SuddenDeath

Legendary member

- Messages

- 14,063

- Likes

- 143

Morning SD

Great question.

London RIO/BLT currently outperform.

UK ones are now at 2010 lows, but Aussie ones now close to 2009 lows(GFC levels).

What I look for is say there is current 3% differences for the last 6 to 12 months in each stock in Australia and UK.

Then that gaps goes to say 5%. I look for the market to close that gap.

And try play that with a short or long on the FTSE or ASX200.

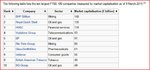

Is BLT still the largest in the FTSE. BHP is the largest market cap in the ASX200.

Hi Bustech, I am guessing that the most volume is done in London.