You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Pazienza

Senior member

- Messages

- 2,334

- Likes

- 442

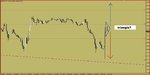

I took a long on the bounce off old resistance that has been forming most of the week (YM).

Balls of solid concrete or what?

I'll probably get stopped out at break even though, I moved up when it hit yesterdays lows. Can't see too much sense in taking risks with this one.

EDIT: Just stopped out at BE.

Balls of solid concrete or what?

I'll probably get stopped out at break even though, I moved up when it hit yesterdays lows. Can't see too much sense in taking risks with this one.

EDIT: Just stopped out at BE.

Attachments

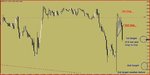

It broke the triangle - should go up the length of the flag post?

Conservative approach would be to wait for the price to go above the high of the triangle.

Sorry - no time to enter. Went for a short on that break below.

That was quick and nice.

15:44 Stop to 1.4290 (GU is going up if that means anything)

Attachments

Last edited:

bbmac

Veteren member

- Messages

- 3,584

- Likes

- 789

Re: U.s NFP tomorrow

A febrile atmosphere/environment into which the U.s releasr the monthly employment numbers tomorrow (Friday 5th Au)..Nfp, un-emp rate etc...

In this environment a bad print could well see risk aversion grip the market - ( like it hasn't already lol!) and the opposite of what traditionally we might have expected in instruments such as gbpusd ?

Last month diaapointed re the headline figure of +18k and with weekly intial claims rising and soft surveys of late we could well see an increase in the current 9.2% un-emp rate with a headline low print ?

It's data - anything can happen...will comment more tomorrow.

Could be like throwing 'fuel on the fire?' 'The perfecct Storm ?'

Whatever - with volatility comes opportunity so you gotta love it.

G/L

A febrile atmosphere/environment into which the U.s releasr the monthly employment numbers tomorrow (Friday 5th Au)..Nfp, un-emp rate etc...

In this environment a bad print could well see risk aversion grip the market - ( like it hasn't already lol!) and the opposite of what traditionally we might have expected in instruments such as gbpusd ?

Last month diaapointed re the headline figure of +18k and with weekly intial claims rising and soft surveys of late we could well see an increase in the current 9.2% un-emp rate with a headline low print ?

It's data - anything can happen...will comment more tomorrow.

Could be like throwing 'fuel on the fire?' 'The perfecct Storm ?'

Whatever - with volatility comes opportunity so you gotta love it.

G/L

Pazienza

Senior member

- Messages

- 2,334

- Likes

- 442

Re: U.s NFP tomorrow

Definitely loving it at the moment. I wonder though, I'm starting to think tomorrow might actually be on the dull side unless there's a real surprise.

A febrile atmosphere/environment into which the U.s releasr the monthly employment numbers tomorrow (Friday 5th Au)..Nfp, un-emp rate etc...

In this environment a bad print could well see risk aversion grip the market - ( like it hasn't already lol!) and the opposite of what traditionally we might have expected in instruments such as gbpusd ?

Last month diaapointed re the headline figure of +18k and with weekly intial claims rising and soft surveys of late we could well see an increase in the current 9.2% un-emp rate with a headline low print ?

It's data - anything can happen...will comment more tomorrow.

Could be like throwing 'fuel on the fire?' 'The perfecct Storm ?'

Whatever - with volatility comes opportunity so you gotta love it.

G/L

Definitely loving it at the moment. I wonder though, I'm starting to think tomorrow might actually be on the dull side unless there's a real surprise.

Re: U.s NFP tomorrow

👍 👍 👍

Whatever - with volatility comes opportunity so you gotta love it.

G/L

👍 👍 👍

bbmac

Veteren member

- Messages

- 3,584

- Likes

- 789

Interesting article re NFP:

http://www.fxtimes.com/fundamental-...tomorrows-nfp-after-this-weeks-labor-reports/

G/L

http://www.fxtimes.com/fundamental-...tomorrows-nfp-after-this-weeks-labor-reports/

G/L

robster970

Guest Author

- Messages

- 4,567

- Likes

- 1,390

Consolidation today I think. I don't think NFP will make much of a difference if it prints low or high compared to consensus. Damp squib.

bbmac

Veteren member

- Messages

- 3,584

- Likes

- 789

Your broker newsfeed is quickest you will see in print as a retail trader.. or try this: http://www.newsstrike.com/ it is free.

No guarantee of volatility on the release but I for one am hopeful.

G/L

No guarantee of volatility on the release but I for one am hopeful.

G/L

WEll am waiting to tap from this volatility. This will actually be the first time am trading the NFP because am not use to it. Can somebody help me with were I can get quick news release forexfactory is 2 mins late

bbmac

Veteren member

- Messages

- 3,584

- Likes

- 789

Should volatility result from NFP release (I favour a high number well above the forecast with an upside revision to last month, good +'ve no's in component private and manuf jobs and decrease in un-emp rate -or- a lo number well below the forecast with a downside revision to last month, bad -'ve no's in component private and manuf jobs and increase in un-emp rate) for greatest chance of a big reaction either way.

My tactic will be to 'follow the money.' Will be flat going into the release and should a set-up result will aim to do 1 or all of the following:

1. Buy/Sell a momentum b/o on the immediate release on close of a 1min 3min or 5min candle.

2. Sell the 1st hi-buy the 1st pullback lo -or- conversely - buy the 1st lo-sell the 1st pullback hi.

Will see what, if anything sets-up.

G/L

My tactic will be to 'follow the money.' Will be flat going into the release and should a set-up result will aim to do 1 or all of the following:

1. Buy/Sell a momentum b/o on the immediate release on close of a 1min 3min or 5min candle.

2. Sell the 1st hi-buy the 1st pullback lo -or- conversely - buy the 1st lo-sell the 1st pullback hi.

Will see what, if anything sets-up.

G/L

Your broker newsfeed is quickest you will see in print as a retail trader.. or try this: http://www.newsstrike.com/ it is free.

No guarantee of volatility on the release but I for one am hopeful.

G/L

Thanks bbmac the speed at which you replied was wonderful. I have never seen a forum like this am happy am here and am here.

bbmac

Veteren member

- Messages

- 3,584

- Likes

- 789

rawrschach

Experienced member

- Messages

- 1,223

- Likes

- 277

looks like no one was paying attention

Similar threads

- Replies

- 0

- Views

- 2K

- Replies

- 0

- Views

- 1K