You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

barjon

Legendary member

- Messages

- 10,752

- Likes

- 1,863

Whats in my mind atm is one of the invisible members down there called Mark, and is he typing??! I won't rep anyone to say thanks for participating... don't want people thinking those repped are correct or something..

Yes, it would be something indeed if Mark would participate. For the uninitiated, Mark provided some absolutely spot on analyses in the original wot series - so good, in fact, that some people cried foul and started hurling abuse around. It got so wearing that Mark got justifiably fed up and removed his posts which was a great loss to those wishing to learn and understand the mechanics of the market.

jon

Skill Leverage

Experienced member

- Messages

- 1,316

- Likes

- 186

tbh this thread isn't worth **** until Spanish has drawn 8,000 lines on the chart and told us what's going to happen

dick_dastardly

Established member

- Messages

- 843

- Likes

- 152

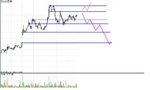

something to argue about... trading related 😱

What happened next......?

WHAT! 😡 an argument about trading ????

Oh, go on then :cheesy: 😱

Well, I don't do EOD and I don't do prediction ( I gave that up a long time ago ) so I'm firmly in the "I haven't a furkin clue camp".

However, if this were a shorter TF chart then this might be one scenario I would be on the look out for.

Basically, I think the way I would approach this is to bravely and courageously stand aside whilst the bulls and bears fight it out, wait to see who wins and then bravely and courageously join the winning side.

dd

[edit] hmmm Wasp, I've just realised, in your original chart there's more fresh air below the price action than above it. Using my 20/20 hindsight glasses suggests a down move then ?????

:cheesy:

.

.

Attachments

Last edited:

rathcoole_exile

Guest Author

- Messages

- 3,925

- Likes

- 767

blackcab

Established member

- Messages

- 523

- Likes

- 51

Here's my hunch (heavily guided by the amount of white space available to draw in - a trick question?)something to argue about... trading related 😱

What happened next......?

waspwot1.png - File Shared from Box.net - Free Online File Storage

(Are attachments on here not working? Was timing out when I tried to attach the file.)

TheBramble

Legendary member

- Messages

- 8,394

- Likes

- 1,171

I don’t know what’s going to happen next.

When I used charts to trade I always used (needed) far more context to assist me in formulating a plan of action. The sector the instrument was in, the market in which it was traded and the markets sentiment as a whole. What currencies were doing, bond yield, commodities, interest rates. They are all vital to me in coming up with a view that I feel has a higher than lower probability of coming about. But always with a counter-view plan if I was totally wrong about how it might pan out. This tended more often than not to be ‘do nothing’.

While all the textbook stuff on island tops, gaps and VSA and all the other good old boys have their place, I did find that in and of themselves, there was a remarkably low success rate if all other factors/knowledge/experience are excluded.

However, that’s just me. As has been mentioned, there was one among us who still quietly wanders the halls in the early hours who did have an almost supernatural skill in working without any apparent context and looking at a completely unannotated chart as wasp has presented here. I say almost supernatural, in the strictest sense of the word it is in reality, supernatural - above normal. Well done Mr. M and I know you’re not blushing.

I have this image of him when presented with such a blank canvass similar to those bods on ‘Heroes’. His eyes suddenly become opaque. He stares – sightlessly – into the void and begins to move his green and red and blue e-markers over that chart – almost always exactly predicting (dictating???) the very real future.

It may be the severe Vindaloos that was/is his almost constant diet that caused that effect.

When ever I have a Vindaloo it’s normally other people’s eyes that glaze over…

FWIW – There appears to be a top currently defined by the action of those two longish (relatively) range bars 3-4 weeks back. We’re seeing Higher Highs and start-edit:Higher (not Lower):end-edit Lows but volume looks to be dropping over the last few weeks and the most recent pump of volume in the last week has not propelled the price that much higher than the previous high. I’m suggesting overall weakness.

If it broke down past the prior Lower Low (where that big mother of red volume sits) on increasing volume I’d play it down to halfway between the top and bottom of the gap over on the left. Leave a little bit for the pure TA boys to fight over. LOL.

I wouldn’t be looking to play any upside move.

Again, without any other context to work within this is, by definition, a poor analysis and in reality, why would you choose to trade with one arm tied behind your back.

When I used charts to trade I always used (needed) far more context to assist me in formulating a plan of action. The sector the instrument was in, the market in which it was traded and the markets sentiment as a whole. What currencies were doing, bond yield, commodities, interest rates. They are all vital to me in coming up with a view that I feel has a higher than lower probability of coming about. But always with a counter-view plan if I was totally wrong about how it might pan out. This tended more often than not to be ‘do nothing’.

