Having had several days of grinding higher, there seems to be little appetite to stay short for long. Even after more greek eurobabble and the overnight sell off, the selling did not continue through this morning. We've had a 26 pt range for all of this mornings price action. Again, I am using short targets of 5 pts or less. By the time you get the entry signal there isn't much left to run. It seems pretty flat across all markets this morning. It's just building up steam for a bigger move some tome soon.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

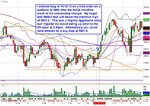

Just thought I would post a chart of the trade I made on the breakout of the descending triangle. It was a slightly aggressive entry on a limit as opposed to a stop, but I noticed that the ES and FESX were already breaking upwards so I felt it was safe to get in. I didn't set a particularly high target, but 8 pts is good in todays market and the move only went 10 pts total.

Attachments

Interesting to see the 5795 level being supported so strongly. For several minutes there between 3:00pm and 3:15pm the volume increased significantly, but the price failed to break lower. When the fight was over between the bulls and the bears we finally reluctantly moved up.

Also the ES was trying to hold on to the 161.8% extension, which it finally held. I still think we will see a slow slog back up as I said earlier, and it will take some greek pizza news to break below this level.

Also the ES was trying to hold on to the 161.8% extension, which it finally held. I still think we will see a slow slog back up as I said earlier, and it will take some greek pizza news to break below this level.

Just thought I would post a chart of the trade I made on the breakout of the descending triangle. It was a slightly aggressive entry on a limit as opposed to a stop, but I noticed that the ES and FESX were already breaking upwards so I felt it was safe to get in. I didn't set a particularly high target, but 8 pts is good in todays market and the move only went 10 pts total.

Hey Martin. Some good analysis. Think everyone need to chip in as its been quite on here this week and we want to keep this thread going strong.

Quick question Martin. The 14:09 closed above the 37sma which is your change in bias and the close of the 5min candle. So would you not consider the pull-back to break the lbb on the 1MC a good aggressive buy on the 14:10 candle? Its was at level that had shown support many times since 12:00. When it got to level that was within your 4pt stop to the low or whatever you are currently using.

Not suggesting its better 😀 just picking your Brain as I know you have been looking deep into these 1 minute charts for years.

Putting in a limit order to buy at the lower boly band at around 5797 is acceptable with a tight stop. Especially as it has been a mostly non trending day and moves have been small. Effectively that is a range trade.

When looking for a breakout of a triangle, I like to enter close to the break of the sloping trendline, in this case to the upside. The flat trendline, ie the bottom of the triangle, I would enter on a continuation entry. So for our example, I would have waited for it to break below 5794, wait for a pullback, and then enter on a sell stop on a 1 tick lower low.

As for buying on limit orders at a level or a trend line I don't have a set rule. It is always the more aggressive entry, but it isn't wrong. You just have to time it well and keep a tight stop. I tend to go by gut feel with these. My preferred entry is always on a stop, but I do limit orders on many occasions. May be we should throw it open to all and have everyone post their views on entering on a limit order. It is important for scalpers but less so for swingers.

When looking for a breakout of a triangle, I like to enter close to the break of the sloping trendline, in this case to the upside. The flat trendline, ie the bottom of the triangle, I would enter on a continuation entry. So for our example, I would have waited for it to break below 5794, wait for a pullback, and then enter on a sell stop on a 1 tick lower low.

As for buying on limit orders at a level or a trend line I don't have a set rule. It is always the more aggressive entry, but it isn't wrong. You just have to time it well and keep a tight stop. I tend to go by gut feel with these. My preferred entry is always on a stop, but I do limit orders on many occasions. May be we should throw it open to all and have everyone post their views on entering on a limit order. It is important for scalpers but less so for swingers.

I do love how the US market likes to stick two fingers up at the european markets after 4:30pm. They must be really fed up with the greeks and the ECB and Merkozy and......

The US economy is clearly on the rebound and when the yanks get the chance to vote on it without any european influence, they buy the markets up.

The US economy is clearly on the rebound and when the yanks get the chance to vote on it without any european influence, they buy the markets up.

Dick Lexic

Veteren member

- Messages

- 4,954

- Likes

- 124

you can hear a pin drop in here🙁

you can hear a pin drop in here🙁

We need to bring this back to life :clap:

you can hear a pin drop in here🙁

You having any joy today Dick?

