Thanks BLS, I had the chance to apply your advice yesterday. I thought this whole week was great in terms of setups and also the breaks actually working out. Anybody else noticed this as well ?

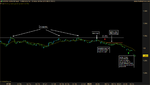

My trades from yesterday. Tipping point idiocy kept me from making some serious (paper) pips.

Hi Giorrgi,

I Like the first trade and think it is valid, despite shorting in the lows. There was previous support in 60 area but the price action leading up to the break negated this. The market definitely looked like it wanted to trade lower.

With the second trade - I think it was a little premature and with not enough squeeze. However, you are right - the initial TP should have been at 41 and not have moved until a new low was made. I'm thinking the best entry was the break below 36 with a stop at 41.

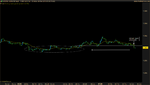

I also took the trade you labelled as an ARB that was 1 pip short of your barrier. I guess I saw it as more of a DD or small block which had the added benefit of stalling in previous support and also putting the 20 level to work in favour of the trade.

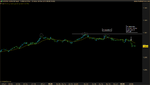

I agree that the trade on your third chart is aggressive, especially with the triple bottom just to the left. And again, some squeeze before entry would be more preferable. I also agree with your comment on the TP. I think if you're going to take trades like this you have to give them a little more room.

I believe your last trade (DD) is valid. I am usually nervous about these type of continuation trades straight into the 00 level after they have already been touched. It will be interesting to see if Bob took this trade. Well done on managing the trade!

I agree with you about the abundance of opportunity. However, I had a week of trying to trade a little more intuitively with poor results (thinking I'm a little too smart). Just a reminder that I need to stick to a plan. I definitely feel more in control that way too.

Looking forward to seeing Bob's charts.