V

-

Welcome to the Darwinex Forums, these forums are member-run and managed by CavaliereVerde. Member-run forum rules may differ from the site guidelines.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Alternatives to Darwinex

- Thread starter Viro Major

- Start date

- Watchers 32

V

Viro Major

FTMO October 2020 Statistics - FTMO®

ftmo.com

ftmo.com

TLN

Well-known member

- Messages

- 259

- Likes

- 411

TLN

Well-known member

- Messages

- 259

- Likes

- 411

FYI!Good!

But not enough transparent as expextation of @CavaliereVerde I think

Almost things need to know about FTMO can be found quickly here.

V

Viro Major

About trailing vs fixed stoploss, if the challenge is sliced in many small steps / levels when there is a reset of the anchor of the stop to the new starting balance, like it is the case with The 5ers (5 levels), I’m very ready to consider it is a trick to illusion and make the trader face a flawed progression. In that case, fixed stoploss is almost equal to trailing permanently.

Then there is manipulative marketing which enters into play. I noted that many of these companies with more than 1 step / level advertise upfront about eased conditions of the 1st level in bold and try to hide the next levels with tighter conditions.

This is the case with The 5ers.

For the Low Risk scheme, level 1 metrics are -4% / +7% but if you read fineprints below, level 2 and above turn out to become -4% / +10% which is then a way more difficult ratio than the 1:1 of FTMO and on par with the difficulty of all futures FT programs, at about 2.5:1 more or less.

If we consider the Aggressive scheme of The 5ers, level 1 starts at -4% / 12% but level 2 and above increase to -4% / +25% to achieve within 2 months. Clearly these are impossible parameters based on more than sheer luck and we can safely say the site is not here to measure competency but to strictly watch you fail and cash in the ticket entry.

This is just one example to boot...

About the Low Risk scheme, it is set to take so long (max 6 months each levels), that given the previous remark of the mindset and the absence of regulation, I would not dare to be confident. Every conditions are deployed to pocket in contenders money about the participation fee more than paying success and I would be seriously scared that after many months if not years of slow efforts, the management could disappear all of a sudden while foreseeing upcoming losses through higher payouts and just run away with the money of the successful clients.

It’s a fact that all these sites have no framework and a few dared to state openly they could change the conditions as they see fit on the fly... it’s clear it’s a predatory industry but no different than other sharks in it who are trying to exploit probabilities (brokers running a B-Book). Here is Enfoid which basically can invent any excuse to kick you out of their program at will if your success becomes disturbing for them

There are other FT programs making it so obvious they are trying to sell virtual money big time. Here is the example which made me laugh the most : BluFx

This is obsviously even more the case of the forex/cfd FT programs. It cannot happen with futures FT programs running with real funded accounts instead of virtual casinos, which consequently have tighter conditions in place to compensate and make it equally difficult.

I’m not naive and could go on and on... it’s very interesting to review these programs because it teaches you the kind of failure statistics they bet against.

So, don’t get me wrong, the only interest is to notice the programs who pull down their guard, letting breaches behind them as having the eyes bigger than the stomach with avarice, then try to scam them back in return...

For this purpose and without jeopardising with extreme danger (the Enfoid site does not even speak english correctly and the support is non-existent, impossible to reach), I would admit that FTMO is by far the most loose program and actually very manageable unlike all the other ones. They’re all about slick and outrageous marketing campaigns but it’s okay as long as aware you pact with the devil. So I would go with FTMO only and make the other programs understand that they are not competitive and consider us for clowns. Sorry @The5ers you’ve got to share bigger pieces of your cake in order to be convincing towards a non-novice crowd.

Then there is manipulative marketing which enters into play. I noted that many of these companies with more than 1 step / level advertise upfront about eased conditions of the 1st level in bold and try to hide the next levels with tighter conditions.

This is the case with The 5ers.

For the Low Risk scheme, level 1 metrics are -4% / +7% but if you read fineprints below, level 2 and above turn out to become -4% / +10% which is then a way more difficult ratio than the 1:1 of FTMO and on par with the difficulty of all futures FT programs, at about 2.5:1 more or less.