While all the textbook stuff on island tops, gaps and VSA and all the other good old boys have their place, I did find that in and of themselves, there was a remarkably low success rate if all other factors/knowledge/experience are excluded.

However, that’s just me. As has been mentioned, there was one among us who still quietly wanders the halls in the early hours who did have an almost supernatural skill in working without any apparent context and looking at a completely unannotated chart as wasp has presented here. I say almost supernatural, in the strictest sense of the word it is in reality, supernatural - above normal. Well done Mr. M and I know you’re not blushing.

I have this image of him when presented with such a blank canvass similar to those bods on ‘Heroes’. His eyes suddenly become opaque. He stares – sightlessly – into the void and begins to move his green and red and blue e-markers over that chart – almost always exactly predicting (dictating???) the very real future.

It may be the severe Vindaloos that was/is his almost constant diet that caused that effect.

When ever I have a Vindaloo it’s normally other people’s eyes that glaze over…

FWIW – There appears to be a top currently defined by the action of those two longish (relatively) range bars 3-4 weeks back. We’re seeing Higher Highs and start-edit:Higher (not Lower):end-edit Lows but volume looks to be dropping over the last few weeks and the most recent pump of volume in the last week has not propelled the price that much higher than the previous high. I’m suggesting overall weakness.

If it broke down past the prior Lower Low (where that big mother of red volume sits) on increasing volume I’d play it down to halfway between the top and bottom of the gap over on the left. Leave a little bit for the pure TA boys to fight over. LOL.

I wouldn’t be looking to play any upside move.

Again, without any other context to work within this is, by definition, a poor analysis and in reality, why would you choose to trade with one arm tied behind your back.

Last edited:

Re: Volume

Can you tell us which asset class this is - I mean, it's not "tick volume' or anything stupid like that, its an asset traded in an exchange with verifiable transactions?

And, although it states "data is end of day", can you confirm it is infact daily data, not 5min intervals downloaded later on?

thanks

P.S. Not that any of this makes a blind bit of difference to me, I still don't know.

Can you tell us which asset class this is - I mean, it's not "tick volume' or anything stupid like that, its an asset traded in an exchange with verifiable transactions?

And, although it states "data is end of day", can you confirm it is infact daily data, not 5min intervals downloaded later on?

thanks

P.S. Not that any of this makes a blind bit of difference to me, I still don't know.

mr.marcus

Active member

- Messages

- 245

- Likes

- 176

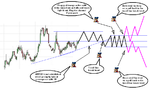

....hmmmm...is this really a good idea...did this last night with one of my students ...we call the top pattern a ghost...although i dont really like the term pattern....tradtionally pattern interpretation like bull****ski and surinotes etc are chocolate tea pot syndrome...as is volume reading ...VSA..etc...book sellers no more ..anyways..we both called it immediately with a sucker gap...not gonna go into full explaination like before..marked on the only areas needed to be considered.

The key is understanding the reason for the gap...the preceding action gives a clue as does the post action...the prior action would have likely been sideways for time...a low demand and supply enviroment...the gap was used to sucker in new longs and free up shorts for future downside liquidity....the volume expresses this and professional intent.....so this is a gap into weak demand.....a sucker gap.Its more than likely also to have taken out a major level used as a trigger...red lineish....you can see something goin off in anticipation to this i belive at the blue circle which backs this thoery up.

Can only be drawn to the info on the chart....but would be looking for a major support to be taken out which isnt shown ...if we had prices and other support shown the level could be anticapted.

theres 10-20 other clues on the chart...but off for a builders lunch now....and back into retirement....laters.

ps.....heres a tip.....stand back from charts youve drawn.....do they really look right?...the angles ...depth etc.....my boyz have to white board to they can draw charts blindfolded..(but not bound to chairs btw)...future charts that is with varying degrees of prior information....anyways....practice drawing .

The key is understanding the reason for the gap...the preceding action gives a clue as does the post action...the prior action would have likely been sideways for time...a low demand and supply enviroment...the gap was used to sucker in new longs and free up shorts for future downside liquidity....the volume expresses this and professional intent.....so this is a gap into weak demand.....a sucker gap.Its more than likely also to have taken out a major level used as a trigger...red lineish....you can see something goin off in anticipation to this i belive at the blue circle which backs this thoery up.

Can only be drawn to the info on the chart....but would be looking for a major support to be taken out which isnt shown ...if we had prices and other support shown the level could be anticapted.

theres 10-20 other clues on the chart...but off for a builders lunch now....and back into retirement....laters.

ps.....heres a tip.....stand back from charts youve drawn.....do they really look right?...the angles ...depth etc.....my boyz have to white board to they can draw charts blindfolded..(but not bound to chairs btw)...future charts that is with varying degrees of prior information....anyways....practice drawing .

