You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Crap Buddist

Senior member

- Messages

- 2,458

- Likes

- 289

dbphoenix

Guest Author

- Messages

- 6,954

- Likes

- 1,266

Good post, and i agree to a large extent.

Also, what interests me is different interpretations of what actually is a TRUE pin bar.

Recently it seems on T2W that a long lower or upper wick alone suffices as a pin bar.

As i understood it, supplemental to this, the high/low of the candle body also needed to be within the high/low of the candle body of the candle to the left of it.

So there seems to be a looseness in the definition/interp. of what a pin bar is - i'm not saying this is the case on this thread though....just generally.

The bar initself means very little...like taking a few sentences from a book and forgetting the rest....understand what they represent within context and "failing bars" is no longer an issue...the threads on t2w do not adress correct context.

Many traders -- and they aren't necessarily beginners -- are convinced that if something "works" that it must be true. However, this is not the case. Many things "work", even the most bizarre creations you ever heard of. But this doesn't make them true.

What is true, i.e., the territory, is price action. Candles, bars, pin bars, lines, indicators, even charts themselves are all representations, like maps. Sometimes the maps are closely tied to the territory. Sometimes they are very nearly fancy. But they are all the result of trader choice. The so-called "pin bar" is the result of the choices the trader has made. It does not exist in its form in price action (there is, for example, no "close" during the trading day). Whether the pin bar (or hammer or WRB or whatever) "works" for the trader is irrelevant to whether or not the bar exists outside the choices he has made.

Few traders understand how to interpret price action. Perhaps they don't want to know. But for whatever reason, they insert many levels -- or degrees of separation, if you will -- between them and the price action that is supposed to yield profits. They trade with gloves on, through a veil, often in the dark, looking in the rearview mirror. Could this have anything to do with the failure rate among traders?

Crap Buddist

Senior member

- Messages

- 2,458

- Likes

- 289

Note it traded above pinhead 213.55-214.05 . could see 21370 and drop back through 355 should pick up paces... ?

Crap Buddist

Senior member

- Messages

- 2,458

- Likes

- 289

hmm yeah what I call pin heads refer to S/R & potential S/R where price may bang its head . Just jumping on the craze. But on my chart I can see pins. I like it. essentially I think of rejection around zones. With maybe a slight "nose" or price flicking lower then back onto support and up for example.

Must admit line charts do help to destract less. Not everyones cup of tea but most are schooled with candles maybe. I suppose its like taking your clothes off and going shopping, feels weird at first but its perfectly natural 🙂

Must admit line charts do help to destract less. Not everyones cup of tea but most are schooled with candles maybe. I suppose its like taking your clothes off and going shopping, feels weird at first but its perfectly natural 🙂

TheBramble

Legendary member

- Messages

- 8,394

- Likes

- 1,171

I'm struggling with this Mr. B.Many traders -- and they aren't necessarily beginners -- are convinced that if something "works" that it must be true. However, this is not the case. Many things "work", even the most bizarre creations you ever heard of. But this doesn't make them true.

I suppose we could press for what you personally mean by 'work' and 'true', but there is no hint of any complex equivalence between the two for most people - there is a distinct and direct relationship.

If you throw a ball up in the air, unless anything acts to prevent it - it'll come back down - sometime. Works every time. You can believe it's going to happen every time. A basic truth.

Bringing the topic back to trading, there are few traders I believe who have anything that works every time, but enough things do enough of the time to be worth holding as a given, a truth.

I get what your saying about pinbars and how they don’t really exist. I’m delighted you’ve picked up on this issue as I am sure you can assist me as well as anyone can in ensuring the central theme and message I’m dallying and dancing around at the moment, thinking of the best way to construct it, gets delivered in a clear enough manner to benefit all who are interested enough to read it.

Crap Buddist

Senior member

- Messages

- 2,458

- Likes

- 289

Crap Buddist

Senior member

- Messages

- 2,458

- Likes

- 289

Into the pot.

But then I thought about ticks and thought of thousands of actual individual closed transactions . Hence one could say There is no single close during the day but thousands of them ? lol what does the individual want to believe?

Maybe thats a good question people should ask themselves. What do I want to believe ? Yeah maybe even if the individual can see themselves wanting to believe what they want to believe,then it may help them be open to opposite views and make open attitude easier? But wait, the need for opposite rigid views needs to exist in order to make the markets function. mmmm.

(there is, for example, no "close" during the trading day).

But then I thought about ticks and thought of thousands of actual individual closed transactions . Hence one could say There is no single close during the day but thousands of them ? lol what does the individual want to believe?

Maybe thats a good question people should ask themselves. What do I want to believe ? Yeah maybe even if the individual can see themselves wanting to believe what they want to believe,then it may help them be open to opposite views and make open attitude easier? But wait, the need for opposite rigid views needs to exist in order to make the markets function. mmmm.

Last edited:

tune

Well-known member

- Messages

- 394

- Likes

- 51

They trade with gloves on, through a veil, often in the dark, looking in the rearview mirror.

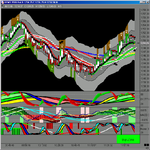

I collect all manner of charts and here is an almost painful example of hiding from the price. No offence intended to the creator of this map, it may well work just fine for them. But mixing the price up with the volume and then covering it in smoke so that you can definetly not see either properly? That is putting yourself some way away from the raw data. Although nowhere near as far as the second one.

Attachments

firewalker99

Legendary member

- Messages

- 6,655

- Likes

- 613

I collect all manner of charts and here is an almost painful example of hiding from the price. No offence intended to the creator of this map, it may well work just fine for them. But mixing the price up with the volume and then covering it in smoke so that you can definetly not see either properly? That is putting yourself some way away from the raw data. Although nowhere near as far as the second one.

