You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

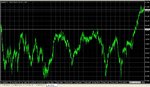

eur gbp showing a textbook cup with handle on the dailies. it's showing very trendy price action with perfect stair stepping up so i think it has potential to go up but i don't know by how much but of course i'm waiting for a pullback as always, it had a bit of touble breaking its previous highs but today it has just blasted through them ...buy when price is falling in an uptrend is the way for me.

Attachments

B

Black Swan

fair enough but you haven't actually said anything worth taking into consideration but only dossy lines to make yourself sound great

oops now you've gone and done it....😆

GladiatorX

Established member

- Messages

- 905

- Likes

- 119

Are you f*cking retarded or something? I said you need to ask yourself WHY it's consolidating and instead of answering that you simply repeated your original post with some mumbo-jumbo about 'price action'. Unlike GJ I have no intention of giving you the answers, I would rather guide you into how to find the answers for youself, or you've learnt nothing about how to look at future situations.

I give up on this site, it's a waste of time.

The reason no one listens to you is because

1) You have no substance; Only questions that you haven't proven that you know the answers to.

2) You seem to be as clueless as everybody else, so why should anyone show a particular interest in you when you have shown nothing to earn such respect.

3) Someone who actuallys knows what hes talking about, wouldn't act so self-defensive towards a 15-year old kid who disagreed with them and would rather take the time to explain precisely what they meant... Rather than just throwing insults like a child.

The reason its consolidating is because there is an equilibrium of demand and supply?

Lets hear your answer?...

oildaytrader

Senior member

- Messages

- 2,806

- Likes

- 125

I see all clouseau are here!

Buyin Aud is a simple trade , it is so easy.

Stay long Aud until the they stop raising interest rates or announce a hold .That is the only thing supporting

Short the currency which is weak or trending , looks like yen.

Until the trend is reversed on the dailies , stay long and earn the interest.

Look at hourlies on Aud/usd,Aud/yen and Euro/aud

Stop scribbling those lines on charts, its all up in the intellectual

Buyin Aud is a simple trade , it is so easy.

Stay long Aud until the they stop raising interest rates or announce a hold .That is the only thing supporting

Short the currency which is weak or trending , looks like yen.

Until the trend is reversed on the dailies , stay long and earn the interest.

Look at hourlies on Aud/usd,Aud/yen and Euro/aud

Stop scribbling those lines on charts, its all up in the intellectual

glyder

Established member

- Messages

- 755

- Likes

- 94

The reason no one listens to you is because

1) You have no substance; Only questions that you haven't proven that you know the answers to.

2) You seem to be as clueless as everybody else, so why should anyone show a particular interest in you when you have shown nothing to earn such respect.

3) Someone who actuallys knows what hes talking about, wouldn't act so self-defensive towards a 15-year old kid who disagreed with them and would rather take the time to explain precisely what they meant... Rather than just throwing insults like a child.

The reason its consolidating is because there is an equilibrium of demand and supply?

Lets hear your answer?...

Gladiator,

thanks for saying what I've been thinking. I even read thru that 'hunting' thread today hoping for something worthwhile, It all amounts to nothing in the end. If Virt has some trading knowledge to share, and he may well, I wish he'd find a more suitable and user friendly way to share it rather than keep on saying what amounts to 'think think think for yourself'. We do that quite OK anyway.

Its getting to remind me a lot of Socrates, who also never came to the point nor ever placed a trade so far as I saw.

Good point about the equilibrium too.

Last edited:

oildaytrader

Senior member

- Messages

- 2,806

- Likes

- 125

Guys

Trading currencies is all about interest rates and economies , and where they are heading.

Here is a thread and posts about why the Aussie is rising, and these guys knew before everybody else .

Audusd - Forex Trading | MetaTrader Indicators and Expert Advisors

Trading currencies is all about interest rates and economies , and where they are heading.

Here is a thread and posts about why the Aussie is rising, and these guys knew before everybody else .

Audusd - Forex Trading | MetaTrader Indicators and Expert Advisors

glyder

Established member

- Messages

- 755

- Likes

- 94

Hi oildaytrader,

Thanks, but thats a fundamental argument, which is all well and good but if your a technical /PA trader you tend to work on the lines that the fundies are built in (i'm sure I'm going over the top and you don't need this detail). For me yes int rates and economies are the main drivers but I cannot trade that info in realtime. It takes more funds than I have and there are much better (and faster) informed market players.

I do keep an eye on the fundies, and, well, tend to keep an eye on whats going on in the world anyway, but I treat it a little like knowing which way the wind is blowing. It may inform my trades but as I take trades lasting just hours and minutes to a couple of days the fundies can't rule my trades. Price action does a pretty good job for me in that time frame.

Alse re the thread you linked to ...it is from Sep this year, but the AUD seemed to reach a bottom and turn bullish in Sep/Oct last year.

