You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

roguetrader

Senior member

- Messages

- 2,062

- Likes

- 49

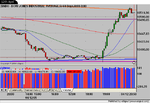

Market a bit of a mess here, NYSE internals bearish, Nasdaq internals more or less neutral. Semis and Biotech leading the Nasdaq, may have to wait for FOMC minutes to resolve this.

Total volume more or less on par with yesterdays pace.

Total volume more or less on par with yesterdays pace.

roguetrader

Senior member

- Messages

- 2,062

- Likes

- 49

SOX right at 200 week sma, could be interesting.

counter_violent

Legendary member

- Messages

- 12,672

- Likes

- 3,787

Just caught a cracking dollar 50 cent drop on google 😉

Bluewave

Active member

- Messages

- 240

- Likes

- 2

counter_violent said:Just caught a cracking dollar 50 cent drop on google 😉

...but were you long yesterday?! Now that was tasty 😉

counter_violent

Legendary member

- Messages

- 12,672

- Likes

- 3,787

Bluewave said:...but were you long yesterday?! Now that was tasty 😉

No Blue , I only looked at google after Lion 63 posted yesterday on this thread....tx to Lion 63 . I do'nt want to go all fundamental here , but suffice to say , when the rot set in purely from a tech angle ....it had to be the easiest short of the year 😆

Well done Counter Violent.

It must be pointed out that the meteoric rise of Google shares in the last two sessions is down to it's inclusion in the S&P 500.

Those that said the DOW would find it hard to stay above 10,500 on a technical basis seem to be right (at least for the moment). User had a good post backed up with charts over the weekend.

It must be pointed out that the meteoric rise of Google shares in the last two sessions is down to it's inclusion in the S&P 500.

Those that said the DOW would find it hard to stay above 10,500 on a technical basis seem to be right (at least for the moment). User had a good post backed up with charts over the weekend.

User

Experienced member

- Messages

- 1,170

- Likes

- 23

19.00 UK time is going to be interesting......

Are we going to see volatility? Could the Dow climb into positive mode or will we see a continuation of current declines.....FOMC minutes...............

VIX is up only 1% in relation to todays session...

It fair to say that after last weeks strong gains and yesterdays continuation it will be difficult to make progress on the downside intially.......but once we can get some confirmed downward action then the pace should pick up and this upward bias will probably stop.

Are we going to see volatility? Could the Dow climb into positive mode or will we see a continuation of current declines.....FOMC minutes...............

VIX is up only 1% in relation to todays session...

It fair to say that after last weeks strong gains and yesterdays continuation it will be difficult to make progress on the downside intially.......but once we can get some confirmed downward action then the pace should pick up and this upward bias will probably stop.

User

Experienced member

- Messages

- 1,170

- Likes

- 23

Does anyone know what the Dow did after the last FOMC minutes were released?

I need reminding myself? Can anyone shed light on the question?

roguetrader

Senior member

- Messages

- 2,062

- Likes

- 49

counter_violent

Legendary member

- Messages

- 12,672

- Likes

- 3,787

Interesting down triangle pattern now well established on the Dow .....basing at circa 470... mouth of the triangle some 40 points .....so a break to the down will give us 425/30...... a pop to the upside will give us 510 possibly even 530 ......I favour downside action ......after 19.00 hrs

just my ten penneth 😉

just my ten penneth 😉

Very interesting commentary on safehaven.com from Dr Robert Mchugh.Reckons that we have all sorts of fibs tomorrow coinciding with 10610.

At the moment though imo it all looks like its consolidating before more upside only because it has done so far everytime while its hovered like this so maybe 10610 not out of the question.

At the moment though imo it all looks like its consolidating before more upside only because it has done so far everytime while its hovered like this so maybe 10610 not out of the question.

roguetrader

Senior member

- Messages

- 2,062

- Likes

- 49

FOMC minutes a bit of a non-event

User

Experienced member

- Messages

- 1,170

- Likes

- 23

FOMC minutes a bit of a non-event

Only for the moment......

As my analysis suggested before......the troubles of 10500 continue.......We moved higher touched the area and came back down......

No real reaction at the moment but in fairness the resistance at 10500 is becoming more obvious.....

How the session will develop......who knows?!

We could close above 10500 as simply anything could happen but at this moment in time it does seem difficult...IMHO

Similar threads

- Replies

- 1

- Views

- 3K

- Replies

- 1

- Views

- 5K