Bottom in?

Can a selling climax occur on low overnight volume (low relative to the regular session but highish for overnight)? Is 2H chart long enough interval for analyzing move this size? (chart 1)

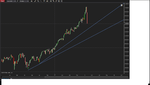

Weekly demand line seems to be holding for now. (chart 2)

Watching 6445 on 30 min for turn back down and test of lows. (just blew thru it) (chart 3)

Possibly all moot once market opens but interested in how others are seeing it.

Can a selling climax occur on low overnight volume (low relative to the regular session but highish for overnight)? Is 2H chart long enough interval for analyzing move this size? (chart 1)

Weekly demand line seems to be holding for now. (chart 2)

Watching 6445 on 30 min for turn back down and test of lows. (just blew thru it) (chart 3)

Possibly all moot once market opens but interested in how others are seeing it.