You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Giorrgi

Well-known member

- Messages

- 253

- Likes

- 0

You have to remind yourself to monitor the overall picture. This means focusing only on your chart and trying to scrape up all the bullish/bearish clues. I know this is not always easy to do but it will keep you (mostly) out of bad trades.

Hey BLS, thanks for your advice. I'm still having trouble with this. Most of the time I look at a chart and just see random candles. I read and reread the book. I'd like to make a sort of list of things that I have to look out for. Most of them are probably different technical chart formations : double/triple tops/bottoms, head and shoulders, cup and handle or the Mm/Ww pattern bob talks about. Also, I've learned to look out for 50 or 00 vacuum/magnet effect, 20 level as potential resistance/support, possible retraces to look out for before taking on a continuation trade, false breaks as indication that prices might go in the other direction. I know it's a daunting read but I'm trying to make a list to remind myself all the time... because else I tend to just stare blankly at the chart. Can you remind me of anything else I might've forgotten in this of "technical clues" ?

Also I'm having major trouble with this concept of "tension" that we use all the time. I very frequently take BBs that only look like BBs because they have a clear barrier line and maybe a couple of dojis towards the end but no tension. Because of this the "break" doesn't really "break" anything but is a simple upside tick. Therefore, I'm looking for ways to "detect" the tension other than by instinct. I've noticed that when prices bounce inside the block or the range (Ww or Mm patterns basically), it's a good indicator. But, on your second chart at 7:30 you point towards a line of dojis saying that it was building nice upwad pressure, whereas to me it doesn't look like anything special. So, in regards to "tension" and "pressure", should I be looking for something else other than what I've mentioned already?

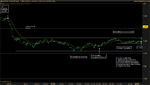

With that said here are two trades I took today. Both failed... but at least I'm fairly confident that the second trade was a valid one, whereas the first can be attributed to my over eagerness.

Once again sorry for the long message that doesn't bring anything new to the table.

Attachments

BLS

Established member

- Messages

- 642

- Likes

- 229

Sounds about right but I don't keep a list myself so I might be missing some. I guess I have the most trouble with remembering to use angular lines as an aid.Hey BLS, thanks for your advice. I'm still having trouble with this. Most of the time I look at a chart and just see random candles. I read and reread the book. I'd like to make a sort of list of things that I have to look out for. Most of them are probably different technical chart formations : double/triple tops/bottoms, head and shoulders, cup and handle or the Mm/Ww pattern bob talks about. Also, I've learned to look out for 50 or 00 vacuum/magnet effect, 20 level as potential resistance/support, possible retraces to look out for before taking on a continuation trade, false breaks as indication that prices might go in the other direction. I know it's a daunting read but I'm trying to make a list to remind myself all the time... because else I tend to just stare blankly at the chart. Can you remind me of anything else I might've forgotten in this of "technical clues" ?

Also I'm having major trouble with this concept of "tension" that we use all the time. I very frequently take BBs that only look like BBs because they have a clear barrier line and maybe a couple of dojis towards the end but no tension. Because of this the "break" doesn't really "break" anything but is a simple upside tick. Therefore, I'm looking for ways to "detect" the tension other than by instinct. I've noticed that when prices bounce inside the block or the range (Ww or Mm patterns basically), it's a good indicator. But, on your second chart at 7:30 you point towards a line of dojis saying that it was building nice upwad pressure, whereas to me it doesn't look like anything special. So, in regards to "tension" and "pressure", should I be looking for something else other than what I've mentioned already?

Sorry I should have made it clearer. I see bullish pressure because after that small double bottom price retested that area, built up, and moved on. Price sort of moves in a stepwise fashion and not in a strong move that is likely to exhaust the bulls near the top. You might benefit from rereading the BB chapter. I think Bob does say (I can't remember though, haven't reread BB chapter in awhile, might have been the IRB chapter) that the BB setup itself is quite meaningless without considering the context of the overall price action. You have to know WHEN to start looking for trades. I used to fall for the same traps you describe. I used to trade BB's just anywhere I saw a signal line. But you have to read the overall picture first and try to come up with clues that might hint at a possible future direction. That sounds like it should be simple but I think it's one of the hardest things to do, not least because it's easy to get caught up in the moving price action or the possible development of a tradeable setup.

That DD trade doesn't look terrible but you do have the accept the risk of a 20 retest (though that seems like likely since it was tested before already).With that said here are two trades I took today. Both failed... but at least I'm fairly confident that the second trade was a valid one, whereas the first can be attributed to my over eagerness.