Attachments

Last edited:

rags2riches

Well-known member

- Messages

- 399

- Likes

- 135

wasp

Legendary member

- Messages

- 5,107

- Likes

- 880

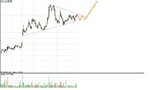

What I find the most interesting and fascinating about these threads is not, who gets it right and how much so, but how people come to their conclusions.

It really sheds light on different approaches and I think helps teach newbies so much more than a pile of books, or some of the badly phrased questions that appear, as it shows them what an array of different traders see and how they try to see what will be.

I am in the camp of wait and see. I don't know volume so it doesn't help me so I have to see action at said levels and thus, despite knowing the answer, would still have produced 2 scenarios and would like to see the action at each key area.

So here is my answer regardless... the actual result I will post tonight. I urge experienced and newbies to post without fear, their interpretation, as its not about being right or wrong, but learning.

It really sheds light on different approaches and I think helps teach newbies so much more than a pile of books, or some of the badly phrased questions that appear, as it shows them what an array of different traders see and how they try to see what will be.

I am in the camp of wait and see. I don't know volume so it doesn't help me so I have to see action at said levels and thus, despite knowing the answer, would still have produced 2 scenarios and would like to see the action at each key area.

So here is my answer regardless... the actual result I will post tonight. I urge experienced and newbies to post without fear, their interpretation, as its not about being right or wrong, but learning.

Attachments

mr.marcus

Active member

- Messages

- 245

- Likes

- 176

What I find the most interesting and fascinating about these threads is not, who gets it right and how much so, but how people come to their conclusions.

It really sheds light on different approaches and I think helps teach newbies so much more than a pile of books, or some of the badly phrased questions that appear, as it shows them what an array of different traders see and how they try to see what will be.

I am in the camp of wait and see. I don't know volume so it doesn't help me so I have to see action at said levels and thus, despite knowing the answer, would still have produced 2 scenarios and would like to see the action at each key area.

So here is my answer regardless... the actual result I will post tonight. I urge experienced and newbies to post without fear, their interpretation, as its not about being right or wrong, but learning.

really?....the point being with all the information giving it could only produce ONE highly probable directional scenario.....so any apparent upside setup would more than likely be faking in final demand...leading to a reversal back down and a stop out.

If a car is low on fuel you do dont plan a long trip but head for a petrol station....the market is no different....the volume and price action lead you to estimate whats in the tank. Therefore if i am aware that 95% of the time with the information given the market will break down hard soon ...then why would i want to consider a long and ruin my odds....the 5% of being wrong leads me to re analyze the information as i have missed a clue...being "wrong" leads me to search harder so i can be even more "right"...i accept being "wrong" but if i dont act upon it post market than im a fool.

If i look for a long or a short...im saying the market has no pressure or bias i can read...50/50....poor odds indeed...however money management and discipline can still lead to profitabilty...this should not be confused with market reading.....one can make you good money....one will make you great money.

To add..markets dont travel in straight lines for one reason only....there are a limited amount of numpties ...and never enough to quench the need of those that "know"...hence numpties have to be displaced countless times through gyrations in price , price action and news.Understanding whats in the tank....where the re fueling stations are...and how much fuel is needed for the journey is the market.

Back to my more comfortable state of hemitosis.....see you in 2010.

Last edited:

wasp

Legendary member

- Messages

- 5,107

- Likes

- 880

Nope....the point being with all the information giving it could only produce ONE directional scenario.....so any apparent upside setup would more than likely be faking in final demand...leading to a reversal back down and a stop out.

If a car is low on fuel you do dont plan a long trip but head for a petrol station....the market is no different....the volume and price action lead you to estimate whats in the tank.

However you can be profitable not knowing whats in the tank with good money management and great discipline....this should not be confused with market reading.....one can make you good money....one will make you great money.

To add..markets dont travel in straight lines for one reason only....there are a limited amount of numpties ...and never enough to quench the need of those that "know"...hence numpties have displaced countless times thru gyrations in price , price action and news.Understanding whats in the tank....where the re fueling stations are...and how much fuel is needed for the journey is the market.

Back to my more comfortable state of hemitosis.....see you in 2010.

Well I guess that makes me a numpty as I prefer to gauge the distance to travel and the amount in my tank at each stage of the journey. Not to say I am ever left on the side of the road, jerry can in hand and thumb out!

It is enough to see the horizon, but not past it till you get there, just be ready.

Similar threads

- Replies

- 35

- Views

- 9K