You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Best Thread The 3 Duck's Trading System

- Thread starter Captain Currency

- Start date

- Watchers 259

Thanks but this trade today is providing a dose of reality. I'm trying to stick to my rules and not to bale out until either my profit target or stop is hit. I should say that I'm using minimum stakes with these trades.

Sell Eur/Jpy at 99.35 30pip stop two units. First target 30 pips profit, then stop to BE. However not going too well as I write after moving into a small profit of around 8 pips price has reversed sharply and has stopped me out for a full 30 pips on both units.

Hi Howlinwolf, I hope you don't mind but I've used your Eur.Jpy trade as an example. You will find you achieve better results if you enter in the direction of the 4 hour trend. Although your entry on this one was indeed below all three moving averages, the 4 hr trend was pointing in a bullish direction.

The best way to do it is to put the odds in your favour as much as you can. It's like running with a stiff breeze at your back. If you enter only in the same way as the 4 hour MA is pointing, you will increase the probabilities of a successful trade. If price is already moving in a particular direction it is more likely to continue in that direction than it is to reverse. Newton's Laws and all that :smart:

If you contrast this with your previous Gbp.Usd trade on 31st January you will see the clear difference.

Your trade wasn't an invalid trade, but it was sort of counter trend and therefore very very aggressive! I hope you don't mind me commenting like this, hopefully it is of some assistance. Stick with it!

Good trading

Nigel

Attachments

Howlinwolf

Member

- Messages

- 71

- Likes

- 2

Hi Nigel,Hi Howlinwolf, I hope you don't mind but I've used your Eur.Jpy trade as an example. You will find you achieve better results if you enter in the direction of the 4 hour trend. Although your entry on this one was indeed below all three moving averages, the 4 hr trend was pointing in a bullish direction.

The best way to do it is to put the odds in your favour as much as you can. It's like running with a stiff breeze at your back. If you enter only in the same way as the 4 hour MA is pointing, you will increase the probabilities of a successful trade. If price is already moving in a particular direction it is more likely to continue in that direction than it is to reverse. Newton's Laws and all that :smart:

If you contrast this with your previous Gbp.Usd trade on 31st January you will see the clear difference.

Your trade wasn't an invalid trade, but it was sort of counter trend and therefore very very aggressive! I hope you don't mind me commenting like this, hopefully it is of some assistance. Stick with it!

Good trading

Nigel

I don't mind at all that you have taken the trouble to comment on these trades and thanks for the tip about the 4 hour MA filter. I will make a note each morning about which direction each MA is pointing and also which are flat and use the information as a filter for which pairs to concentrate on.

Captain Currency

Experienced member

- Messages

- 1,093

- Likes

- 681

Captain Currency's mid-week “Simple Market Scan” using The 3 Ducks Trading System

Hello Duck Hunter,

Mind yourself with the EUR and GBP pairs because there will be a rate statement out from the ECB and the BoE this Thursday.

Thought for Today;

Your discipline and patience are going to be tested daily as a pro trader. Be aware of this side of trading, manage yourself and separate yourself from the armature trader. A small bit of patience and discipline can be worth more than lots of brains.

Below is my mid-week “Simple Market Scan” using The 3 Ducks Trading System and my preference for the next few days.

February 8th 2012

Eur.Usd – current spot price is 1.3274, I would be looking for buying opportunities when my 3 ducks line up 👍

Gbp.Usd – current spot price is 1.5917, I would be looking for buying opportunities when my 3 ducks line up 👍

Eur.Gbp – current spot price is 0.8340, the Eur and the Gbp are currently about the same strength so neither currency has a real advantage over the other at the moment. I would be sitting on my hands at the moment 😢

Usd.Chf – current spot price is 0.9133, I would be looking for selling opportunities when my 3 ducks line up 🙂

Aud.Usd – current spot price is 1.0835, I would be looking for buying opportunities when my 3 ducks line up 🙂

Usd.Cad – current spot price is 0.9943, I would be looking for selling opportunities when my 3 ducks line up 🙂

Usd.Jpy – current spot price is 77.05, not a lot of action on this pair over the last couple of months so a safe bet would be to sit on your hands until your ducks look happier 😴

Eur.Jpy – current spot price is 102.24, I would be looking for buying opportunities when my 3 ducks line up 🙂

Hope that helps you.