The right chart hurts my eyes to be honest!

About the left one, I believe the creator of that map just used stockcharts.com where volume is presented as an overlay on the price chart. You can switch to a more classic separate volume representation below the chart though, so I doubt the author's intentions were to cloud things up. Just a fact that I've seen a lot of people copy charts from stockcharts.com...

Crap Buddist

Senior member

- Messages

- 2,458

- Likes

- 289

Release of Manhattan Souls

🙂 Manhattan skyline, and tortured souls being finally free ascending towards heaven ,peace and a plain price chart maybe.? Quite a nice piece when you look at it....new dawn arriving in th background 🙂Quality

(word for terrible word thread?)

I think maybe a Take Heart type members gallery should perhaps be considered opened sure Tony Heart would like a few of em ? Who didnt like that music whilst thinking "what the hells that , Sam aged 6, Eastbourne?" 🙂

No offence intended to the creator of this map, it may well work just fine for them. But mixing the price up with the volume and then covering it in smoke so that you can definetly not see either properly?

🙂 Manhattan skyline, and tortured souls being finally free ascending towards heaven ,peace and a plain price chart maybe.? Quite a nice piece when you look at it....new dawn arriving in th background 🙂Quality

(word for terrible word thread?)

I think maybe a Take Heart type members gallery should perhaps be considered opened sure Tony Heart would like a few of em ? Who didnt like that music whilst thinking "what the hells that , Sam aged 6, Eastbourne?" 🙂

Last edited:

tune

Well-known member

- Messages

- 394

- Likes

- 51

... I doubt the author's intentions were to cloud things up.

Maybe not, but they were not to uncloud either.

tune

Well-known member

- Messages

- 394

- Likes

- 51

I think maybe a Take Heart type members gallery should perhaps be considered opened

What's the address?

dbphoenix

Guest Author

- Messages

- 6,954

- Likes

- 1,266

But then I thought about ticks and thought of thousands of actual individual closed transactions . Hence one could say There is no single close during the day but thousands of them ? lol what does the individual want to believe?

Maybe thats a good question people should ask themselves. What do I want to believe ? Yeah maybe even if the individual can see themselves wanting to believe what they want to believe,then it may help them be open to opposite views and make open attitude easier? But wait, the need for opposite rigid views needs to exist in order to make the markets function. mmmm.

Freeing oneself from the traps offered by belief and focusing on reality is a large part of the process of negotiating as much as possible by the territory and as little as possible -- or at least as carefully -- with one's representations of it.

As for the "close", I'm sure that readers understood that I was not referring to the close of a trade. But then perhaps a glossary is required . . .

dbphoenix

Guest Author

- Messages

- 6,954

- Likes

- 1,266

Maybe not, but they were not to uncloud either.

Chip has been a devotee of indicators for years, which is why one has to put up with all the junk that he applies to free charts by default. One can spend time ridding the charts of all of that, try to ignore it, or pay for customizable charts.

But then it's Chip's site, so if one doesn't like it, he can always go elsewhere . . . 🙂

Crap Buddist

Senior member

- Messages

- 2,458

- Likes

- 289

Freeing oneself from the traps offered by belief and focusing on reality is a large part of the process of negotiating as much as possible by the territory and as little as possible -- or at least as carefully -- with one's representations of it.

As for the "close", I'm sure that readers understood that I was not referring to the close of a trade. But then perhaps a glossary is required . . .

I understood it that way too, but I mean if two people did a deal, a trade at say 50. then the print or close would be 50. and maybe thats the truth without time bars being involved. Or any close on an hourly 4 hourly or 5 minute bar. The truth is each done and closed deal ticking, away thousands of closed trades (closed as in agreed transaction) thats what I mean by thousands of closes.

Struck bargains maybe a better way of saying it and that struck bargain price prints on a screen. It may come across as a play on words but ,its not is it... ? Not meaning to split hairs or anything but there is no one close through the day but thousands of em?

indigowave

Newbie

- Messages

- 6

- Likes

- 0

time based indication

I am curious, does anyone "publish" or make available transactions per second? If one could see this domain as well then maybe the interpreted sentiment could be correctly visualised? I mean that is the intention of TA isn't it?

//indigo

I am curious, does anyone "publish" or make available transactions per second? If one could see this domain as well then maybe the interpreted sentiment could be correctly visualised? I mean that is the intention of TA isn't it?

//indigo

dbphoenix

Guest Author

- Messages

- 6,954

- Likes

- 1,266

I understood it that way too, but I mean if two people did a deal, a trade at say 50. then the print or close would be 50. and maybe thats the truth without time bars being involved. Or any close on an hourly 4 hourly or 5 minute bar. The truth is each done and closed deal ticking, away thousands of closed trades (closed as in agreed transaction) thats what I mean by thousands of closes.

Struck bargains maybe a better way of saying it and that struck bargain price prints on a screen. It may come across as a play on words but ,its not is it... ? Not meaning to split hairs or anything but there is no one close through the day but thousands of em?

The close of a trade and the close of a bar have nothing to do with each other. Again, my use of the word "close" had nothing to do with completing a transaction.

dbphoenix

Guest Author

- Messages

- 6,954

- Likes

- 1,266

I am curious, does anyone "publish" or make available transactions per second? If one could see this domain as well then maybe the interpreted sentiment could be correctly visualised? I mean that is the intention of TA isn't it?

//indigo

Yes. Volume. See this thread for a detailed treatment:

http://www.trade2win.com/boards/price-volume/27069-s-p-analysis-friday-2nd-oct.html