barjon

Legendary member

- Messages

- 10,752

- Likes

- 1,863

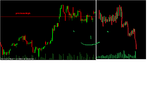

Thought I'd try a new series of wots happens next.

So try this for starters. Here's the scene:

You're working in the back room and listening to a vehement argument going on at the morning meeting. Some want to add to the position that's been built up in this instrument, some want to start unwinding it and some want just want to sit on the sidelines. To resolve matters the chart's slung on your desk (you've got nothing else to work with) and you're ask to advise on the course of action to take.

So, what do you advise and why?

have fun

jon

So try this for starters. Here's the scene:

You're working in the back room and listening to a vehement argument going on at the morning meeting. Some want to add to the position that's been built up in this instrument, some want to start unwinding it and some want just want to sit on the sidelines. To resolve matters the chart's slung on your desk (you've got nothing else to work with) and you're ask to advise on the course of action to take.

So, what do you advise and why?

have fun

jon