You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

bangkoker

Well-known member

- Messages

- 314

- Likes

- 17

Just back at the screen and I see my target was missed by 1 point. anyway, I'm out here: not a bad day and it's more imortant to be putting money in the bank than be totally right.

I think within 1 point is right enough. I was only lucky to check when it was hovering near target and get out as I was risk adverse.

Also think when range is over 40, I will look at trailing stop. We'll see

Good results, I am guessing you closed out for circa 20 pts.

I think within 1 point is right enough. I was only lucky to check when it was hovering near target and get out as I was risk adverse.

Also think when range is over 40, I will look at trailing stop. We'll see

Good results, I am guessing you closed out for circa 20 pts.

No, made +33pts net today, long at 5460.8 10:16, closed manually at 5493.8 17:42. Happy with that.

I still can't believe this system.

StephenMcCreedy

Active member

- Messages

- 168

- Likes

- 3

i got short at the low of the dow's 2.30-4pm range at 10430. it's now hovering around even but it did go up 40 odd points at one point but my plan was to hold to close so that is what i am going to do. not nice to see paper profit evaporate but more important is the learning that this figure did seem a line in the sand what once crossed led to a lot more weakness. i am going to try the same again tomorrow.

StephenMcCreedy

Active member

- Messages

- 168

- Likes

- 3

sounds good, what is interesting is how often the levels from 8-10 become important the next day. for example the low for the day so far is the high of the 8-10 from yesterday.

russell and dow transport didn't move higher last night along with the dow and s&p. i think we might see a breakdown so am looking to short the 8-10 range low.

russell and dow transport didn't move higher last night along with the dow and s&p. i think we might see a breakdown so am looking to short the 8-10 range low.

sounds good, what is interesting is how often the levels from 8-10 become important the next day. for example the low for the day so far is the high of the 8-10 from yesterday.

russell and dow transport didn't move higher last night along with the dow and s&p. i think we might see a breakdown so am looking to short the 8-10 range low.

That's not data i'm collecting as earlier session's prices, trends etc. seem (so far) not to influence the Big Ben win rate. It would be possible to collect this, but a bit tricky to gauge objectively how important is an important level: e.g. a level from yesterday could establish a level of support/resistance today that lasts 90% of the session. But if it then fails in the last hour, how important was it really?

StephenMcCreedy

Active member

- Messages

- 168

- Likes

- 3

i agree, starting each day with an open mind is a good idea. i think the fact the prev bb levels seem to show an affect the day after add credibility to them, no level holds forever for a level you can identify to hold the next day is something tradable albeit not in keeping with this thread i guess.

i'm going to trade it on the dow. when i leave each evening i'm going to place an order at the 2.30-4 range on the dow and leave till close. last night it worked ok.

as i said i have all the futures data if you want to back test further. the results in terms of win rate etc will be the same more or less and more reliable.

i'm going to trade it on the dow. when i leave each evening i'm going to place an order at the 2.30-4 range on the dow and leave till close. last night it worked ok.

as i said i have all the futures data if you want to back test further. the results in terms of win rate etc will be the same more or less and more reliable.

i agree, starting each day with an open mind is a good idea. i think the fact the prev bb levels seem to show an affect the day after add credibility to them, no level holds forever for a level you can identify to hold the next day is something tradable albeit not in keeping with this thread i guess.

i'm going to trade it on the dow. when i leave each evening i'm going to place an order at the 2.30-4 range on the dow and leave till close. last night it worked ok.

as i said i have all the futures data if you want to back test further. the results in terms of win rate etc will be the same more or less and more reliable.

One of BB's main drawbacks is that it's one trade per day. If you can glean more from the BB range to allow later trades either same session or subsequently, that's a great way to add value.

I think BB should be worth pursuing on the Dow if it suits your work hours etc. If the significance of early session range setting up temporary support/resistance is driven by market dynamics rather than local fundamentals / topical newsflow / recent trend etc., these should surely be the same in NY as in London (as in Hong Kong, Tokyo etc.?).

StephenMcCreedy

Active member

- Messages

- 168

- Likes

- 3

yes. the way i view it is that by 4pm uk time in the us the rush to buy and sell has abated. for the market to break out of that range an underlying tone must be there. that must apply for any exchange traded market. no matter how much the us futs trade out of hours the heavy buying and selling of stocks that move the averages is done in the normal session. the same will hold for stocks. the trouble i have at the minute is an excel one that if i can crack would give the chance to test the idea on a lot of instruments very quickly. i'm going to hassle my excel geek again for some help.

One of BB's main drawbacks is that it's one trade per day. If you can glean more from the BB range to allow later trades either same session or subsequently, that's a great way to add value.

I think BB should be worth pursuing on the Dow if it suits your work hours etc. If the significance of early session range setting up temporary support/resistance is driven by market dynamics rather than local fundamentals / topical newsflow / recent trend etc., these should surely be the same in NY as in London (as in Hong Kong, Tokyo etc.?).

I do not believe that the Footsie is anything more thn a clone of Wall Street. I don't watch Dow much, but US tech and Footsie do much the same in the mornings and much the same in the afternoons! 🙂

My argument on using the Dow is that it is is larger---around double the Footsie in point terms, so why not stay with Footsie? It is less risky. This is the conclusion that I came to last month when I was home in the afternoons.