If we consider the Aggressive scheme of The 5ers, level 1 starts at -4% / 12% but level 2 and above increase to -4% / +25% to achieve within 2 months. Clearly these are impossible parameters based on more than sheer luck and we can safely say the site is not here to measure competency but to strictly watch you fail and cash in the ticket entry.

This is just one example to boot...

About the Low Risk scheme, it is set to take so long (max 6 months each levels), that given the previous remark of the mindset and the absence of regulation, I would not dare to be confident. Every conditions are deployed to pocket in contenders money about the participation fee more than paying success and I would be seriously scared that after many months if not years of slow efforts, the management could disappear all of a sudden while foreseeing upcoming losses through higher payouts and just run away with the money of the successful clients.

It’s a fact that all these sites have no framework and a few dared to state openly they could change the conditions as they see fit on the fly... it’s clear it’s a predatory industry but no different than other sharks in it who are trying to exploit probabilities (brokers running a B-Book). Here is Enfoid which basically can invent any excuse to kick you out of their program at will if your success becomes disturbing for them

There are other FT programs making it so obvious they are trying to sell virtual money big time. Here is the example which made me laugh the most : BluFx

This is obsviously even more the case of the forex/cfd FT programs. It cannot happen with futures FT programs running with real funded accounts instead of virtual casinos, which consequently have tighter conditions in place to compensate and make it equally difficult.

I’m not naive and could go on and on... it’s very interesting to review these programs because it teaches you the kind of failure statistics they bet against.

So, don’t get me wrong, the only interest is to notice the programs who pull down their guard, letting breaches behind them as having the eyes bigger than the stomach with avarice, then try to scam them back in return...

For this purpose and without jeopardising with extreme danger (the Enfoid site does not even speak english correctly and the support is non-existent, impossible to reach), I would admit that FTMO is by far the most loose program and actually very manageable unlike all the other ones. They’re all about slick and outrageous marketing campaigns but it’s okay as long as aware you pact with the devil. So I would go with FTMO only and make the other programs understand that they are not competitive and consider us for clowns. Sorry @The5ers you’ve got to share bigger pieces of your cake in order to be convincing towards a non-novice crowd.

Last edited by a moderator:

V

Viro Major

Hey Viro

The 5%ers is a private fund holding ownership of a Forex Trading account under a regulated broker. However, there is no regulation clause to what we do, because we are not a financial institute and do not provide any financial services. We trade using our fund’s capital, with the support of our competent funded traders.

Regarding the email you sent, I will do another check, thank you very much!

Best...

So do you pass any clients’ trades onto the market at all ? I doubt it.

Your description is very awkward. Private Fund holding a single trading account, so how does it operate in concrete, you take the positions of the successful traders by copy trading them on their behalf ? Obviously, you don’t but just play a financial virtual game of accounting, based on odd statistics where you just buy and sell the incompetency of the crowd you address to, through their ticket entries, in order to self-fund. It’s a pyramid-like scheme but well done, relying on sure proven probabilities. It’s a traditional commercial activity, there is so little tech on the front-end and none on the back-end ...but prove me wrong

Last edited by a moderator:

V

Viro Major

So let’s summarise some of the advantages of FTMO over the competition which appears obsolete

* symetric ratio of stop-out / profit target of 1:1 at -10% / +10% which is a mega difference versus (way) unbalanced ratios

* only 2 steps of challenge (instead of occasionally 5) and the time constraint is eased by 2 fold as soon as the second stage (the other parameters don’t change)

* ability to run and get payouts in parallel on 3 accounts of 80k € max, on which 1:100 max leverage is allowed, so a buying power of 24M €

* ...this exposure can even increase every 4 months by 25% if a 10% goal has been reached with at least half (2) of positive months. So yearly, the target is to nail down 25% which is about realistic, especially since the okay risk constraint can be mitigated through the fact the stop is not trailing, and as soon as funded the time constraint disappears, and ultimately, if you build a cushion slowly, then you can toy around with more leverage on selected bets where to reuse profits (and all tactics in between)

