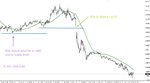

Captain Currency's mid-week “Simple Market Scan” using The 3 Ducks Trading System

Hello Duck Hunters,

Lots of good chat going on here! :clap:

Thought for Today;

Logic and simplicity, possibly the two things most traders lack are the very things The 3 Duck’s Trading System offers on a plate.

A change in sentiment (bearish to bullish, bullish to bearish and neutral to bullish) on some currency pairs since last week which is probably the kick the market needed.

Below is my mid-week “Simple Market Scan” using The 3 Ducks Trading System and my preference for the next few days.

January 25th 2012

Eur.Usd – current spot price is 1.2991, could be looking for buying opportunities if/when your 3 ducks line up 😀

Gbp.Usd – current spot price is 1.5580, could be looking for buying opportunities if/when your 3 ducks line up 😀

Eur.Gbp – current spot price is 0.8335, the Eur is slightly stronger than the Gbp at the moment and you could be looking for buying opportunities if/when your 3 ducks line up 🙂

Usd.Chf – current spot price is 0.9308, could be looking for selling opportunities if/when your 3 ducks line up. A break below the 0.9268 area is needed first for the bears to get control back 😀

Aud.Usd – current spot price is 1.0478, same as last week and steadily up over the last few days, could be looking for buying opportunities if/when your 3 ducks line up 😀

Usd.Cad – current spot price is 1.0132, I would be sitting on my hands with this pair for the moment 👎

Usd.Jpy – current spot price is 78.11 and getting some bullish movement lately, could be looking for buying opportunities if/when your 3 ducks line up 🙂

Eur.Jpy – current spot price is 101.43 and more bullish movement on this pair too, could be looking for buying opportunities if/when your 3 ducks line up 😀

Hope that helps you.

Until next time, Keep it Simple

Andy

These are not trade recommendations. The 3 Ducks Trading System is best used as a set of guidelines with discretion in addition with your own market analysis and trading ideas. I do not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.