Old buddy just called me out and invited me for a quick after work beer. I'm going. I feel quite bad looking at the chart now - the mid price is 28 currently - nearer my target of 17 than my entry price. I'm annoyed at covering that one out of panic. I was to be taking a break.

Anyways, I'm down -25 from the day, up from an intra-day loss of -35.

Taking into account my profit yesterday (the only trade this week I've had the guts to hold), I'm +£2 for the week so far.

Good to know I've only wasted my time (and I don't see learning as a waste) and not my money this week.

Quick pondering before I have a shower, ****, shave.

I made a few good short calls today. One I exited prematurely at a loss. The short after that was from 1 tic lower and showed me a profit before I made the best cover of the day. Premature exit. My next short was a little early, but my overall market prediction was correct and I allowed it some room, not panicking an exit while it showed me a loss. Then I took +3 when I had a target of at least support. I see it is coming back to my exit again, but I could have squeezed another 10 out of it before even one indicator (volume, price, or tick) showed me a cover signal.

My other good long call I discussed with firewalker and didn't have the guts to take.

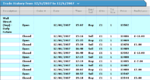

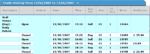

I am going to quickly list my trades for today, and leave you with my charts for today. If anyone would like to sift through my posts from today and the entries and exits I have mentioned, combined with my chart pictures, and make comments either to this thread or my journal I would appreciate it.

Most of what would be going in my journal is already on this thread, so I don't feel too bad about breaking my commitment to posting it here for you all immediately after EOD. I need some leisure time, I've not been out for a drink with mates in quite a while, and a nice civilised after work (for them, and I suppose me too) beer would be in order. I've found myself getting quite stressed today, and

all work and no play makes Jack a dull boy. All work and no play makes Jack a dull gboy. All work and no play makes Jacka dull boy.

(sorry - couldn't resist)

I bid you all good evening. I hope you have all done well. Most folk who had losing pips have made them up by my calculations. I'd like to trade the last hour, but I needed a break in the middle of the last trade and suspect I am overtrading anyway.

I promise you all some thoughtful ponderings on todays trading early tomorrow morning. Should be no later than 10am, as I need to have lunch, and do my daily premarket from 1pm onwards.

Have a good evening all, and thanks for the comments.