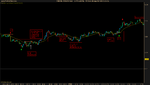

well i goofed up this morning, lol. I took this rb (which i'm not sure it had the best buildup) into a round number zone. It definitely needed one more lower high going into a round number zone, but i had just woken up, glanced at the chart and forgot to check the levels before i got in. I guess i treated it as a bb which was the wrong way to approach it, because it was obvious that i should've been looking at it like an rb or waiting for an irb.

Two questions about this trade.

1. Should my tipping point have been the bottom of the range? I waited until it passed that last high within the range before the breakout, but that was like a 7 pip loss. Stupid on my part. There were plenty of good touches on that rb line that i feel like if it didn't hold up, i should have cut it. If there was a tighter push before the barrier broke, maybe i could have stayed in.

2. If it wasn't in a round number zone, should i have taken this trade?

Next, i missed that irb which i spotted, but decided not to take. I think this was a better setup than the first because the box contained four lower highs.

Then i missed the 2nd break of the box. You can see five lower highs and a couple double tops before the rb broke, so even though it doesn't compress a ton at the barrier level, it really doesn't get more bearish than that. This was probably the easiest setup on the chart.

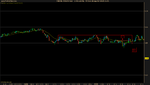

Then finally i missed an irb. The stop wouldn't have been that economical so i didn't like it. I spotted it, but was just too slow to evaluate the positives/negatives of the setup. Still, it's probably one of the most risky setups in this chart. After looking at it, it has round number support and is at a third higher low. There are basically 2 double bottoms before it (not quite, the bottoms of both of them are 1 pip apart, but still...) i did not like that top at 6:15 and that's the main reason i didn't take this trade. Yes, it was 3 hours before, but it was within 200 bars on the chart. I can't decide what my default should be and am still trying to figure that out. Since the market has been a bit slower lately, i am not sure if i should still disregard everything past the last 2 hours even if it's only, say 100 or 150 bars on the chart.

Yesterday i clicked buy on a valid sb setup, but had some computer problems and it didn't execute. Bummer! That would have me in the positive this week, but right now i'm sitting at 0-1. I am feeling good about my progress with identifying irb's and bb's though. That's been my week area and i feel like i am seeing a gigantic improvement.

If anyone has any thoughts on these setups let me know, the feedback on this forum has helped me a lot and i've only been on here for a week. So i would just like to say thanks. Had i played this chart correctly, it could have been a very nice morning. I am sure it will come with experience.