Until next time, Keep it Simple

Andy

These are not trade recommendations. The 3 Ducks Trading System is best used as a set of guidelines with discretion in addition with your own judgement, market analysis and trading ideas. I do not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Hello Duck Hunter,

Mind yourself with the EUR and GBP pairs because there will be a rate statement out from the ECB and the BoE this Thursday.

Thought for Today;

Your discipline and patience are going to be tested daily as a pro trader. Be aware of this side of trading, manage yourself and separate yourself from the armature trader. A small bit of patience and discipline can be worth more than lots of brains.

Below is my mid-week “Simple Market Scan” using The 3 Ducks Trading System and my preference for the next few days.

February 8th 2012

Eur.Usd – current spot price is 1.3274, I would be looking for buying opportunities when my 3 ducks line up 👍

Gbp.Usd – current spot price is 1.5917, I would be looking for buying opportunities when my 3 ducks line up 👍

Eur.Gbp – current spot price is 0.8340, the Eur and the Gbp are currently about the same strength so neither currency has a real advantage over the other at the moment. I would be sitting on my hands at the moment 😢

Usd.Chf – current spot price is 0.9133, I would be looking for selling opportunities when my 3 ducks line up 🙂

Aud.Usd – current spot price is 1.0835, I would be looking for buying opportunities when my 3 ducks line up 🙂

Usd.Cad – current spot price is 0.9943, I would be looking for selling opportunities when my 3 ducks line up 🙂

Usd.Jpy – current spot price is 77.05, not a lot of action on this pair over the last couple of months so a safe bet would be to sit on your hands until your ducks look happier 😴

Eur.Jpy – current spot price is 102.24, I would be looking for buying opportunities when my 3 ducks line up 🙂

Hope that helps you.

Until next time, Keep it Simple

Andy

These are not trade recommendations. The 3 Ducks Trading System is best used as a set of guidelines with discretion in addition with your own judgement, market analysis and trading ideas. I do not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Captain Currency

Experienced member

- Messages

- 1,093

- Likes

- 681

Why the trader is really the most important part of any trading system

Some traders focuses on long term results and accepts that they can have losing trades in the short term through no fault of their own.

On the other hand some traders concerned with short term results will change things if results are not going their way.

Good Idea

It may be a good idea to review your trades, your performance, your approach/method and yourself and makes changes only if the make logical sense.

Bad Idea

It’s a bad idea to make changes to your approach just because of short term negative results. This seems to be a common error among some traders.

While they have a losing run they will panic or get emotionally involved and tinker or even jump ship with their approach in order to improve their result even though the approach or method maybe logically sound.

A good trader understands and accepts that their losses are a natural part of trading.

A good weekend to all the good traders and those who wish to become one.

Andy

Some traders focuses on long term results and accepts that they can have losing trades in the short term through no fault of their own.

On the other hand some traders concerned with short term results will change things if results are not going their way.

Good Idea

It may be a good idea to review your trades, your performance, your approach/method and yourself and makes changes only if the make logical sense.

Bad Idea

It’s a bad idea to make changes to your approach just because of short term negative results. This seems to be a common error among some traders.

While they have a losing run they will panic or get emotionally involved and tinker or even jump ship with their approach in order to improve their result even though the approach or method maybe logically sound.

A good trader understands and accepts that their losses are a natural part of trading.

A good weekend to all the good traders and those who wish to become one.

Andy

Captain Currency

Experienced member

- Messages

- 1,093

- Likes

- 681

Captain Currency's mid-week “Simple Market Scan” using The 3 Ducks Trading System

Hello Duck Hunters,

Nothing really happening on a lot of the major pair recently and the only two pairs that look decent are the JPY pairs.