For that IRB you could have moved you tipping point down the previous swing up before price broke past the previous low (so new tipping point is 2 pip below your IRB barrier). It would look bad for the bears if the bulls managed to print a false low so it would make sense to tighten your stop that the swing.

ptsnu

Member

- Messages

- 89

- Likes

- 0

Thanks for the replies guys. Yes, I admit taking it on the chin is prob the best attitude. In my case, I don't have trouble about being wrong, or right, but is the fact that I spent so much time, of high focus, and a bar of less than 15 seconds defined it and change it all, at the very end.

Mr. Bob mentions something about 1 bar capable of changing it all, and this one certainly must be one of those.

At least, we are all very aware of the MManagent issue, that is above our mortals psycollogy or T.Analysis matters. If we respect that deity, we should be ok on the long run.

Mr. Bob mentions something about 1 bar capable of changing it all, and this one certainly must be one of those.

At least, we are all very aware of the MManagent issue, that is above our mortals psycollogy or T.Analysis matters. If we respect that deity, we should be ok on the long run.

Today was certainly a test of will. Angry that my first TP did not automatically take after hanging out at +10 for a few seconds, and even more at myself for not manually closing the order (greed), I took a revenge trade shortly thereafter (greed), and then left my desk for an hour, with predictable results. A bullish buildup made me take another spill later on (thinking I saw a RB when it was really just a trend) -19 pips was the cost of doing business, but may be chalked up more to overconfidence based on recent gains.

Dust yourself off and try again! 😆

Dust yourself off and try again! 😆

Attachments

Last edited:

matty_dunn

Active member

- Messages

- 188

- Likes

- 17

Thank you virtuesoft and ptsnu for sharing pics of your workstations. It's helps.

So virtuesoft, do you trade 3 different markets simultaneously using Bob's method?

So virtuesoft, do you trade 3 different markets simultaneously using Bob's method?

Still in revenge mode, but thinking harder and trying to exercise more patience. Just caught 15 pips off of a very interesting Asian market trade.

Props to Bob Volman! 😆

I was so confident in this (my folly) that I set a stop loss of-10 (what's a tipping point?), and increased my TP to 25 pips (explained in the chart comments). I closed out before that.

I find myself happy after this trade, which is to be expected, but should be nullified if I expect to make a career out of this. After all, I'm still 4 pips down on the day. But this trade sure says a lot about the method!

Props to Bob Volman! 😆

I was so confident in this (my folly) that I set a stop loss of-10 (what's a tipping point?), and increased my TP to 25 pips (explained in the chart comments). I closed out before that.

I find myself happy after this trade, which is to be expected, but should be nullified if I expect to make a career out of this. After all, I'm still 4 pips down on the day. But this trade sure says a lot about the method!

Attachments

Last edited:

virtuesoft

Member

- Messages

- 94

- Likes

- 2

Thank you virtuesoft and ptsnu for sharing pics of your workstations. It's helps.

So virtuesoft, do you trade 3 different markets simultaneously using Bob's method?

Yes, I trade EURUSD, EURJPY and USDJPY. I've also been keeping an eye on GBPUSD a bit recently as it has been moving well. EURJPY provides the most opportunities so I focus mainly on that.

Giorrgi

Well-known member

- Messages

- 253

- Likes

- 0

Excellent day in hindsight. I wasn't there to see most setups but some were textbook quality.

I did take 3 trades, 2 I consider to be valid and another one is due to my nasty habit of taking lame BBs. Only +2 (paper) pips. Which is disappointing in light of all the action.

I did take 3 trades, 2 I consider to be valid and another one is due to my nasty habit of taking lame BBs. Only +2 (paper) pips. Which is disappointing in light of all the action.

Attachments

Giorrgi

Well-known member

- Messages

- 253

- Likes

- 0

Still learning. Started looking at setups more which allowed to spot some block breaks which actually broke, but I didn't assess overall conditions that well most of the time so those breaks got shut down. Probably only half of the trades that I took were "valid". -7 pips. Kinda hard to face the fact that I'm still far from the results I want. I wanted to start trading on a real account on april but it's too soon. *Personal note over*.

As far as actual learning... I'd really like to know if there was a way to detect the bear RB/trap that I traded on chart 2.

As far as actual learning... I'd really like to know if there was a way to detect the bear RB/trap that I traded on chart 2.