* no scaling program

* 70% perf fees (the max I found was 90% with Leeloo but impossible risk to respect)

* little to no restrictions about the nature of the trading strategies accepted

* more of a professional outlook about their business (site / team, support), and better tracability / reputation although they’re bold marketers first and foremost with instagram account selling dream

* they provide clean analysis tools of the account ! as well as trading journal (Darwinex should have focused on this kinda practical tool instead of APIs, since it speaks to a larger audience)

* most of all asset classes are supported, not only forex

* the whole thing is rather approached as stripped down, straight-forward and simple

What am I forgetting ? Please help.

* symetric ratio of stop-out / profit target of 1:1 at -10% / +10% which is a mega difference versus (way) unbalanced ratios

* only 2 steps of challenge (instead of occasionally 5) and the time constraint is eased by 2 fold as soon as the second stage (the other parameters don’t change)

* ability to run and get payouts in parallel on 3 accounts of 80k € max, on which 1:100 max leverage is allowed, so a buying power of 24M €

* ...this exposure can even increase every 4 months by 25% if a 10% goal has been reached with at least half (2) of positive months. So yearly, the target is to nail down 25% which is about realistic, especially since the okay risk constraint can be mitigated through the fact the stop is not trailing, and as soon as funded the time constraint disappears, and ultimately, if you build a cushion slowly, then you can toy around with more leverage on selected bets where to reuse profits (and all tactics in between)

* no scaling program

* 70% perf fees (the max I found was 90% with Leeloo but impossible risk to respect)

* little to no restrictions about the nature of the trading strategies accepted

* more of a professional outlook about their business (site / team, support), and better tracability / reputation although they’re bold marketers first and foremost with instagram account selling dream

* they provide clean analysis tools of the account ! as well as trading journal (Darwinex should have focused on this kinda practical tool instead of APIs, since it speaks to a larger audience)

* most of all asset classes are supported, not only forex

* the whole thing is rather approached as stripped down, straight-forward and simple

What am I forgetting ? Please help.

Last edited by a moderator:

V

Viro Major

haven’t listened yet

Enfoid is very juicy and appealing and particular just as it displays distrust

So Darwin providers could fit in there as appropriate candidates ? How is it just a hook scheme fitting into fake ?

for me Enfoid remains obscure but intriguing. have to lift more dust under the carpet to figure it out but alarm signs are also flashing. Donno yet, they’re the most bizarre / unique

Last edited by a moderator:

TLN

Well-known member

- Messages

- 259

- Likes

- 411

I think enough.What am I forgetting ? Please help.

Just only increase their transpanrency more. They will be the best.

Some cons are:

-No trades before and after 2 mins of high impacted news

-Close all orders at the weekend.

TLN

Well-known member

- Messages

- 259

- Likes

- 411

Thanks a lot your effort to make all clear.About trailing vs fixed stoploss, if the challenge is sliced in many small steps / levels when there is a reset of the anchor of the stop to the new starting balance, like it is the case with The 5ers (5 levels), I’m very ready to consider it is a trick to illusion and make the trader face a flawed progression. In that case, fixed stoploss is almost equal to trailing permanently.

Then there is manipulative marketing which enters into play. I noted that many of these companies with more than 1 step / level advertise upfront about eased conditions of the 1st level in bold and try to hide the next levels with tighter conditions.

This is the case with The 5ers.

For the Low Risk scheme, level 1 metrics are -4% / +7% but if you read fineprints below, level 2 and above turn out to become -4% / +10% which is then a way more difficult ratio than the 1:1 of FTMO and on par with the difficulty of all futures FT programs, at about 2.5:1 more or less.

If we consider the Aggressive scheme of The 5ers, level 1 starts at -4% / 12% but level 2 and above increase to -4% / +25% to achieve within 2 months. Clearly these are impossible parameters based on more than sheer luck and we can safely say the site is not here to measure competency but to strictly watch you fail and cash in the ticket entry.

This is just one example to boot...

