NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

the ole corrie index is not a bad little tool actually I am gradually concluding....

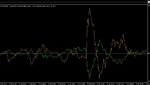

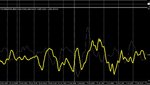

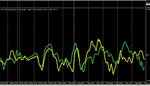

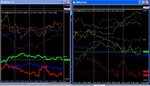

heres it stripped down on a 5m 20ma corrie setting + a 4h chart with just the USD on there (not replicatable on a pair chart) and gold.....look at the crosses )......interesting ?

remember - most people can only compare traditional Usd pairs to the gold price (eg G/U or E/U) and then proclaim that there is x or y % correlation........but we go one step further dont we ....😏

my humble opinion is that GBP and a few of the other G8's have no relationship whatsoever with gold........😱

its the direct 1 to 1 USD vs Gold that is the important relationship as seen through the corries eyes (or any good strength meter)....nothing else can do it 👍

the FXcorrelator "brings currencies to life" and shows their unique characteristics that remain unseen on normal pairs charts.....this thread is all about correlation and you cannot talk forex correlation without identifying the participants seperately in their own natural environment

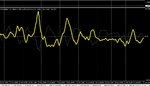

so heres Correlation 101..........USD generally moves oppositely to Gold price (very useful to use in any USD forex pair play) and when it doesnt that is just as important as it gives you an indication of USD's strength is resisting the "normal" bias....

later........

N

heres it stripped down on a 5m 20ma corrie setting + a 4h chart with just the USD on there (not replicatable on a pair chart) and gold.....look at the crosses )......interesting ?

remember - most people can only compare traditional Usd pairs to the gold price (eg G/U or E/U) and then proclaim that there is x or y % correlation........but we go one step further dont we ....😏

my humble opinion is that GBP and a few of the other G8's have no relationship whatsoever with gold........😱

its the direct 1 to 1 USD vs Gold that is the important relationship as seen through the corries eyes (or any good strength meter)....nothing else can do it 👍

the FXcorrelator "brings currencies to life" and shows their unique characteristics that remain unseen on normal pairs charts.....this thread is all about correlation and you cannot talk forex correlation without identifying the participants seperately in their own natural environment

so heres Correlation 101..........USD generally moves oppositely to Gold price (very useful to use in any USD forex pair play) and when it doesnt that is just as important as it gives you an indication of USD's strength is resisting the "normal" bias....

later........

N

Attachments

Last edited: