but I find handling myself, my emotions, my discipline etc etc the hardest thing by a mile.

Sorry for the rant, especially since I know this thread is primarily related to discussing set-ups/trades, but I would be very interested in what people have to say about how they deal with the learning process, set backs, their emotional/mental state etc.

It's hard to fight boredom but if you set reasonable expectation and view your trading losses as tuition paid instead of punishment, you don't get angry if you have a loss. I myself don't expect to get consistently profitable soon.

I started writing a trading journal in October, every day I document lessons learned, both from fellow traders here and from my own trading, and any new ideas I learned. Some recommends that you write down your emotion as well. I haven't done that but I think it's a good idea, esp. if it's easy for you to get angry and frustrated. I should've reviewed the journal every week but I've been too busy studying Bob's charts to do that. Just to list some of the mistakes I've written in my journal:

1) Spent too much time adjusting the position of boxes, tipping points, etc., on the chart;

2) In a pullback trade, went long when price was well below the ema;

3) Manually changed stop level in the trading platform.

I found that by writing down a mistake, I may make the same mistake one more time, but not repeatedly (so far never twice again or more).

There are a lot of ways to get more disciplined, one just needs to find one that's best for him and stick to it (which is the most difficult part).

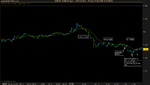

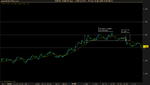

Also I'm inspired by Bob's charts. Though I cannot see everything he sees, there are setups that I shouldn't have missed every week. Just by knowing that gives me the motivation to study harder and stay calm. Once I can see more valid setups I won't get bored as easily as I do now.

Not much advice I can give you but just to share my experiences. Have a nice weekend.