Be careful during these market conditions as past winning pips could be easily parted with.

Usd.Jpy – current spot price is 80.15, I would be looking for buying opportunities when my 3 ducks line up.

Eur.Jpy – current spot price is 106.02, I would be looking for buying opportunities when my 3 ducks line up.

Thought for Today: A great trader gets very little praise.

1) If a trader has 5 winning trades in a row it was probably because the current market conditions are in-tune with their method. (Thanks market, thanks method)

2) If a trader has a losing trade it was probably because the current market conditions suited their method but the probabilities on this trade didn’t follow through. (Unlucky that time method, we know it’s all about probabilities with you)

3) If a trader has 5 losing trades in a row it was probably because the current market conditions are not in-tune with their method, but they were impatient and continued to trade. (Bad Trader)

4) If a trader sits on their hand when the market conditions are not in-tune with their method they get a little praise. (Well done Trader)

Now you have a good reason to sit on your hands…

Chat soon,

Andy

These are not trade recommendations. The 3 Ducks Trading System is best used as a set of guidelines with discretion in addition with your own market analysis and trading ideas. I do not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Hello Duck Hunters,

Nothing really happening on a lot of the major pair recently and the only two pairs that look decent are the JPY pairs.

Be careful during these market conditions as past winning pips could be easily parted with.

Usd.Jpy – current spot price is 80.15, I would be looking for buying opportunities when my 3 ducks line up.

Eur.Jpy – current spot price is 106.02, I would be looking for buying opportunities when my 3 ducks line up.

Thought for Today: A great trader gets very little praise.

1) If a trader has 5 winning trades in a row it was probably because the current market conditions are in-tune with their method. (Thanks market, thanks method)

2) If a trader has a losing trade it was probably because the current market conditions suited their method but the probabilities on this trade didn’t follow through. (Unlucky that time method, we know it’s all about probabilities with you)

3) If a trader has 5 losing trades in a row it was probably because the current market conditions are not in-tune with their method, but they were impatient and continued to trade. (Bad Trader)

4) If a trader sits on their hand when the market conditions are not in-tune with their method they get a little praise. (Well done Trader)

Now you have a good reason to sit on your hands…

Chat soon,

Andy

These are not trade recommendations. The 3 Ducks Trading System is best used as a set of guidelines with discretion in addition with your own market analysis and trading ideas. I do not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Captain Currency

Experienced member

- Messages

- 1,093

- Likes

- 681

Hello Duck Hunters,

Thought for Today:

Tomorrow is the first day of a new trading month and 2 simple things you could think about doing are:

1. Put last month behind you, if February was a bad trading month, March gives you a new start.

2. One month at a time, just focus on the month ahead. If your goal is to make 3-5% per month and you reach you goal a week before the month ends – stop trading, take a few days off from your charts and go into the next month feeling good and with the wisdom that you can make a few percent in a month.

If you take it one month at a time it allows you to measure your progress and performance.

Simple Market Scan

Below is my mid-week “Simple Market Scan” using The 3 Ducks Trading System and my preference for the next few days.

February 29th 2012

Eur.Usd – current spot price is 1.3437, I would be looking for buying opportunities when my 3 ducks line up.

Gbp.Usd – current spot price is 1.5958, I would be looking for buying opportunities when my 3 ducks line up.

Eur.Gbp – current spot price is 0.8420, the Eur and the Gbp are currently about the same strength so neither currency has a real advantage over the other at the moment.

Usd.Chf – current spot price is 0.8991, I would be looking for selling opportunities when my 3 ducks line up. A break below the 0.8930 area is needed for the bears to be in control.

Aud.Usd – current spot price is 1.0809, it looks like it wants to go up but can it? I would prefer to be looking for buying opportunities when my 3 ducks line up.

Usd.Cad – current spot price is 0.9892, I would be looking for selling opportunities when my 3 ducks line up.