All the best

Thanks, but thats a fundamental argument, which is all well and good but if your a technical /PA trader you tend to work on the lines that the fundies are built in (i'm sure I'm going over the top and you don't need this detail). For me yes int rates and economies are the main drivers but I cannot trade that info in realtime. It takes more funds than I have and there are much better (and faster) informed market players.

I do keep an eye on the fundies, and, well, tend to keep an eye on whats going on in the world anyway, but I treat it a little like knowing which way the wind is blowing. It may inform my trades but as I take trades lasting just hours and minutes to a couple of days the fundies can't rule my trades. Price action does a pretty good job for me in that time frame.

Alse re the thread you linked to ...it is from Sep this year, but the AUD seemed to reach a bottom and turn bullish in Sep/Oct last year.

All the best

virtuos0

Well-known member

- Messages

- 423

- Likes

- 117

Let us just for a moment take out my contributions to this thread, and imagine this thread is simply TAJammy and GammaJammer interacting. What you have is a 15 year with not an inkling of a clue how to trade, completely ignoring the advice of a professional trader with 15 years experience. What does that tell you? The same thing is played out over and over and over again on this site. Good advice and prods in the right direction are ignored, and the same myths and fairytales are perpetuated, as the blind continue to lead the blind. It's not far off being some kind of religion or sect, where only one faith is allowed and outsiders are shunned.The reason no one listens to you is because

1) You have no substance; Only questions that you haven't proven that you know the answers to.

2) You seem to be as clueless as everybody else, so why should anyone show a particular interest in you when you have shown nothing to earn such respect.

3) Someone who actuallys knows what hes talking about, wouldn't act so self-defensive towards a 15-year old kid who disagreed with them and would rather take the time to explain precisely what they meant... Rather than just throwing insults like a child.

The reason its consolidating is because there is an equilibrium of demand and supply?

Lets hear your answer?...

If I seem clueless to you it's because you don't understand me. The interesting thing is that I haven't had a single newbie PM me asking for advice, the only people I've had PM me are experienced traders wanting to discuss issues or asking me to point out literature that might interest them. The people that need the advice the most are the least capable of seeing it.

Apologies that you think I act defensive, I'm just tired of fighting against the tide and I'm no longer going to do it.

What would be the purpose of giving my analysis? What would TAJammy have learnt if I had said it was because of interest rates, inflation fears, Asian attitude towards the dollar etc. What I was going to do was to show him how to carry out an analysis from basic principles, strengths/weakness, correlations, etc so that he could have taken that and applied it to any situation. As GJ said, it's an interesting opportunity to carry out an analysis, but that opportunity is now wasted, along with this thread as a whole.

GammaJammer

Guest Author

- Messages

- 1,246

- Likes

- 830

Well you tried damn hard. That has to be worth something.

oildaytrader

Senior member

- Messages

- 2,806

- Likes

- 125

Hi oildaytrader,

Alse re the thread you linked to ...it is from Sep this year, but the AUD seemed to reach a bottom and turn bullish in Sep/Oct last year.

All the best

Glyder

That is incorrect.It is all about timing.The Aussie wasn't bullish , it was the dollar getting weaker.

The Aussie has only just turned bullish in October ,2009.

I thought I would pass in some of my knowledge to you guys,its called giving back.

I read one good book on currencies and it told me all I need to be a successful currency trader.

Trading currency cross rates by Gary Klopfenstein

Charts are often used incorrectly by traders.Next time look at the relative strength of the currency against the majors.

Best of luck

O D T

Attachments

oildaytrader

Senior member

- Messages

- 2,806

- Likes

- 125

i've been keeping just a small eye out for the econ announcements, but to say i use fundamentals to actually trade would be a lie, i'd use them to get out of a position more likely e.g. long aud and australia get bombed lol

Vituoso is trying to help you guys and you come up with this xxxx

O D T

oildaytrader

Senior member

- Messages

- 2,806

- Likes

- 125

What you have is a 15 year with not an inkling of a clue how to trade, completely ignoring the advice of a professional trader with 15 years experience. What does that tell you? The same thing is played out over and over and over again on this site. Good advice and prods in the right direction are ignored, and the same myths and fairytales are perpetuated, as the blind continue to lead the blind. It's not far off being some kind of religion or sect, where only one faith is allowed and outsiders are shunned.

.

The religion is called learn the hard way.

O D T

glyder

Established member

- Messages

- 755

- Likes

- 94

Glyder

That is incorrect.It is all about timing.The Aussie wasn't bullish , it was the dollar getting weaker.

The Aussie has only just turned bullish in October ,2009.

I thought I would pass in some of my knowledge to you guys,its called giving back.

I read one good book on currencies and it told me all I need to be a successful currency trader.