About the Low Risk scheme, it is set to take so long (max 6 months each levels), that given the previous remark of the mindset and the absence of regulation, I would not dare to be confident. Every conditions are deployed to pocket in contenders money about the participation fee more than paying success and I would be seriously scared that after many months if not years of slow efforts, the management could disappear all of a sudden while foreseeing upcoming losses through higher payouts and just run away with the money of the successful clients.

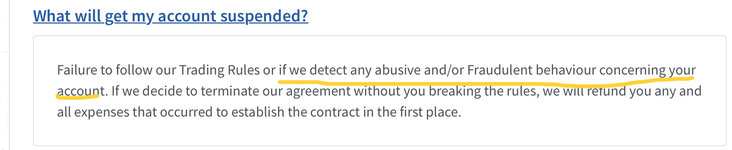

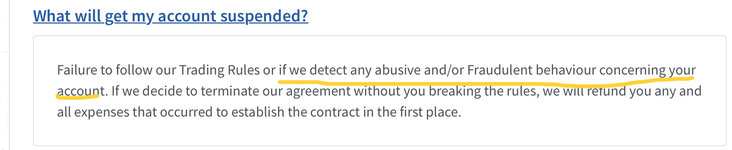

It’s a fact that all these sites have no framework and a few dared to state openly they could change the conditions as they see fit on the fly... it’s clear it’s a predatory industry but no different than other sharks in it who are trying to exploit probabilities (brokers running a B-Book). Here is Enfoid which basically can invent any excuse to kick you out of their program at will if your success becomes disturbing for them

View attachment 293924

There are other FT programs making it so obvious they are trying to sell virtual money big time. Here is the example which made me laugh the most : BluFx

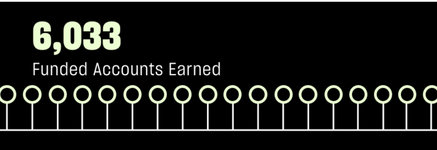

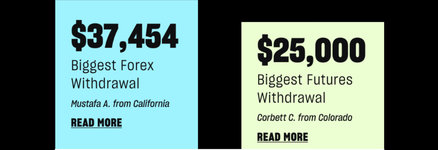

View attachment 293923

This is obsviously even more the case of the forex/cfd FT programs. It cannot happen with futures FT programs running with real funded accounts instead of virtual casinos, which consequently have tighter conditions in place to compensate and make it equally difficult.

I’m not naive and could go on and on... it’s very interesting to review these programs because it teaches you the kind of failure statistics they bet against.

So, don’t get me wrong, the only interest is to notice the programs who pull down their guard, letting breaches behind them as having the eyes bigger than the stomach with avarice, then try to scam them back in return...

For this purpose and without jeopardising with extreme danger (the Enfoid site does not even speak english correctly and the support is non-existent, impossible to reach), I would admit that FTMO is by far the most loose program and actually very manageable unlike all the other ones. They’re all about slick and outrageous marketing campaigns but it’s okay as long as aware you pact with the devil. So I would go with FTMO only and make the other programs understand that they are not competitive and consider us for clowns. Sorry @The5ers you’ve got to share bigger pieces of your cake in order to be convincing towards a non-novice crowd.

I have same understanding as yours about Ther5ers.

I now only try to seek for any similar one as good as FTMO.

V

Viro Major

Do you need to be flat during news ? Or just don’t pass new trades ?I think enough.

Just only increase their transpanrency more. They will be the best.

Some cons are:

-No trades before and after 2 mins of high impacted news

-Close all orders at the weekend.

I like volatility and don’t even stay informed about news release, which I welcome as normal price action

no overweekend or at reduced leverage is wise to avoid lottery

TLN

Well-known member

- Messages

- 259

- Likes

- 411

Please check below their FAQ.Do you need to be flat during news ? Or just don’t pass new trades ?

Can I trade news?

Frequently Asked Questions Search New with FTMO How to start? Is FTMO a trustworthy company? What is FTMO? Where is your office? How do I contact you? Who can join FTMO? Why should I join FTMO? Evaluation Process How do I become an FTMO Trader? How long does it take to become an FTMO Trader? […]

Do I have to close my positions overnight?