Usd.Jpy – current spot price is 80.63, this pair has been trending up nicely over the last few weeks and I would be looking for buying opportunities when my 3 ducks line up.

Eur.Jpy – current spot price is 108.02, I would be looking for buying opportunities when my 3 ducks line up. A break above the 108.76 would be good for buyers.

Hope that helps you.

Keep it Simple

Andy

These are not trade recommendations. The 3 Ducks Trading System is best used as a set of guidelines with discretion in addition with your own market analysis and trading ideas. I do not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Thought for Today:

Tomorrow is the first day of a new trading month and 2 simple things you could think about doing are:

1. Put last month behind you, if February was a bad trading month, March gives you a new start.

2. One month at a time, just focus on the month ahead. If your goal is to make 3-5% per month and you reach you goal a week before the month ends – stop trading, take a few days off from your charts and go into the next month feeling good and with the wisdom that you can make a few percent in a month.

If you take it one month at a time it allows you to measure your progress and performance.

Simple Market Scan

Below is my mid-week “Simple Market Scan” using The 3 Ducks Trading System and my preference for the next few days.

February 29th 2012

Eur.Usd – current spot price is 1.3437, I would be looking for buying opportunities when my 3 ducks line up.

Gbp.Usd – current spot price is 1.5958, I would be looking for buying opportunities when my 3 ducks line up.

Eur.Gbp – current spot price is 0.8420, the Eur and the Gbp are currently about the same strength so neither currency has a real advantage over the other at the moment.

Usd.Chf – current spot price is 0.8991, I would be looking for selling opportunities when my 3 ducks line up. A break below the 0.8930 area is needed for the bears to be in control.

Aud.Usd – current spot price is 1.0809, it looks like it wants to go up but can it? I would prefer to be looking for buying opportunities when my 3 ducks line up.

Usd.Cad – current spot price is 0.9892, I would be looking for selling opportunities when my 3 ducks line up.

Usd.Jpy – current spot price is 80.63, this pair has been trending up nicely over the last few weeks and I would be looking for buying opportunities when my 3 ducks line up.

Eur.Jpy – current spot price is 108.02, I would be looking for buying opportunities when my 3 ducks line up. A break above the 108.76 would be good for buyers.

Hope that helps you.

Keep it Simple

Andy

These are not trade recommendations. The 3 Ducks Trading System is best used as a set of guidelines with discretion in addition with your own market analysis and trading ideas. I do not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Captain Currency

Experienced member

- Messages

- 1,093

- Likes

- 681

It's World Book Day today and if anybody would like a free copy of The 3 Duck's Trading System e-book, a simple system that will improve your trading, details are on The Captain Currency blog.

The e-book is a quick read (1 hour) and you'll want to go back to it time and time again.

The 3 Duck's Trading System e-book was published in 2007 and has been helpful to traders.

The Foundation for Successful Trading

What the 3 ducks are trying to get you to do are LOGICALLY scan your charts and LOGICALLY trade your charts as well as keeping it SIMPLE!

Happy Reading,

Andy

The e-book is a quick read (1 hour) and you'll want to go back to it time and time again.

The 3 Duck's Trading System e-book was published in 2007 and has been helpful to traders.

The Foundation for Successful Trading

What the 3 ducks are trying to get you to do are LOGICALLY scan your charts and LOGICALLY trade your charts as well as keeping it SIMPLE!

Happy Reading,

Andy

Hi

Some of the main pairs I watch have been consolidating over the course of the last few weeks and they have offered slim pickings as far as 3 ducks trades have been concerned. The downside of consolidation is that if you don't trade it properly (or not at all) you can get whipsawed out very easily and your equity can take a hit. But the upside of consolidation is that usually the longer the consolidation the better and stronger the move is when price inevitably breaks out. You will be rewarded for your patience. It's like shaking a bottle of a fizzy drink then opening it, the longer you shake it the bigger the explosion.

