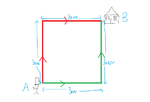

Don't take the p1ss, I was gonna introduce a toll on the green route, and then switch the postman and house for positions.

The key point is that he thinks that the trader who is flat is, in some way, "missing out" on something that the trader who is long/short has. The fact is that there is nothing to choose between them - any profit or loss that one trader may make can equally be made or lost by the other. The only difference is that one incurrs higher costs.

If, by being long/short, the markets behaved differently, then there could be an argument for that. But they don't, because nobody knows or cares whether you are "long/short2 or "flat". All the mkt knows is that you've bought and you've sold.

I mean, let's say you have to choose between investing in two trading systems - the "blue" system or the "green" system. You are never going to know the rules of each system, they could be the same or they could be different. All you know is that the "green" system has higher costs.

Which do you choose? The "blue" system, obvioulsy, right? With nothing to choose between them, pick the one with least cost.

That's what we've got here.