You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Beat The Broker Compo!

- Thread starter Lightning McQueen

- Start date

- Watchers 17

I finished at 27,000 today, but was pleased to try out a new product: GBP futures.

Got in short at 14:00 @ 1.4963 and was still in it at 21:00! Plodded up to a £190 position which was nearly enough at one stage.

I think Friday was a particularly good day for the members on here: well done to Lmq, Timsk, TD, Options and Hoggums (sorry if I've missed anyone out).

Joey

Got in short at 14:00 @ 1.4963 and was still in it at 21:00! Plodded up to a £190 position which was nearly enough at one stage.

I think Friday was a particularly good day for the members on here: well done to Lmq, Timsk, TD, Options and Hoggums (sorry if I've missed anyone out).

Joey

Attachments

Last edited:

Lightning McQueen

Moderator

- Messages

- 5,029

- Likes

- 841

I saw TD and Hoggums in the "league table" - pretty impressive!

Well done guys, I do hope someone from T2W takes the big prize :clap:

All the best!!! 👍

thegoose was the star player for me, got the ipod and a score in excess of 400k, always on the leader board thereabouts at the top :clap:

T_D doing the biz as usual, winning a prize and up there near the top.

dilesh23 winning a prize and always in the frame.

Tim did great and always in there fighting at the top, got a prize, well done

Hoggums also, doing really great.

options doing well in there above The_Broker.

arabia always thereabouts, now and then, should have won something this bloke!! or was it killphil lol

2CeeeVee doing well and beating the broker (and me!!!), well done mate.

arb doing really good, got in there by a whisker there phatt fingers phooey lol

bluetipex and Bluewave making a really good showing.

Joey25 getting in on the action on the leaderboard.

ego9 doing real good.

Sorry if i've missed anyone, if you didn't post in the thread it was real hard trying to keep track of you.

Where were the girls???

UKtradergirl

Established member

- Messages

- 825

- Likes

- 148

I didn't have much time this week but did have a go on two of the days.

Monday- i blew up completely. Three times. Then gave up.

Yesterday (Friday) i got to 11th place just before lunchtime- i think my account peaked at around £47k. Then i blew up again. And again. And again. haha.

I've never done a comp. before so this was a first. Also scary going 'all-in' on every trade- even though it was a demo i'm really not used to this.

Still, proud of myself for being able to turn £20k into £47k in a couple of hours... shows it can be done 😀

Monday- i blew up completely. Three times. Then gave up.

Yesterday (Friday) i got to 11th place just before lunchtime- i think my account peaked at around £47k. Then i blew up again. And again. And again. haha.

I've never done a comp. before so this was a first. Also scary going 'all-in' on every trade- even though it was a demo i'm really not used to this.

Still, proud of myself for being able to turn £20k into £47k in a couple of hours... shows it can be done 😀

Directional

Experienced member

- Messages

- 1,992

- Likes

- 251

Can't let you go out on that mistake...

cheers Mic, you're a top sport! 👍 If only the markets were so forgiving!

As regards a beer, I'll definately look you up when I'm next in London. I'd also like to echo Trader Dante's comments that its been a great idea for a competition, and thanks for your efforts, as well as joining in with us here!

counter_violent

Legendary member

- Messages

- 12,672

- Likes

- 3,787

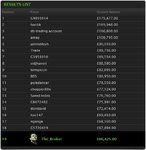

Members in the draw

113 placements above The Broker over the 5 days.

If anyone is missing, let me know I will update.

Ok statisticians, go to work 🙂

dilesh...................... 3

Trader_ Dante............ 2

Options.................... 2

The Philosopher.......... 2

C_V ....................... 2

Hoggums.................. 2

Timsk ..................... 2

Bluewave ................. 1

Arbitrageur............... 1

The Goose.................1

Day 1

Day 2

Day 3

Day 4

Day 5

113 placements above The Broker over the 5 days.

If anyone is missing, let me know I will update.

Ok statisticians, go to work 🙂

dilesh...................... 3

Trader_ Dante............ 2

Options.................... 2

The Philosopher.......... 2

C_V ....................... 2

Hoggums.................. 2

Timsk ..................... 2

Bluewave ................. 1

Arbitrageur............... 1

The Goose.................1

Day 1

Day 2

Day 3

Day 4

Day 5

Attachments

Directional

Experienced member

- Messages

- 1,992

- Likes

- 251

I got my account up above 40-60k most days at various points, but blew up in true spanish style every single time. Big congrats to everyone here who ranked, even if momentarily!

This was my crowning moment before I instantly robbed myself through clumsy fingered click-rushing...

This was my crowning moment before I instantly robbed myself through clumsy fingered click-rushing...

Attachments

I would also like to add. That doing something like this can actually assist in your trading.

Most people made money. IF they got the timing right.