The two pairs I have been gauging this consolidation through are Aud/Usd and Nzd/Usd. I notice that Nzd/Usd has taken a break outside of its recent range this morning and the 4 hr SMA has started to turn to the downside. This could be an indication that we are in for some bearish movement over the next while.

Some of the best opportunities come as the 4hr sma is beginning to turn because you could find yourself in the market right at the beginning of a trend that conceivably could last a few hundred pips or more. If a trend develops you will get further 3 ducks opportunities further into the trend to add to your position. The trick is to keep your ammo dry during the consolidation so you can take maximum reward when the price does decide to make a run for it.

The pairs that are on my radar over the next while if the ducks line up to the downside are: Nzd/Usd, Aud/Usd, Eur/Usd, Eur/Cad, and possibly Eur/Gbp, although it might take a few sessions for the SMA to turn properly. Gbp/Nzd looks like it could be starting a trend to the upside.

Obviously any trades need to be opening according to the 3 ducks rules. It goes without saying that this outlook could change with one news release, but it is how I am seeing the market right now.

Good trading.

Some of the main pairs I watch have been consolidating over the course of the last few weeks and they have offered slim pickings as far as 3 ducks trades have been concerned. The downside of consolidation is that if you don't trade it properly (or not at all) you can get whipsawed out very easily and your equity can take a hit. But the upside of consolidation is that usually the longer the consolidation the better and stronger the move is when price inevitably breaks out. You will be rewarded for your patience. It's like shaking a bottle of a fizzy drink then opening it, the longer you shake it the bigger the explosion.

The two pairs I have been gauging this consolidation through are Aud/Usd and Nzd/Usd. I notice that Nzd/Usd has taken a break outside of its recent range this morning and the 4 hr SMA has started to turn to the downside. This could be an indication that we are in for some bearish movement over the next while.

Some of the best opportunities come as the 4hr sma is beginning to turn because you could find yourself in the market right at the beginning of a trend that conceivably could last a few hundred pips or more. If a trend develops you will get further 3 ducks opportunities further into the trend to add to your position. The trick is to keep your ammo dry during the consolidation so you can take maximum reward when the price does decide to make a run for it.

The pairs that are on my radar over the next while if the ducks line up to the downside are: Nzd/Usd, Aud/Usd, Eur/Usd, Eur/Cad, and possibly Eur/Gbp, although it might take a few sessions for the SMA to turn properly. Gbp/Nzd looks like it could be starting a trend to the upside.

Obviously any trades need to be opening according to the 3 ducks rules. It goes without saying that this outlook could change with one news release, but it is how I am seeing the market right now.

Good trading.

Last edited:

Captain Currency

Experienced member

- Messages

- 1,093

- Likes

- 681

Good morning Duck Hunters,

Stay Safe - Get Out of DODGE!

Mind yourself with the EUR, GBP, CAD and NZD pairs because there will be a rate statement out for these pairs tomorrow (Thur).

And also mind yourself this Friday on all currency pairs as The Non-Farm Payrolls are due to be released.

Simple Market Scan

Below is my mid-week “Simple Market Scan” using The 3 Ducks Trading System and my preference for the next few days.

Wednesday March 7th 2012

Eur.Usd – current spot price is 1.3135, I would be looking for selling opportunities when my 3 ducks line up.

Gbp.Usd – current spot price is 1.5726, I would be looking for selling opportunities when my 3 ducks line up.

Eur.Gbp – current spot price is 0.8351, GBP is currently a bit stronger than the EUR and I would be looking for selling opportunities when my 3 ducks line up. A break below the 0.8300 area is needed for the bears to be back in control.

Usd.Chf – current spot price is 0.9175, I would be looking for buying opportunities when my 3 ducks line up.

Aud.Usd – current spot price is 1.0558, its been down for the last few days and I would be looking for selling opportunities when my 3 ducks line up.

Usd.Cad – current spot price is 0.9998, I would be neutral on this pair at the moment so sitting on my hands.

Usd.Jpy – current spot price is 80.77, I would be looking for buying opportunities when my 3 ducks line up. A break above the 0.8160 area is needed for the bulls to be back in control.

Eur.Jpy – current spot price is 106.11, neutral on this pair at the moment but a break and hold below the 105.60 area could get me bearish and looking for selling opportunities when my 3 ducks line up.

Hope that helps you.

Until next time, Stay Safe,

Andy

These are not trade recommendations. The 3 Ducks Trading System is best used as a set of guidelines with discretion in addition with your own market analysis and trading ideas. I do not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Stay Safe - Get Out of DODGE!

Mind yourself with the EUR, GBP, CAD and NZD pairs because there will be a rate statement out for these pairs tomorrow (Thur).

And also mind yourself this Friday on all currency pairs as The Non-Farm Payrolls are due to be released.

Simple Market Scan

Below is my mid-week “Simple Market Scan” using The 3 Ducks Trading System and my preference for the next few days.

Wednesday March 7th 2012

Eur.Usd – current spot price is 1.3135, I would be looking for selling opportunities when my 3 ducks line up.

Gbp.Usd – current spot price is 1.5726, I would be looking for selling opportunities when my 3 ducks line up.

Eur.Gbp – current spot price is 0.8351, GBP is currently a bit stronger than the EUR and I would be looking for selling opportunities when my 3 ducks line up. A break below the 0.8300 area is needed for the bears to be back in control.

Usd.Chf – current spot price is 0.9175, I would be looking for buying opportunities when my 3 ducks line up.

Aud.Usd – current spot price is 1.0558, its been down for the last few days and I would be looking for selling opportunities when my 3 ducks line up.

Usd.Cad – current spot price is 0.9998, I would be neutral on this pair at the moment so sitting on my hands.

Usd.Jpy – current spot price is 80.77, I would be looking for buying opportunities when my 3 ducks line up. A break above the 0.8160 area is needed for the bulls to be back in control.

Eur.Jpy – current spot price is 106.11, neutral on this pair at the moment but a break and hold below the 105.60 area could get me bearish and looking for selling opportunities when my 3 ducks line up.

Hope that helps you.

Until next time, Stay Safe,

Andy

These are not trade recommendations. The 3 Ducks Trading System is best used as a set of guidelines with discretion in addition with your own market analysis and trading ideas. I do not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Hi,

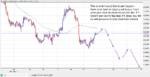

I pointed out a few pairs last week that I was looking to roll over to the bear side. Most of the 4 hr MAs are now nicely pointing downwards. The one that I think I will be focusing on this week will be the main currency pair, Eur.Usd.

You can see that there was strong downward movement on Friday and today has seen a weak retrace to the upside. I would like to see a little more upward movement and then a stronger movement back into the main 4hr downtrend.

I'll be keeping my stops tight as usual. Be prepared to spend a few pips to earn far more back. If a trade looks like it will trigger when I am at my main pc I will log in here and describe how I am seeing the price action.

Just a note on reality versus perception, a topic I was thinking about at the weekend, with all of the Greek news and all the rest of it. I used to get hung up a lot on fundamentals. Unless you really know your fundamental stuff it is very difficult to trade based on the news. It is very tempting to allow the constant newsflow we have nowadays to influence your view of what a market is doing and where it might be headed. The fact is that us retail traders as a group are consistently on the wrong side of the market, we will sell a rally the whole way up, and then when it turns we will try to buy it the whole way down.

If you hear a pretty girl on Bloomberg tell you that the Euro is doomed, as they were in December almost every day, it is tempting to look at a chart, see the euro is appreciating and then initiate a short, thinking that you are early, and "it can't go up much more now". You are fighting trend. If you are lucky you will get stopped out. If you are not so lucky or suffer from ill discipline you might start to average losers and enter another position higher up, because "the euro is doomed", it must fall anytime now. Sometimes you will get out ok with just a few more grey hairs, most of the time it will end in tears. Look what happened to the stock markets (and the Euro to a lesser extent) from the middle/end of December till the end of February. They rallied the strongest they have in years. If you were trying to short them in anticipation of the world ending you would have lost your shirt.