StephenMcCreedy

Active member

- Messages

- 168

- Likes

- 3

firstly the spread out of hours is large on the ftse which makes the dow more attractive. also you can trade the dow £1pp where as with ig the ftse is £2pp so little difference there.

also if you compare the ftse to the dow over the last month or so (or even s&p or nasdaq) there is massive divergence. the dow has gone down a lot lot more and come back a lot lot less than the ftse.

also if you compare the ftse to the dow over the last month or so (or even s&p or nasdaq) there is massive divergence. the dow has gone down a lot lot more and come back a lot lot less than the ftse.

StephenMcCreedy

Active member

- Messages

- 168

- Likes

- 3

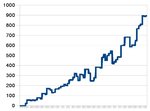

here is a backtest of the jun future from march till june.

the system is to BUY the lowest level traded between 8-10 if given the chance after 10.

the system closes the trade at the close of the 3pm bar (4pm).

it's worked very well.

interestingly it's the opposite of selling the 10am low as per big ben. of course i know there are other rules with bb that i'm in the middle of trying to test. it's not easy.

i thought this was interesting.

i can offer the spreadsheet to anyone interested in case i've messed something up.

stephen

the system is to BUY the lowest level traded between 8-10 if given the chance after 10.

the system closes the trade at the close of the 3pm bar (4pm).

it's worked very well.

interestingly it's the opposite of selling the 10am low as per big ben. of course i know there are other rules with bb that i'm in the middle of trying to test. it's not easy.

i thought this was interesting.

i can offer the spreadsheet to anyone interested in case i've messed something up.

stephen

Attachments

Sorry, I got diverted back to the trading platform, there.

I would add, Tom, that it you close a successful BB trade, simply because the exchange closes, that could be a shame if Wall Street continues in the same direction.

I'm not suggesting that you break your trading rules, just like that. But, certainly, I would investigate that with paper trading.

I would add, Tom, that it you close a successful BB trade, simply because the exchange closes, that could be a shame if Wall Street continues in the same direction.

I'm not suggesting that you break your trading rules, just like that. But, certainly, I would investigate that with paper trading.

firstly the spread out of hours is large on the ftse which makes the dow more attractive. also you can trade the dow £1pp where as with ig the ftse is £2pp so little difference there.

also if you compare the ftse to the dow over the last month or so (or even s&p or nasdaq) there is massive divergence. the dow has gone down a lot lot more and come back a lot lot less than the ftse.

There is some difference, true, but each has to draw his own conclusions. I can't remember the spread on FT that Fins has but, on a good BB morning, I doubt whether it would be a consideration. I'm talking, really, about the continuation of a BB trade, instead of closing it down.

Attachments

here is a backtest of the jun future from march till june.

the system is to BUY the lowest level traded between 8-10 if given the chance after 10.

the system closes the trade at the close of the 3pm bar (4pm).

it's worked very well.

interestingly it's the opposite of selling the 10am low as per big ben. of course i know there are other rules with bb that i'm in the middle of trying to test. it's not easy.

i thought this was interesting.

i can offer the spreadsheet to anyone interested in case i've messed something up.

stephen

A quite amazing chart. I don't see it as appealing to me personally compared to Big Ben - trying to ride break-out momentum sits easier with me than trying to pick a top or bottom, on principle - but it seems to underline the significance of the Big Ben range boundaries - that they really are important pivotal levels. Are you trading on this plan?

Sorry, I got diverted back to the trading platform, there.

I would add, Tom, that it you close a successful BB trade, simply because the exchange closes, that could be a shame if Wall Street continues in the same direction.

I'm not suggesting that you break your trading rules, just like that. But, certainly, I would investigate that with paper trading.

I am no fan of the old advice to always let your winners run - I prefer to set a target and get out (all out) when I hit it. There's always another entry opportunity and the cost of in-out-in-out is fractional compared to when this avice was written. I will put up, some data at the wekend that help see if Big Ben trades can be run past target.

There is some difference, true, but each has to draw his own conclusions. I can't remember the spread on FT that Fins has but, on a good BB morning, I doubt whether it would be a consideration. I'm talking, really, about the continuation of a BB trade, instead of closing it down.

I will put up some data at the weekend on the times BB trades are triggered and hit targets.

barjon

Legendary member

- Messages

- 10,752

- Likes

- 1,863

....................also if you compare the ftse to the dow over the last month or so (or even s&p or nasdaq) there is massive divergence. the dow has gone down a lot lot more and come back a lot lot less than the ftse...........

Starting with January as the base line FTSE has been as much as 140 strong (ie: 140 higher than it should have been compared to the DOW) and as much as 335 weak (ie: 335 lower than it should have been compared to DOW).

Over the last 10 days FTSE's been strong and about 100 higher than where it was compared to DOW around ten days ago. FTSE'll probably snap back towards the mean FTSE/DOW relationship - it oscillates back and forth (as it does during the day too).

jon

Similar threads

- Replies

- 40

- Views

- 12K

- Replies

- 202

- Views

- 78K