Keeping it, while trying to improve on it was the hard thing to do.

Seeing a massive profit evaporate before your eyes was a common theme and emphasises that timing is crucial. And greed and fear needs to be controlled.

Although I don't like resetting, I did 3 days out of the 5. Even if the account dropped to 19,500. Better to start again with the 20,000 right? The reset button was there to be taken advantage of. Like the compounding into a trade.

Things sometime did not go to plan, slow system. Their end, your end? (A lot of people blame the other end for 'system malfunction' when it is actually a problem at your end.)

LOL At least I never got any requotes!!!

The comp could have reflected real life trading, but the chancers were the winners.

How many would risk 100% of their capital on a single trade if it were their own real money?

No, Not you Arabian. I know you would.

Most people made money. IF they got the timing right.

Keeping it, while trying to improve on it was the hard thing to do.

Seeing a massive profit evaporate before your eyes was a common theme and emphasises that timing is crucial. And greed and fear needs to be controlled.

Although I don't like resetting, I did 3 days out of the 5. Even if the account dropped to 19,500. Better to start again with the 20,000 right? The reset button was there to be taken advantage of. Like the compounding into a trade.

Things sometime did not go to plan, slow system. Their end, your end? (A lot of people blame the other end for 'system malfunction' when it is actually a problem at your end.)

LOL At least I never got any requotes!!!

The comp could have reflected real life trading, but the chancers were the winners.

How many would risk 100% of their capital on a single trade if it were their own real money?

No, Not you Arabian. I know you would.

I would also like to add. That doing something like this can actually assist in your trading.

Most people made money. IF they got the timing right.

Keeping it, while trying to improve on it was the hard thing to do.

Seeing a massive profit evaporate before your eyes was a common theme and emphasises that timing is crucial. And greed and fear needs to be controlled.

Although I don't like resetting, I did 3 days out of the 5. Even if the account dropped to 19,500. Better to start again with the 20,000 right? The reset button was there to be taken advantage of. Like the compounding into a trade.

Things sometime did not go to plan, slow system. Their end, your end? (A lot of people blame the other end for 'system malfunction' when it is actually a problem at your end.)

LOL At least I never got any requotes!!!

The comp could have reflected real life trading, but the chancers were the winners.

How many would risk 100% of their capital on a single trade if it were their own real money?

No, Not you Arabian. I know you would.

For me it's opened up a can of worms about scaling-in rather than scaling-out.

I looked at the "Original Turtles Rules" on Thursday night, (written by Curtis Faith because someone published the rules for 000s of dollars).

They used this method:

Initial stop: 2 x ATR, position size 1% of capital

If position moves 0.5 ATR, add another 1% of capital and trail to 2 x ATR behind the whole lot.

You then keep adding and trailing at 0.5 ATR intervals, until you are "loaded" at 4%.

It seems to make sense, but very hard to do in reality, because it feels like you're getting in at "worse" prices.

It seems most of the literature is about scaling-out, but that might just be me 🙂

For me it's opened up a can of worms about scaling-in rather than scaling-out.

I looked at the "Original Turtles Rules" on Thursday night, (written by Curtis Faith because someone published the rules for 000s of dollars).

They used this method:

Initial stop: 2 x ATR, position size 1% of capital

If position moves 0.5 ATR, add another 1% of capital and trail to 2 x ATR behind the whole lot.

You then keep adding and trailing at 0.5 ATR intervals, until you are "loaded" at 4%.

It seems to make sense, but very hard to do in reality, because it feels like you're getting in at "worse" prices.

It seems most of the literature is about scaling-out, but that might just be me 🙂

Mmmmmmmm, Don't know. For me, scaling in or out of anything is always taken on a 'feeling'. Not a fixed amount. I do believe that sticking to a 'fixed' plan is a recipe for total disaster. Markets are not 'fixed' in their movement. So how can you trade them as such?

Mmmmmmmm, Don't know. For me, scaling in or out of anything is always taken on a 'feeling'. Not a fixed amount. I do believe that sticking to a 'fixed' plan is a recipe for total disaster. Markets are not 'fixed' in their movement. So how can you trade them as such?

Yes, and the whole ATR thing doesn't seem to work as well as plain old support and resistance for me - in fact it has the unwanted effect of sticking wide stops in between levels. Perhaps those Turtles haven't been totally truthful about their methods!

UKtradergirl

Established member

- Messages

- 825

- Likes

- 148

Yes, and the whole ATR thing doesn't seem to work as well as plain old support and resistance for me - in fact it has the unwanted effect of sticking wide stops in between levels. Perhaps those Turtles haven't been totally truthful about their methods!

They were trading much longer term don't forget.

If i recall correct- they also had very many losing trades, lost on most occasions actually. But the strategy meant that when a great big trend did come along- they made shed loads all in one go- more than made up for all the losses.

I've been wondering how adaptable their strategy might be to shorter term trading. Still investigating the matter. 🙂

They were trading much longer term don't forget.

If i recall correct- they also had very many losing trades, lost on most occasions actually. But the strategy meant that when a great big trend did come along- they made shed loads all in one go- more than made up for all the losses.

I've been wondering how adaptable their strategy might be to shorter term trading. Still investigating the matter. 🙂

Wouldn't work. Not for day trading in any case.

UKtradergirl

Established member

- Messages

- 825

- Likes

- 148

Wouldn't work. Not for day trading in any case.

Breakout of 20 minute range? (or 55 minute range)?

Certainly wouldn't work at the moment, you'd probably end up buying the top and selling the bottom of these wild swings.

😆

UKtradergirl

Established member

- Messages

- 825

- Likes

- 148

Breakout of 20 minute range? (or 55 minute range)?

Certainly wouldn't work at the moment, you'd probably end up buying the top and selling the bottom of these wild swings.

😆

oh, not to mention the stoploss would be HUGE due to volatility.

I'm hoping someone will publish "The Original Geese Rules" 😆

Joey. These 'rules' have already been 'published'.

Hold on son, I'll try to find the post.

KillPhil08

Experienced member

- Messages

- 1,860

- Likes

- 381

Update: WHO WON!?

timsk

Legendary member

- Messages

- 8,836

- Likes

- 3,538

My take on the week . . .

1. ETX and Mic 'The_Broker'. . .

First and foremost I'd like to add to the chorus of thanks to ETX Capital for putting on a great competition. Along with everyone else, I really enjoyed it. More importantly, I learnt a lot from it - more on that later. A number of us (me included) made less than complimentary remarks about their platform. However, as Ian 'The Goose' pointed out, it's only a demo' version and the real thing is likely to be a lot better and free of the bugs that we all had to contend with (like being logged out through 'inactivity' [lol] whilst in the middle of unwinding a large position. Grrr!) So, I don't think it would be right or fair to comment on their platform until we've used the live version. Lastly, congratulations to Mic 'The_Broker' who is clearly a very good sport and also an excellent trader. As competitors, we had absolutely nothing to lose, but the same could not be said of him. As the face of the company, a respectable performance was important, which he achieved with great consistency throughout the comp'. That said, I have a sneaking suspicion that he could have done a lot better than he did. I'm only guessing, but it wouldn't surprise me if he was under instructions from the top brass not to place too highly each day, so that competitors felt they were in with a chance of beating him. I'm sure I wasn't the only person to notice that he didn't make an entrance onto the leader board until late morning at the earliest. After all, the object of the exercise from ETX's perspective was to attract new customers, not to put people off. So, big respect to Mic 'The_Broker'!

2. An old chestnut. . .

The issue of paper trading virtual money Vs trading with real money is an old chestnut surrounded in controversy, and probably always will be. Someone commented earlier in the thread something to the effect that it's good to see some high profile T2W members doing well in the comp'. I don't actually agree with this in as much as I don't attach any significance to it at all. I did quite well in the comp' and loved playing it but, at best, all anyone can (or should) conclude from this is that I'm quite good at playing these sorts of competitions. Boy oh boy, how I wish I could mirror my performance in the comp' with my real trading account! Sadly, they are literally poles apart. The steps I outlined earlier in the thread for playing the comp' worked quite well for me - but only because there was the reset button. Without it, I doubt I'd have been placed on the leader board at all. With one notable exception that I'll come to next, most of the tactics I employed would virtually guarantee a blow up using real money. Certainly, if ETX run a similar comp' in the future, I would support the call to curb the use of the reset button.

3. Lessons learnt . . .

Without doubt, the real eye opener for me has been scaling into and out of positions. At the start of the game, I was frustrated at having to put on separate orders of £100 each - seven of them in the case of the DAX - which I traded in the mornings. The tactic was to sell strength and buy weakness as price approached an obvious area of S/R, RN or PDL/H. This meant that by the time I'd got the 7th position in place, the first position was often showing a loss of -£500 to -£1,5000. Perhaps the first position even got stopped out for -£2,000 (with the min' permitted 20 point stop). But when the pullback or reversal came, one by one all those positions started to go into positive territory and then you're in the lovely situation of being in the money at £600 or £700 p/p. I then closed each position in the order that I put it on - i.e. the most vulnerable one first - the one that will go into negative territory the first if the move was short lived. Stupidly, it wasn't until Friday that I started to use limit orders to give me control at what price each position was executed. This made a big difference as I had no control (obviously) at the price I was filled at using market orders. So, with the latter, I might end up with 2 (or more) of the seven positions at the same price - which I didn't want. An elementary mistake some might think, but I don't normally trade like this and never use limit orders to enter trades. This might well change as it proved to be a highly effective tactic and it's one I want to introduce to my 'real' trading. In the case of the DAX example, I would choose a position size such that if all seven are stopped out, I'd only lose 1% (or whatever) of equity - instead of 70% in the comp'. I know these ideas are as old as the hills and many of you will have been using them to great effect for years. I never have - until this week - and it's been quite a revelation to me.

Finally, some bad news. If you've read this far and you're still awake, then you're suffering from insomnia! Thanks to everyone for their generous comments of support and for making this thread a shining example of what a good thread should be. Cheers everyone - and count me in for the booze up or meal at dinesh's mum's / nan's / auntie's restaurant!

Tim.

1. ETX and Mic 'The_Broker'. . .

First and foremost I'd like to add to the chorus of thanks to ETX Capital for putting on a great competition. Along with everyone else, I really enjoyed it. More importantly, I learnt a lot from it - more on that later. A number of us (me included) made less than complimentary remarks about their platform. However, as Ian 'The Goose' pointed out, it's only a demo' version and the real thing is likely to be a lot better and free of the bugs that we all had to contend with (like being logged out through 'inactivity' [lol] whilst in the middle of unwinding a large position. Grrr!) So, I don't think it would be right or fair to comment on their platform until we've used the live version. Lastly, congratulations to Mic 'The_Broker' who is clearly a very good sport and also an excellent trader. As competitors, we had absolutely nothing to lose, but the same could not be said of him. As the face of the company, a respectable performance was important, which he achieved with great consistency throughout the comp'. That said, I have a sneaking suspicion that he could have done a lot better than he did. I'm only guessing, but it wouldn't surprise me if he was under instructions from the top brass not to place too highly each day, so that competitors felt they were in with a chance of beating him. I'm sure I wasn't the only person to notice that he didn't make an entrance onto the leader board until late morning at the earliest. After all, the object of the exercise from ETX's perspective was to attract new customers, not to put people off. So, big respect to Mic 'The_Broker'!

2. An old chestnut. . .

The issue of paper trading virtual money Vs trading with real money is an old chestnut surrounded in controversy, and probably always will be. Someone commented earlier in the thread something to the effect that it's good to see some high profile T2W members doing well in the comp'. I don't actually agree with this in as much as I don't attach any significance to it at all. I did quite well in the comp' and loved playing it but, at best, all anyone can (or should) conclude from this is that I'm quite good at playing these sorts of competitions. Boy oh boy, how I wish I could mirror my performance in the comp' with my real trading account! Sadly, they are literally poles apart. The steps I outlined earlier in the thread for playing the comp' worked quite well for me - but only because there was the reset button. Without it, I doubt I'd have been placed on the leader board at all. With one notable exception that I'll come to next, most of the tactics I employed would virtually guarantee a blow up using real money. Certainly, if ETX run a similar comp' in the future, I would support the call to curb the use of the reset button.

3. Lessons learnt . . .

Without doubt, the real eye opener for me has been scaling into and out of positions. At the start of the game, I was frustrated at having to put on separate orders of £100 each - seven of them in the case of the DAX - which I traded in the mornings. The tactic was to sell strength and buy weakness as price approached an obvious area of S/R, RN or PDL/H. This meant that by the time I'd got the 7th position in place, the first position was often showing a loss of -£500 to -£1,5000. Perhaps the first position even got stopped out for -£2,000 (with the min' permitted 20 point stop). But when the pullback or reversal came, one by one all those positions started to go into positive territory and then you're in the lovely situation of being in the money at £600 or £700 p/p. I then closed each position in the order that I put it on - i.e. the most vulnerable one first - the one that will go into negative territory the first if the move was short lived. Stupidly, it wasn't until Friday that I started to use limit orders to give me control at what price each position was executed. This made a big difference as I had no control (obviously) at the price I was filled at using market orders. So, with the latter, I might end up with 2 (or more) of the seven positions at the same price - which I didn't want. An elementary mistake some might think, but I don't normally trade like this and never use limit orders to enter trades. This might well change as it proved to be a highly effective tactic and it's one I want to introduce to my 'real' trading. In the case of the DAX example, I would choose a position size such that if all seven are stopped out, I'd only lose 1% (or whatever) of equity - instead of 70% in the comp'. I know these ideas are as old as the hills and many of you will have been using them to great effect for years. I never have - until this week - and it's been quite a revelation to me.

Finally, some bad news. If you've read this far and you're still awake, then you're suffering from insomnia! Thanks to everyone for their generous comments of support and for making this thread a shining example of what a good thread should be. Cheers everyone - and count me in for the booze up or meal at dinesh's mum's / nan's / auntie's restaurant!

Tim.

Last edited:

Similar threads

- Replies

- 33

- Views

- 10K

- Replies

- 42

- Views

- 11K