Attachments

Here's something that may help with direction as to whether buying bottom(s) vs selling the top(s)

I prefer an hourly candle for the highest time frame

Mull over the chart and note where the current candle opened in relation to the previous

Compare London to Germany, for me it's -5 and -6 GMT respectively

Then I'll look at the 4am est to the 3am etc etc

And now kick in Bob's most appropriate methodology

-Bill

EDIT

The chart is on /6E euro futes

I prefer an hourly candle for the highest time frame

Mull over the chart and note where the current candle opened in relation to the previous

Compare London to Germany, for me it's -5 and -6 GMT respectively

Then I'll look at the 4am est to the 3am etc etc

And now kick in Bob's most appropriate methodology

-Bill

EDIT

The chart is on /6E euro futes

Attachments

Last edited:

BLS

Established member

- Messages

- 642

- Likes

- 229

Still learning. Started looking at setups more which allowed to spot some block breaks which actually broke, but I didn't assess overall conditions that well most of the time so those breaks got shut down. Probably only half of the trades that I took were "valid". -7 pips. Kinda hard to face the fact that I'm still far from the results I want. I wanted to start trading on a real account on april but it's too soon. *Personal note over*.

As far as actual learning... I'd really like to know if there was a way to detect the bear RB/trap that I traded on chart 2.

It's ok to start with a live account...just keep the units small. You can try OANDA (though if I recall correctly they raise the spread to 1.2 after the US open, and when economic numbers get released) and trade the smallest unit possible so you can get a feel for live execution or some other broker that allows micro lots.

As for that RB in your second chart, there is some support around the 50 area but I think the bigger problem was the news release at 12:30 (8:30 NY time) it wasn't anything major like an interest rate decision and you really don't know how the market will react after the release. Bob says not to worry about the less major news releases but I like wait and see. Personal preference I suppose.

The second box you labeled was a very interesting pattern. It reminds me of chart 10 from week 6, although the overall context was different. Chart 10 showed upward pressure, making it a continuation pattern. Today's chart made it look more like a reversal pattern (though price was retracing that earlier spike from 12:30 GMT). I thought it built up nicely but wasn't sure of the context so I passed it up.

Attachments

matty_dunn

Active member

- Messages

- 188

- Likes

- 17

Still learning. Started looking at setups more which allowed to spot some block breaks which actually broke, but I didn't assess overall conditions that well most of the time so those breaks got shut down. Probably only half of the trades that I took were "valid". -7 pips. Kinda hard to face the fact that I'm still far from the results I want. I wanted to start trading on a real account on april but it's too soon. *Personal note over*.

As far as actual learning... I'd really like to know if there was a way to detect the bear RB/trap that I traded on chart 2.

I took the same trade forgetting that a major figure (CPI) was being released about 30 seconds after this trade was triggered. Not a smart move in hindsight. It could have paid off, but somewhat of a gamble in my opinion.

And in response to your "personal note" - I'm in the same situation. It's tough when things aren't progressing as one would like. Just remember, with each failure, obstacle or difficultly overcome, you're one step closer to success.

Also, expectation is what causes pain. I find it helpful to try and let go of expectations and focus on the process. Just concentrating on learning about the market and especially myself, with progress, not perfection, being the goal.

I'm sure all the hard work will pay off in the end, and as we all know the pay off can be substantial.

BLS

Established member

- Messages

- 642

- Likes

- 229

Thanks BLS !

One thing, how do you recall these charts so perfectly??? I mean I remember looking at that chart, but I had completely forgotten it. You make me look like a very lazy student.

It just so happened that I reviewed that chart yesterday. I have to review them from time to time or I start to forget and stray away from the method. Same with rereading the book. It may help to copy the more important charts (the ones that introduce those visual cues to help you read price action) into a Word document or OneNote journal for easy access.

Still learning. Started looking at setups more which allowed to spot some block breaks which actually broke, but I didn't assess overall conditions that well most of the time so those breaks got shut down. Probably only half of the trades that I took were "valid". -7 pips. Kinda hard to face the fact that I'm still far from the results I want. I wanted to start trading on a real account on april but it's too soon. *Personal note over*.

As far as actual learning... I'd really like to know if there was a way to detect the bear RB/trap that I traded on chart 2.

I also got caught on that trade. Didn't know there is going to be a news release. But what really messed up my day, was that I didn't take that trade on your chart 3 bottom. I was worried about counter trend. After that I took a inferior nonsense trade out of impatience and let it stop out all the way. This is a bigger problem for me than finding setup's. Be patience and you get there. There is a lot to learn.

Similar threads

- Replies

- 15

- Views

- 8K