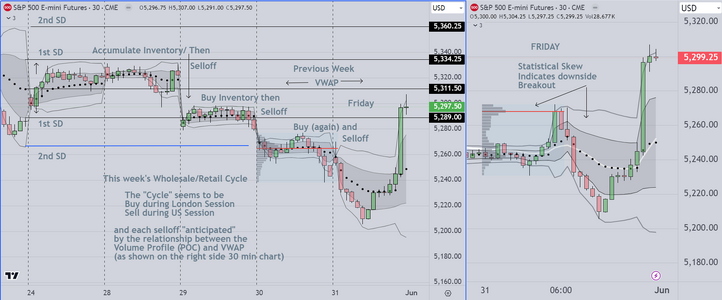

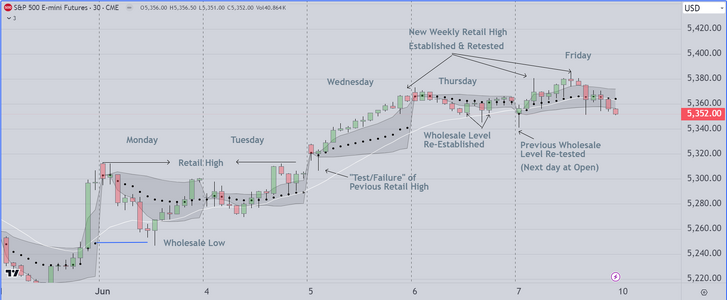

Here is the Weekly Markup that we create during our "End of Week" Session

We will be going through this in about 30 Minutes for our clients. During this time

we review the week, looking at the TIMING of the buys and sells, so that traders can

see the prices where computer programs were activated

After they get into the routine (doing this analysis regularly) the cycle (Wholesale/Retail)

starts to become obvious. The result is that traders learn to anticipate where to

enter and just as importantly, how long to hold positions

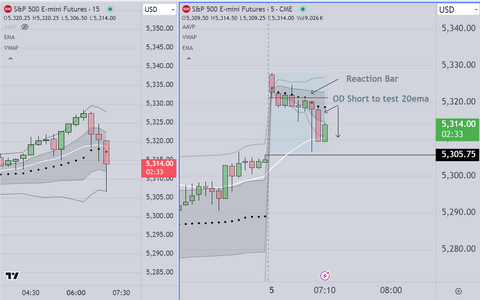

At the risk of being tiresome, let me state the obvious. Just learning "setups" isn't enough

to create a viable (profitable) business Professionals learn to see the bigger picture (context)

and they ADD setups (and those setups work if applied at the right time). This (in our opinion)

is the difference between making a (very good) living as a professional, or, losing money

(so called "death by a thousand cuts") as retail traders get whipsawed back and forth trying to

find a good entry.

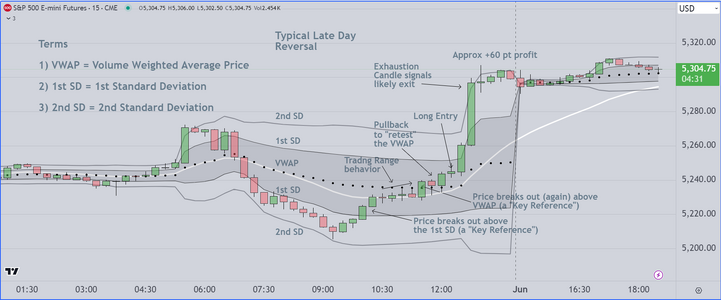

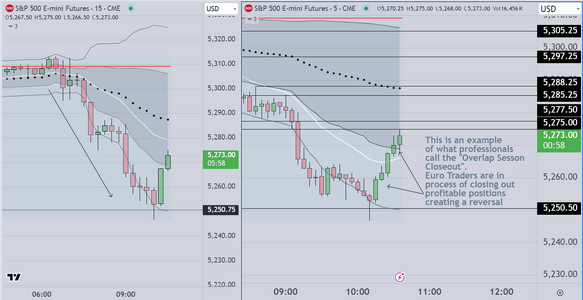

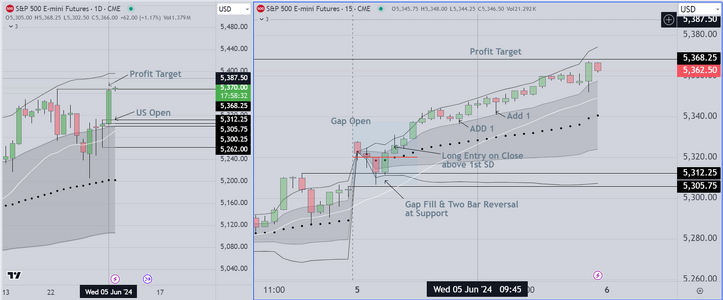

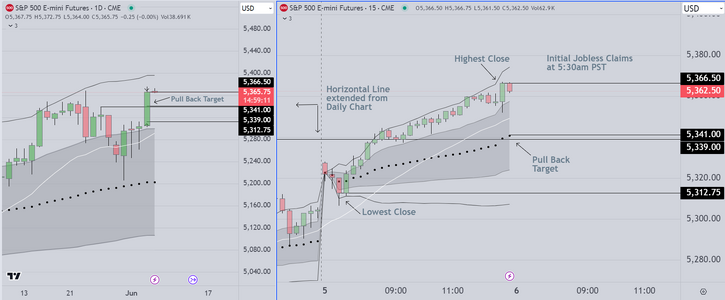

We assume everyone notices the late day (Friday) reversal, which signals the start of a new "Cycle"

We will be going through this in about 30 Minutes for our clients. During this time

we review the week, looking at the TIMING of the buys and sells, so that traders can

see the prices where computer programs were activated

After they get into the routine (doing this analysis regularly) the cycle (Wholesale/Retail)

starts to become obvious. The result is that traders learn to anticipate where to

enter and just as importantly, how long to hold positions

At the risk of being tiresome, let me state the obvious. Just learning "setups" isn't enough

to create a viable (profitable) business Professionals learn to see the bigger picture (context)

and they ADD setups (and those setups work if applied at the right time). This (in our opinion)

is the difference between making a (very good) living as a professional, or, losing money

(so called "death by a thousand cuts") as retail traders get whipsawed back and forth trying to

find a good entry.

We assume everyone notices the late day (Friday) reversal, which signals the start of a new "Cycle"

Attachments

Last edited: