This is a great thread, well done Barjon and all the others for seeing this correlation. Unfortunately though its not new and has been tried and tested over and over throughout the years. You can even bet on this directly with IG, so they know many people want to trade this so you lose and they take your money. The problem with this method is it works brilliant on paper but not so good for real. Sure some will make and many will lose, same old adage, but I don't see anyone screaming from the roof tops that they make money from this method, however I have heard many cries and silent disappearances that its an unfortunate waste of time, like chasing rainbows for gold.

Same with EVERY other method/strategy the thing with human nature is we always want to try and 'improve things' or think we can do better. Usually somebody will post a strategy on a thread before it's even got to page three people are saying "why not add this indicator" etc. The second point to this is how many people have actually tried this over a long enough period of time. You say you have heard many cries and silent disappearances. How long did they try this for? Did they have a bad day a week in and give up and move on to the next holy grail?

Having looked into this I can see the main issue being the markets are closely correlated, this means that they move together so at this time the trade has cost you two lots of commissions or spreads. Remember, setting a trade to break even isn't a 'free trade', it costs you the spread/commission. It may look and feel free on account but you have to recover your spread to make it 'free', therefore you need the market to go in your favour a certain percentage. Its just a fallacy. The same goes for a R:R of 1:1, its not once you factor in the commission and/or spread.

I'm not sure of your point here? You have to wait for every trade go in your favour to recover the spread. Free trade? Who mentioned this being a free trade? I can understand if you are scalping for a few points here and there but Barjon even said it himself that he generally takes +20 or more from this. A spread of 0.8 on ftse is a manageable amount.

If a trade is set at 10pts stop and 10pts target the risk/reward is not 1:1, taking into account the spread/comms its more like 1: 0.9. Typically 10% on this figure (or there abouts).

Where have you got these ratios from? When did Barjon say he sets a 10 point stop and a 10 point limit?

To make money from these two sets of trades you need the markets to go out of sync but yet in your favour whether you feel its extreme or not, this means that it can go either way and therefore you then stand a chance to make or lose money. The only problem bares back to paying two lots of comms/spreads.

Exactly the same for EVERY SINGLE TRADE YOU EVER MAKE THEN.

The other problem I see which is a major one is not being able to set stops, although I believe there are programs out there that can do this. This part would worry me, I have seen over the many years the markets going to extreme (in my opinion), and then out of nowhere, they go even more extreme, and then some more. For this method to work you have to literally guess at which way it will go based on ones own opinion of what is extreme price movement. Its basically a clear cut gamble - red or black but without the odds quite being 50-50 as the spreads/comms get in the way each time.

Whoa there nelly. Okay so you can't set stops this doesn't mean to say you can't exit a trade based on reason. i.e my account is now down 10% and it's NFP today and the data doesn't look good I think I may take a loss and wait for the next setup. Obviously if you just sit there and leave it eventually you are going to take a MOAL but this is bad MM in the first place and you deserve to lose.

Next you say literally guess at which way it will go based on ones own opinion of what is extreme price movement. Literally guess? You really think Barjon sits there on a daily basis literally guessing 😆 Like all trading if you have a good knowledge of the markets you are trading. Historical data tends to point towards what is extreme or not. Yes if you have no idea of the market you could consider 6 points difference as extreme. This isn't guessing though. This is like saying a S/R based strategy once the price gets to S1 you have to literally guess whether the price will rebound or break.

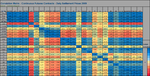

If you want to see extreme on extreme (and it doesn't necessarily have to be a major event) see the previous prices throughout the years. Heres some examples:

Yesterday 19/7/12 Difference was 7227

17/04/12 - 7287 - Looking good so far but not much risk OR reward , just spreads and commissions

20/07/10 - 5090 this is over 2000 points difference from the difference!!!! and in only 2 years with no major events on these dates.

What you see today is not what you will see tomorrow, next month and certainly not next year. Therefore why not just take a single position on one of the markets, pay one commission/spread only AND be able to get out easier AND with an easy to set stop loss.

With all respect to Barjon but as the dragons say........I'm out.... of your head 😉

As I said above, great on paper, not so good on account.