barjon

Legendary member

- Messages

- 10,752

- Likes

- 1,863

Thought you might be bored playing hang-the-man on another thread and be interested in how 3 + bar swings have been doing recently.

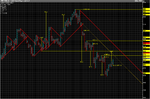

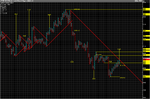

swing trend changed to down late November when the earlier swing low went , then confirmed by the previous one going, but no short signal arrived. Some may have regarded the double top (first white circle) as a swing high and gone short but strict observance of the rules meant a new high had come in which nullified the supposed down trend. A bit later on there was a clear break which changed the swing trend back to up.

The first swing low came (second white circle) but you'd have got stopped out if your stop was too close (mine was 🙄 ). The next swing low gave a long entry around 6260 which is still running.

good trading

jon

swing trend changed to down late November when the earlier swing low went , then confirmed by the previous one going, but no short signal arrived. Some may have regarded the double top (first white circle) as a swing high and gone short but strict observance of the rules meant a new high had come in which nullified the supposed down trend. A bit later on there was a clear break which changed the swing trend back to up.

The first swing low came (second white circle) but you'd have got stopped out if your stop was too close (mine was 🙄 ). The next swing low gave a long entry around 6260 which is still running.

good trading

jon