Frequently Asked Questions Search New with FTMO How to start? Is FTMO a trustworthy company? What is FTMO? Where is your office? How do I contact you? Who can join FTMO? Why should I join FTMO? Evaluation Process How do I become an FTMO Trader? How long does it take to become an FTMO Trader? […]

V

Viro Major

@TrungLN thx for the info & reflections shared until now

Here is my temporary compilation. I‘m not done collecting data and it’s only my very subjective representation. Read websites instead of relying on this overview because the fine details matter

I hid some personal calculus about the interest I derive from it

Here is my temporary compilation. I‘m not done collecting data and it’s only my very subjective representation. Read websites instead of relying on this overview because the fine details matter

I hid some personal calculus about the interest I derive from it

V

Viro Major

About this

ftmo.com

ftmo.com

it is unlimited... so there is no ceiling for the account size. No investors, no hassle, unlimited “capital“ if you perform ...in theory 😂

Scaling Plan

Once you become FTMO trader it doesn't mean that our cooperation is over. Take a look at this page to find out how you can scale your trading account.

it is unlimited... so there is no ceiling for the account size. No investors, no hassle, unlimited “capital“ if you perform ...in theory 😂

TLN

Well-known member

- Messages

- 259

- Likes

- 411

For me, only monthly +1% of 300k $ capital is enough for living.it is unlimited... so there is no ceiling for the account size.

No more greedy. ^^

itstradingtime

Member

- Messages

- 79

- Likes

- 219

I realised this yesterday while I was going through the statistics of my account. This makes the challenge a lot easier!Use max fixed loss 10k $, not trailing the loss.

Another point in their favour is that they have a scaling program that allows to re-evaluate the account every 4 months and, if you meet all the conditions, they will increase the funds by 25%.

Potentially, you could double your managed funds every year.

HFD has done great on Darwinex, of course if you compare his journey to the average guy on FTMO, he crushes it.

If you take many traders who are doing great on Darwinex, but somehow struggle to get any investment, then FTMO may win. You get $100K right from the start and you take 70% of the profits, not 15% like Darwinex.

I prefer the business model that Darwinex has, for many reasons, but I wouldn't say that FTMO is a waste of time or a scam.

CavaliereVerde

Senior member

- Messages

- 2,806

- Likes

- 2,745

Unlimited accounts and unlimited baits.

They bait you and require a new profit target to make you fail.

When you fail you are back to square one while on Darwinex you build a trackrecord.

The value is in the trackrecord not only in earnings.

They bait you and require a new profit target to make you fail.

When you fail you are back to square one while on Darwinex you build a trackrecord.

The value is in the trackrecord not only in earnings.

TLN

Well-known member

- Messages

- 259

- Likes

- 411

I think the best way is take both of them.I prefer the business model that Darwinex has, for many reasons, but I wouldn't say that FTMO is a waste of time or a scam.

Let's say we can trade consistently +6-7%/year , ~0.5%/month.

Darwinex is really a good broker. We trade our own capital on it and build profile and attract investors.

Also, we try to get 300k of FTMO and copy that strategy to it.

Now, we can get almost double performance with the same risk.

^^

V

Viro Major

no, only 2 stages / TP and then no longer a profit targetUnlimited accounts and unlimited baits.

They bait you and require a new profit target to make you fail.

When you fail you are back to square one while on Darwinex you build a trackrecord.

The value is in the trackrecord not only in earnings.

It then becomes similar to Darwinex but more free cause no risk manager left at the trader’s discretion, except for the non negative -10% account value ....which honestly should be enforced as mandatory at Darwinex to filter suckers !

Moreover, the IP protection cannot be beaten, better than darwinex due to the total opacity 😛

Many track records are also hidden at Darwinex... I mean the trader can choose to hide many trader accounts never darwinised. That’s not what I call worthy transparency but it doesn’t exist anywhere

CavaliereVerde

Senior member

- Messages

- 2,806

- Likes

- 2,745

Yes it is perfect for traders that want to hide 🤣 🤣 🤣