I'm not here to argue fundamentals, though I love talking markets. I am advising that you avoid allowing any perception that you may have in relation to what is going on in the world interfere with the facts. If the 4 hr MA is pointing up, the market is going up, that is a FACT. If you think that the market is going to crash because the world is going to end, it is a perception, an opinion, a subjective view. Trade your money with the facts, save your opinions for boring your dinner guests or work colleagues with.

If you always position yourself on the correct side of the SMAs in accordance with the 3 Ducks you will never be sucked into fighting a trend. That alone will put you ahead of most retail traders. The trading maxim "buy low, sell high" is a popular one. It is far easier said than done. It sucks you into fighting strong trends, thinking that the market can't possibly go any further up/down. A better maxim, and an easier one to implement, is the one I think Jessie Livermore used to say, "buy high and sell higher". Wait until the market shows you where it wants to go, let it confirm that to you, and then hop on for the ride. That's the logic of the 3 Ducks.

Here are the Eur.Usd charts I was talking about.

Good luck this week.

Nigel

I pointed out a few pairs last week that I was looking to roll over to the bear side. Most of the 4 hr MAs are now nicely pointing downwards. The one that I think I will be focusing on this week will be the main currency pair, Eur.Usd.

You can see that there was strong downward movement on Friday and today has seen a weak retrace to the upside. I would like to see a little more upward movement and then a stronger movement back into the main 4hr downtrend.

I'll be keeping my stops tight as usual. Be prepared to spend a few pips to earn far more back. If a trade looks like it will trigger when I am at my main pc I will log in here and describe how I am seeing the price action.

Just a note on reality versus perception, a topic I was thinking about at the weekend, with all of the Greek news and all the rest of it. I used to get hung up a lot on fundamentals. Unless you really know your fundamental stuff it is very difficult to trade based on the news. It is very tempting to allow the constant newsflow we have nowadays to influence your view of what a market is doing and where it might be headed. The fact is that us retail traders as a group are consistently on the wrong side of the market, we will sell a rally the whole way up, and then when it turns we will try to buy it the whole way down.

If you hear a pretty girl on Bloomberg tell you that the Euro is doomed, as they were in December almost every day, it is tempting to look at a chart, see the euro is appreciating and then initiate a short, thinking that you are early, and "it can't go up much more now". You are fighting trend. If you are lucky you will get stopped out. If you are not so lucky or suffer from ill discipline you might start to average losers and enter another position higher up, because "the euro is doomed", it must fall anytime now. Sometimes you will get out ok with just a few more grey hairs, most of the time it will end in tears. Look what happened to the stock markets (and the Euro to a lesser extent) from the middle/end of December till the end of February. They rallied the strongest they have in years. If you were trying to short them in anticipation of the world ending you would have lost your shirt.

I'm not here to argue fundamentals, though I love talking markets. I am advising that you avoid allowing any perception that you may have in relation to what is going on in the world interfere with the facts. If the 4 hr MA is pointing up, the market is going up, that is a FACT. If you think that the market is going to crash because the world is going to end, it is a perception, an opinion, a subjective view. Trade your money with the facts, save your opinions for boring your dinner guests or work colleagues with.

If you always position yourself on the correct side of the SMAs in accordance with the 3 Ducks you will never be sucked into fighting a trend. That alone will put you ahead of most retail traders. The trading maxim "buy low, sell high" is a popular one. It is far easier said than done. It sucks you into fighting strong trends, thinking that the market can't possibly go any further up/down. A better maxim, and an easier one to implement, is the one I think Jessie Livermore used to say, "buy high and sell higher". Wait until the market shows you where it wants to go, let it confirm that to you, and then hop on for the ride. That's the logic of the 3 Ducks.

Here are the Eur.Usd charts I was talking about.

Good luck this week.

Nigel

Attachments

Similar threads

- Replies

- 11

- Views

- 4K