samich1262

Well-known member

- Messages

- 293

- Likes

- 3

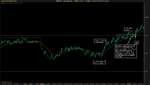

1/ DD - I can't really complain that it didn't go my way if you look at the point from which the trend initiated, was I supposed to even trade this? I am losing most pips on DD setups because it's so easy to see them everywhere. I have to learn to pass on most of them.

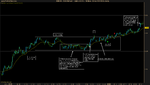

2/ RB - This setup also looks a little akward, but because the price was moving up and down all day and this setup is on the upper side of the chart, I felt like taking it. High odds or not?

1. Hmm, looks ok... I have skipped a lot of DDs that don't have significant compression, but I looked at the book and it probably looks ok. Might have been able to lower your tipping point a pip or two to match that FB to the upside, but that's kinda up to you.

2. I feel weird about breaks like that with the blocky action to the left. I'm avoiding them for now.