Dick Lexic

Veteren member

- Messages

- 4,954

- Likes

- 124

You having any joy today Dick?

well i'm long but i've had a few scary moments..need to be quick draw with the stop for a while i think🙂

well i'm long but i've had a few scary moments..need to be quick draw with the stop for a while i think🙂

I was long first thing. But at this level I have been talking some shorts. At least until I see the market break through this resistance.

Hopefully we might get some decent swings this week.

My guess is that the market is treading water until the Italian Bond auctions. We should hear the results between 10:04 and 10:12 am.

This is what I typed and 10am and then forgot to hit return. Let's see if 5851.5 holds. We have a gap to fill yet so the down move may continue.

This is what I typed and 10am and then forgot to hit return. Let's see if 5851.5 holds. We have a gap to fill yet so the down move may continue.

Dick Lexic

Veteren member

- Messages

- 4,954

- Likes

- 124

just having a look at the long term charts ...we are not that far from the 2011 highs🙂

My guess is that the market is treading water until the Italian Bond auctions. We should hear the results between 10:04 and 10:12 am.

This is what I typed and 10am and then forgot to hit return. Let's see if 5851.5 holds. We have a gap to fill yet so the down move may continue.

Have you had the results come up yet for the auction?

Yes Mark, the results came out at 10:10am and the yield for the 12 month note dropped from 2.735% to 2.23%. Which is a good sign for Italy and the euro. We have also just had the German bond auction results at 10:32am and the yield for the 6 month note increased from -0.012% to 0.0761%. That's a sign to me that the market is less willing to run to the safe haven of German bonds, which means the panic is continuing to calm down.

We are range bound, but there is no appetite to sell off. Also with the greek vote going through last night, the market is breathing new life into french and german banks which stood to lose loads if the greeks defaulted. I still think the greeks will default. They have just kicked the can down the street again.

A week ago we made the breakout up to a new level. The market has since confirmed the breakout. Now all it has to do is to confirm the upper limit of the new range. I guess it has to be 6000 for the FTSE, but I think the other markets will peak before then. So I am going to hazard a guess that the new range will be 5770 to 5970 for the ftse futures until something breaks.

We are range bound, but there is no appetite to sell off. Also with the greek vote going through last night, the market is breathing new life into french and german banks which stood to lose loads if the greeks defaulted. I still think the greeks will default. They have just kicked the can down the street again.

A week ago we made the breakout up to a new level. The market has since confirmed the breakout. Now all it has to do is to confirm the upper limit of the new range. I guess it has to be 6000 for the FTSE, but I think the other markets will peak before then. So I am going to hazard a guess that the new range will be 5770 to 5970 for the ftse futures until something breaks.

Dick Lexic

Veteren member

- Messages

- 4,954

- Likes

- 124

pretty flat at 512 cash...could land a helicopter on the hourly chart🙂🙂

Volumes have now dropped to below 50 lots per minute which is my shut off for trading. It may be moved in one direction or the other over lunchtime, but it looks like we have to wait until 2:30pm now. Unless Ollie Rehn says something daft and the price drops.

Yes Mark, the results came out at 10:10am and the yield for the 12 month note dropped from 2.735% to 2.23%. Which is a good sign for Italy and the euro. We have also just had the German bond auction results at 10:32am and the yield for the 6 month note increased from -0.012% to 0.0761%. That's a sign to me that the market is less willing to run to the safe haven of German bonds, which means the panic is continuing to calm down.

We are range bound, but there is no appetite to sell off. Also with the greek vote going through last night, the market is breathing new life into french and german banks which stood to lose loads if the greeks defaulted. I still think the greeks will default. They have just kicked the can down the street again.

A week ago we made the breakout up to a new level. The market has since confirmed the breakout. Now all it has to do is to confirm the upper limit of the new range. I guess it has to be 6000 for the FTSE, but I think the other markets will peak before then. So I am going to hazard a guess that the new range will be 5770 to 5970 for the ftse futures until something breaks.

Thanks Martin. For some reason im not getting the feed today from Ran. Done all the normal troubleshooting but just not working.

Luckily its a very quite day for data releases.

Should that have been 5870? or you think we are going to break up to 5970.

The longer we cant break down this resistance, the chances of a pull-back are increased.

Dick Lexic

Veteren member

- Messages

- 4,954

- Likes

- 124

any of you guys ever trade the dax?

Similar threads

- Replies

- 1

- Views

- 2K