Gadgetman

Active member

- Messages

- 184

- Likes

- 1

Yes excellent trade on BCRX Lee. Put it on first thing in the morning, get stopped out just before end of day after it's moved nearly $3. If only they were all like that 🙂PitBull said:A few nice trades today.

One thanks to Samtron on RIMM for a quick collapse.

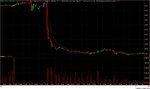

An all day run on BCRX, getting out before sell off

and a breakout on SNDK @ 71, with me and Gadgetman riding this to 72

had a couple of losses on RMBS, so overall a very good day indeed.

Some charts attached.

BTW. Just looked at INTC, IBM and YHOO results. Not great as missed earnings forecasts. YHOO trading down $4.5 and GOOG is down in sympathy. So tomorrow looks like we're gonna be in for a hell of a day! 😎

Never mind about RMBS, you made money on it Friday night......

See you at the Heathrow seminar Saturday - anyone else from this thread going?