my 1000/1 corrie chart is pulling in this information and summarising it onto the 1 chart for analysis and on the 1000/1 setting you get the real time action....the lower MA's will give you more delayed and softened movements of the currencies

download my corrie and isolate the 4 currencies you use....if you use Ma's to identify strength I would recommend you code your favoured Ma into the setting and use this to assist your other methodologies as it will highlight the crossovers on that Ma easily

for example if you looked to trade a currency that has to be above the 20ma generally vs the others you would code 20/1 into the ma/Delta setting and the result is below (5m)

for example - when phreddy (where is he 😏) posts we are using the full G8 on a 60ma delta1 to replicate the 3 ducks methodology which identifies trades where the 60ma crossovers are used as entry points

i then sprinkle in some core correlation strategies (tag moving together ideally etc etc) plus look for additional clues from other markets (Equities, commodities)to assist the signals + price action rules for the pairs we isolate to trade

Regards

Neil

Attachments

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

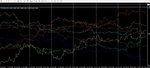

😛if you're wondering what the hell is falling at the moment (as our fantastic 4 are not)... load up a G8 1000/1 on 5m and its the commodity currencies generally that are on the bearish side at present today

N

PS look at the swissie (Grey).....I sometimes wonder if it has a pulse at all 😛

N

PS look at the swissie (Grey).....I sometimes wonder if it has a pulse at all 😛

Attachments

Last edited:

Lord Flasheart

Legendary member

- Messages

- 9,826

- Likes

- 985

sorry to be a pain, ive just downloaded the indicator and tried to put it into esignal,will it work onthere and if so how do I put it in,many thanks

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

sorry to be a pain, ive just downloaded the indicator and tried to put it into esignal,will it work onthere and if so how do I put it in,many thanks

hi julian

sorry my friend shes a metatrader programme so has to be loaded through a broker like CMS or ODL who offer free feeds/Charts for metatrader

just run it in background.........

N

Lord Flasheart

Legendary member

- Messages

- 9,826

- Likes

- 985

thanks, not sure what do you mean by run in the background. Is opening an account the only way. I have enough accounts lol

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

thanks, not sure what do you mean by run in the background. Is opening an account the only way. I have enough accounts lol

hi julian

sorry but yep load up mt4 rom metatrader via odl free 30 day trial (it then seems to stick forever) .......never seen many Strengthmeters on other platforms and if they are theyre usually part of a mega $$$$ package to use them 😢

sorry

N

jrplimited

Active member

- Messages

- 249

- Likes

- 1

Hi N and everyone else,

Straight in....

GU; Watched opening move down turn into a sideway drift which flirted with my 62508 sell target before going up, so set a buy stop target at 62868 and price damn well flirted with this as well before dropping down! Eventually 09:25 bar pulled me into market (news release for UK?) and we were off skywards.... For three bars! I let price drift having pulled initial SL up to three quarters of prior big bar and 09:50 bar low kicked me out for 7 pips profit. Couldnt find any other decent setups and was definitely not (just for a change!) tempted by the 11:10 biggish down bar and wanted a closing bar below 62548 to warrant a short.

EU; Looked sort of weird to me chart wise for earlier session. Entered short at 08:05 and price immediately consolidated on me before trundling off in opposite direction. Had to do a hurried SaR on 08:45 bar for a 18 pip loss and let price slowly drift up with second trade and after smallih 09:10 momentum bar, moved SL to TS at its low and got taken out four bars later for 4 pips profit - might have been better to trail tighter but I wanted to give price a bit of room. Third trade entered short on opening 10:10 bar, watched price go against me for an acceptable (eyes tightly closed!) MAE and roll over then do another smaller (lower highest high) retrace before at last letting go and shooting southwards. Didnt like that fairly strong looking 11:20 bar so ditched immediately on closing for 9 pips profit. And of course price then rolled over again to drop further without me on board!

EG; This pair was all over the place this morning, and having had to wait for either E or G to show its hand properly I kept out of this and even when E made its small late morning short move down, there still wasnt any decent setups for me most likely due to G flopping around without a defined direction.

Tough and fairly volatile morning so caution if trading this afternoon - trade well and regards,

Simon.

Straight in....

GU; Watched opening move down turn into a sideway drift which flirted with my 62508 sell target before going up, so set a buy stop target at 62868 and price damn well flirted with this as well before dropping down! Eventually 09:25 bar pulled me into market (news release for UK?) and we were off skywards.... For three bars! I let price drift having pulled initial SL up to three quarters of prior big bar and 09:50 bar low kicked me out for 7 pips profit. Couldnt find any other decent setups and was definitely not (just for a change!) tempted by the 11:10 biggish down bar and wanted a closing bar below 62548 to warrant a short.

EU; Looked sort of weird to me chart wise for earlier session. Entered short at 08:05 and price immediately consolidated on me before trundling off in opposite direction. Had to do a hurried SaR on 08:45 bar for a 18 pip loss and let price slowly drift up with second trade and after smallih 09:10 momentum bar, moved SL to TS at its low and got taken out four bars later for 4 pips profit - might have been better to trail tighter but I wanted to give price a bit of room. Third trade entered short on opening 10:10 bar, watched price go against me for an acceptable (eyes tightly closed!) MAE and roll over then do another smaller (lower highest high) retrace before at last letting go and shooting southwards. Didnt like that fairly strong looking 11:20 bar so ditched immediately on closing for 9 pips profit. And of course price then rolled over again to drop further without me on board!

EG; This pair was all over the place this morning, and having had to wait for either E or G to show its hand properly I kept out of this and even when E made its small late morning short move down, there still wasnt any decent setups for me most likely due to G flopping around without a defined direction.

Tough and fairly volatile morning so caution if trading this afternoon - trade well and regards,

Simon.

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Hi N and everyone else,

Straight in....

GU; 7 pips profit.

EU; a 18 pip loss and 9 pips profit.

Tough and fairly volatile morning so caution if trading this afternoon - trade well and regards,

Simon.

hmm.....not tooo much damage there partner....better luck this pm

looking at the overnight action we may hae to start trading at 1am for more steady signals.....😛

N

Similar threads

- Replies

- 0

- Views

- 3K