Trading currency cross rates by Gary Klopfenstein

Charts are often used incorrectly by traders.Next time look at the relative strength of the currency against the majors.

Best of luck

O D T

Cheers ODT, I'll look at the book sometime.

I'm lways ready to learn more.

But I also know there are successful traders who don't follow those methods, or don't rely on them as prime reasons for trade.

I've not seen any evidence of Virtuos good intentions you refer to.

GladiatorX

Established member

- Messages

- 905

- Likes

- 119

Don't patronise me about my understanding of your posts; I fully understand and actually agree with what you say, but ultimately you don't follow it up with substance that those unfamiliar with such concepts would understand... Telling people to focus on what really influences price is great for those already aware of the bigger influences, but for those unaware - it just confuses them because you don't follow it up with real applicable information.What would be the purpose of giving my analysis? What would TAJammy have learnt if I had said it was because of interest rates, inflation fears, Asian attitude towards the dollar etc. What I was going to do was to show him how to carry out an analysis from basic principles, strengths/weakness, correlations, etc so that he could have taken that and applied it to any situation. As GJ said, it's an interesting opportunity to carry out an analysis, but that opportunity is now wasted, along with this thread as a whole.

'Interest rates, inflation fears, Asian attitude towards the dollar'

Congratulations - You copy and pasted what Gamma said and oiltrader. You couldn't add anything so replaced it with 'etc' ...

I agree that individuals should focus on trading the market with a focus on components which have a high influence on the market; Interest rates for example - But its not the law, its just a methodology and its still probabilities...

TAjammy could just say now 'Yeah i've been looking at interest rates, the rising price of Gold, the huge inflation fears that are across the globe and especially of Asia and their attitude towards the dollar'

and he'd pretty much be you.

The way you go about 'teaching' is if i were to go;

Use support and resistance levels based on real market volume potential;

And someone who didn't understand goes 'What?'

And i reply 'STFU, your methodology sucks and you should be listening to me'

- Then you never really explain that what you meant was basing Support and resistance off level 2 volume and waiting for Time and Sales confirmation that the level exists...

Ofcourse experienced traders who know about it want to learn more, while inexperienced traders are left wondering what your going on about, pretending to be the Jesus of trading...

Telling people they need to focus on what really influences price is pointless unless you explain what that is and how to get that information and how to use it; Which seems to me what you are struggling to do yourself

Sirr..

Last edited:

GladiatorX

Established member

- Messages

- 905

- Likes

- 119

Vituoso is trying to help you guys and you come up with this xxxx

O D T

Why would TAJammy want help from someone pretending to be a succesful trader?

Everything he says may be relevent, correct, interesting, intellectually; But in the end there is absolutely no substance or truth.

I'll do an impression;

'TAjammy, you ****ing retard, don't look at price action, ask yourself why price is in a consolidation - Don't trade probabilities, trade only certainty - I know 0.0000001% what will happen next and thats when i make my money - So you should do what i do because its the only way'

' Do what Virtuous0 ? '

'I don't know! Figure it out yourself'

That is him summarised. In this thread, he finally wrote what he meant at the end; after someone had written the answer... Mmmmm and he just copied their answer and STILL didn't manage to answer why its consolidating; He just wrote some stuff about fundamentals.

Why is the Aud/Jpy consolidating?

Virtuo: Interest rates.

Wow, world class answer.

Last edited:

GammaJammer

Guest Author

- Messages

- 1,246

- Likes

- 830

To be fair the big moves are rarely down to one factor. They more often than not occur because there is a confluence of factors.

All I was trying to do was to convince the OP that there is far far more to market analysis than a few chart formations and that, further to this, that whereas often the problem with being a retail trader is that the fundamental and especially the contextual factors are hard to gain information on, in this case most of what's going on is pretty well known and commentary on it, often of high quality, is pretty freely available.

As for picking turning points etc, one thing further worth looking at - check out a long term chart of gold adjusted for inflation (will see if I can dig it out - was knocking around last week somewhere). Worth noting that in adjusted terms we're a long long way off historic highs still.

The trend is your friend.....

My $0.02

GJ

edit - chart attached as promised.

All I was trying to do was to convince the OP that there is far far more to market analysis than a few chart formations and that, further to this, that whereas often the problem with being a retail trader is that the fundamental and especially the contextual factors are hard to gain information on, in this case most of what's going on is pretty well known and commentary on it, often of high quality, is pretty freely available.

As for picking turning points etc, one thing further worth looking at - check out a long term chart of gold adjusted for inflation (will see if I can dig it out - was knocking around last week somewhere). Worth noting that in adjusted terms we're a long long way off historic highs still.

The trend is your friend.....

My $0.02

GJ

edit - chart attached as promised.

Attachments

Last edited:

Similar threads

- Replies

- 0

- Views

- 5K