ppplaci

Active member

- Messages

- 133

- Likes

- 6

Hello there!

I was cruising the internet, and I thought why not start a journal like this, never done this before but maybe I can prove myself or those doubting their trading that it is possible to be profitable consistently.

I am only trading now the E-mini Russell, (TF) will try to post every day or when i trade, never been good at stuff like this, keeping a routine for a long time.

Russell was always the favourite, its like a good old friend now.

i started with FX in 2006, switched to ER2 in 2007 December. In 2008 from January to July I had incredible results, one that nobody would believe. Way better percentage than Larry Williams' winning 1000% a year. Unfortunately I started with a small amount of money. I was trading on spreadbetting accounts, been struggling to become profitable again, for reasons I might only be able to detail in a longer book. Some private matters, family losses, and psychological changes that is almost impossible to reverse. Money changes you, more money ... a sh*tload of money does it even more efficiently. So because of that for 5 years I have been struggling, but now I have come to a point where I believe I got it again. To say it in a Mark Douglas way: I am in the zone 🙂

My trades are between 1-2 minutes to even 1-2 hour long, usually shorter time period. I trade very aggressively, but i believe the risk is not that high due to the fact my system seems to be working efficiently.

There is another reason: I am looking for an investor as well, not right now, only after I have proven myself. I see a small chance only that anyone would be so crazy to take this high risk but you never know, got to try. For me, and for my son.

So I will post screenshot of what I made on days, if i don't post i did not trade,.

I will also translate that information as if it was traded in the real market how much would that be, cause I am only trading now a £0.10/tick.

There is a 3 tick spread, so all the trades would be +2 tick in real markets, I will include this info too.This is how I translate the information to myself.

And forgive my English it is not my mother language.

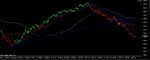

charts: yellow dot entry - blue line exit

Update requested by OP on August 24th 2014

Hello!

I have started this thread in March, Tried and failed many times since, but it seems so far that I may have found the right track. The latest attempt at "robbing" the markets starts at post #52

http://www.trade2win.com/boards/tra...extreme-futures-daytrading-8.html#post2366194

I was cruising the internet, and I thought why not start a journal like this, never done this before but maybe I can prove myself or those doubting their trading that it is possible to be profitable consistently.

I am only trading now the E-mini Russell, (TF) will try to post every day or when i trade, never been good at stuff like this, keeping a routine for a long time.

Russell was always the favourite, its like a good old friend now.

i started with FX in 2006, switched to ER2 in 2007 December. In 2008 from January to July I had incredible results, one that nobody would believe. Way better percentage than Larry Williams' winning 1000% a year. Unfortunately I started with a small amount of money. I was trading on spreadbetting accounts, been struggling to become profitable again, for reasons I might only be able to detail in a longer book. Some private matters, family losses, and psychological changes that is almost impossible to reverse. Money changes you, more money ... a sh*tload of money does it even more efficiently. So because of that for 5 years I have been struggling, but now I have come to a point where I believe I got it again. To say it in a Mark Douglas way: I am in the zone 🙂

My trades are between 1-2 minutes to even 1-2 hour long, usually shorter time period. I trade very aggressively, but i believe the risk is not that high due to the fact my system seems to be working efficiently.

There is another reason: I am looking for an investor as well, not right now, only after I have proven myself. I see a small chance only that anyone would be so crazy to take this high risk but you never know, got to try. For me, and for my son.

So I will post screenshot of what I made on days, if i don't post i did not trade,.

I will also translate that information as if it was traded in the real market how much would that be, cause I am only trading now a £0.10/tick.

There is a 3 tick spread, so all the trades would be +2 tick in real markets, I will include this info too.This is how I translate the information to myself.

And forgive my English it is not my mother language.

charts: yellow dot entry - blue line exit

Update requested by OP on August 24th 2014

Hello!

I have started this thread in March, Tried and failed many times since, but it seems so far that I may have found the right track. The latest attempt at "robbing" the markets starts at post #52

http://www.trade2win.com/boards/tra...extreme-futures-daytrading-8.html#post2366194

Last edited by a moderator: