You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Best Thread The 3 Duck's Trading System

- Thread starter Captain Currency

- Start date

- Watchers 259

chilltrader

Experienced member

- Messages

- 1,296

- Likes

- 115

looking to go long EUR/USD

looking to go long EUR/USD

Well that definitely wouldn't qualify by the 3 Ducks system

Bouncy-bouncy

Newbie

- Messages

- 5

- Likes

- 0

Recently received the ebook - thanks CC - and exploring the system at the mo. A quick question (which I may have missed the answer too, although I HAVE read all the thread): what are the preferred/better charting programs people use which carry all the features 3 ducks requires?

Being a newbie, at this stage I am looking for free software. I also have an account with IG Index. Any body else using IGI and if so, do their live charts effectively display the correct SMA within the time charts 3 ducks requires, as described by CC? As yet, I am not convinced that I am setting up my charts correctly as I don't see the option to choose the SMA period.

Help and clarification appreciated...

Being a newbie, at this stage I am looking for free software. I also have an account with IG Index. Any body else using IGI and if so, do their live charts effectively display the correct SMA within the time charts 3 ducks requires, as described by CC? As yet, I am not convinced that I am setting up my charts correctly as I don't see the option to choose the SMA period.

Help and clarification appreciated...

Dow Predator

Junior member

- Messages

- 24

- Likes

- 1

i like this guys videos

Learn to Trade the Market | Forex Trading Systems & Strategies | Trading Education |

is there anybody here that trades daily time frame reversal bars.? I am starting to head back to the higher time frames.

Learn to Trade the Market | Forex Trading Systems & Strategies | Trading Education |

is there anybody here that trades daily time frame reversal bars.? I am starting to head back to the higher time frames.

Captain Currency

Experienced member

- Messages

- 1,093

- Likes

- 681

Hello All,

Trendie, Cable I thought the UK retail sales was going to come in a bit better than forecasted but 3.5%!!!! That must be Shadowninja and all his mates spending their winnings on BBQ's, patio sets and cases of Carling black label.

Stuart, that eur.usd was a text book loser, you cant do anything about those trades 🙁

Bouncy Bouncy, Try Metatrader4 free charting software, it has everything you need.

Dow Predator, are you lost?

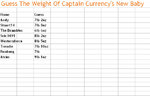

Keep the guesses coming:

Trendie, Cable I thought the UK retail sales was going to come in a bit better than forecasted but 3.5%!!!! That must be Shadowninja and all his mates spending their winnings on BBQ's, patio sets and cases of Carling black label.

Stuart, that eur.usd was a text book loser, you cant do anything about those trades 🙁

Bouncy Bouncy, Try Metatrader4 free charting software, it has everything you need.

Dow Predator, are you lost?

Keep the guesses coming:

Attachments

Captain Currency

Experienced member

- Messages

- 1,093

- Likes

- 681

Idea for The 3 Duck's in a range market

The 3 Duck's Trading System works best when there is a decent trend. But what can we do when the trend dies a bit and we fall into trading ranges?

Take a look at the 4hr chart I attached. First off from looking at our 4hr chart we can see that the trend has died down a bit and prices are just moving above and below the 4hr 60 sma. If you notice the sma on our 4hr chart is horizontal over the last few weeks also. It doesnt take a genius to figure out we are in a range market.

So what can we do in these market conditions?

Here is an idea while still using the Ducks as our guide. We have figured out from looking at our 4hr chart that prices are ranging. Our 1 hr chart is not going to be needed in these conditions as it wont confirm a trend (there is none).

In a range market we need to identify potential support and resistance levels. These levels can be identified on the 4hr or daily charts. Previous day high or lows are decent areas or the top or bottom of the range may be clear on your chart. After we identify potential support and resistance levels we can drop down to our 5min chart to look for enteries.

I know from looking at the chart today that yesterdays low on eur.usd is 1.5458, Mondays lows was also around this level too. Now when I look at my 5min chart I can see eur.usd went as low as 1.5477 today (not too far off the support level).

This is where I can play the range for a potential profit (or loss). From the 5min chart attached, If prices where to cross above the 5min sma and the last 5min high for the extra bit of confirmation after holding the support level I could buy eur.usd.

What we are doing here is, buying at a support area but letting prices go up a bit to hopefully confirm the up move. Our stop-loss can be placed below the actual support level, target as always can be resistance levels.

As always with the Ducks we are using the sma's and timeframes to observe price.

This is just an idea for when we are in trading ranges. As always use The 3 Duck's Trading System as a guide in addition to what else in happening in the markets. Just because you get a "signal" that does not mean you have to take the trade. The 3 Duck's Trading System will always work better when there is a trend and you should be nailing your risk versus reward ration when decent trends are evident.

Kind Regards,

Andy.

The 3 Duck's Trading System works best when there is a decent trend. But what can we do when the trend dies a bit and we fall into trading ranges?

Take a look at the 4hr chart I attached. First off from looking at our 4hr chart we can see that the trend has died down a bit and prices are just moving above and below the 4hr 60 sma. If you notice the sma on our 4hr chart is horizontal over the last few weeks also. It doesnt take a genius to figure out we are in a range market.

So what can we do in these market conditions?

Here is an idea while still using the Ducks as our guide. We have figured out from looking at our 4hr chart that prices are ranging. Our 1 hr chart is not going to be needed in these conditions as it wont confirm a trend (there is none).

In a range market we need to identify potential support and resistance levels. These levels can be identified on the 4hr or daily charts. Previous day high or lows are decent areas or the top or bottom of the range may be clear on your chart. After we identify potential support and resistance levels we can drop down to our 5min chart to look for enteries.

I know from looking at the chart today that yesterdays low on eur.usd is 1.5458, Mondays lows was also around this level too. Now when I look at my 5min chart I can see eur.usd went as low as 1.5477 today (not too far off the support level).

This is where I can play the range for a potential profit (or loss). From the 5min chart attached, If prices where to cross above the 5min sma and the last 5min high for the extra bit of confirmation after holding the support level I could buy eur.usd.

What we are doing here is, buying at a support area but letting prices go up a bit to hopefully confirm the up move. Our stop-loss can be placed below the actual support level, target as always can be resistance levels.

As always with the Ducks we are using the sma's and timeframes to observe price.

This is just an idea for when we are in trading ranges. As always use The 3 Duck's Trading System as a guide in addition to what else in happening in the markets. Just because you get a "signal" that does not mean you have to take the trade. The 3 Duck's Trading System will always work better when there is a trend and you should be nailing your risk versus reward ration when decent trends are evident.

Kind Regards,

Andy.

Attachments

TheBramble

Legendary member

- Messages

- 8,394

- Likes

- 1,171

CC - I know you've always maintained your system is an aid to trading decisions and not a system in its own right. But it's clear some are trading it 'as is' and without, it would seem, due diligence being carried out for current market and instrument dynamics (especially with regard to stops and targets and change of market/instrument mood).

Maybe we could kick around some basic and fundamental considerations for the benefit of those who perhaps haven't either considered them, or haven't taken this thread from post #1 where these issues were first covered. I'm happy to kick this off, but as it's your baby...(arf!).

Hello The Brambles,

To all the newbie Ducksters on this thread, as The Brambles and all the other old pros know, I use The 3 Duck's Trading System as a GUIDE in addition to my own market knowledge ie what else is happening in the markets, news, time of the day, sentiment, etc.

The 3 Duck's Trading System is not a black box, EA or auto system. For the record I hate EA's. I dont take every "signal" from the system because it may go against what im thinking. I must prefer to read and watch what is happening in the markets then flip open a chart and see what the ducks are up to. I may prefer to be buying Euro against the US Dollar, if the ducks line up on this pair im on the trade.

Stop losses and targets can also be deciced on market conditions too. If the market is a bit up and down like it has been lately then a wider stop loss may be needed. Previous daily highs or lows are always a decent area for stops and targets. Risk versus reward is not going to be as good in these conditions as it would be in a nice trending market.

In a trending market you can be a bit more agressive with your stop loss placement (30 pip minimum) and in these market conditions you shoul be nailing your risk versus reward ratio.

The Brambles, sure start the ball rolling with your views on current basics and fundamental considerations.

Mon Capitaine,

By fundamentals, I meant the basics/fundamentals of setting reasonable stoploss and target levels. We could of course get into all that excellent X-Market stuff and go into the inter-relationship of Bonds, Bills, Gold, Oil, Stocks, FX, Interest Rates, Other Commodities, which would be extremely valid and has been touched on in various other threads before. But it doesn’t really belong in this one. And all that boring hard grunt work of X-Market Analysis tends to go down like a lead balloon with the majority. And anyway, X-Market Analysis is primarily a longer TF tool and while the concepts work to a largely similar extent in the shorter TFs, their shorter TF momentums and effects are less bankable due to their contention with the inherent noise of the shorter TFs. So, to be clear, I was only talking about stops and targets.

The thing is, whatever I say in relation to this topic is going to be just my take on things and convey purely my current style of trading FX. It is in no way to be taken as a one size fits all, at all, at all. It works for me because it’s been tailored that way. If it’s useful to others fine, but don’t assume you’ll need to use it or even want to use it.

I am also a bit of a fraud holding forth in this thread as I don’t use this method (not directly, anyway).

That said, lets look at GBPJPY yesterday (Weds June 18) which is when I started writing this. I don’t scalp. Can’t afford to. I tend to trade the longer TFs when I have a longer TF trend. When there is no obvious longer TF trend and there is sufficient volatility to justify my exposure, I’ll trade the range on an obviously much shorter TF. The benefits of range plays is that they give you reasonably solid and obvious (which means I don’t need to explain further here) boundaries for target and stop setting. Which means you can potentially go in on much bigger size than when factoring a longer term trend play. I’m focussing on range as it was a rangey day, most of the time in most majors. Totally useless trying to use 3 Ducks in this type of situation. And that’s probably the first and most important point, don’t waste your time looking for agreement over 3 TFs when the lowest TF is ranging. The longer the lower TF ranges, the more the higher TFs price line will tend toward any MA in that TF. 3 Ducks is looking for nice clear punching through or bouncing off MAs – not gentle gravitation toward. So point 1, use 3 Ducks as written – it’s for strongly trending instruments across multiple TFs, wait for the trades to present themselves – don’t 2nd guess or force them. If it’s ranging on the 5min and you want to trade 3 Ducks – move on to the next pair…

3 Ducks is forcing you to trade with the longer TF trend. Always a good move. It’s also getting you to appreciate price action. But it’s not a proxy for common sense. It is ‘a common sense approach to price observation’ from the words of the master himself. Use in combination with local S&R, and as ampro also suggests you could check Peaks & Troughs (cycles) of the pair. Each pair has it’s own wake/sleep times – eg when London is closed or Friday evening is not the best time to party with FX. Trade the appropriate sessions for your pair. Use whatever tools you have in addition to 3 Ducks.

3 Ducks keeps you the right side (most of the time) of the direction you should be considering and gets you in at a pretty good place (most of the time).

The thing is, 3 Ducks assists (for those with the wit to get it) in recognising how it all works at a more basic level in the markets and more importantly, what works better. Hopefully, some will note the performance of 3 Ducks when the price is crossing all 3 TFs at the same time compared with performance when only the lower TF is crossing and the 2 higher TFs have the price already on that same side.

Equally important will be the realisation of what 3 Ducks is leading them to look at and what it ‘means’. It is very basic and often overlooked for that very reason, which is where many will lose the most important learning aspect of it.

If you just trade it ‘as is’ you’ll not do as well as those who use it in a combination with other factors and intelligence and use it for further research into what it represents at a basic level of market mechanics.

Captain Currency

Experienced member

- Messages

- 1,093

- Likes

- 681

Greetings The Brambles,

Great advice and thanks for taking the time to school the young ducklings.

There was one point in your post which reminded me that I had forgot something in my previous post re: Idea for the 3 Ducks in a range market. That is, If there is no evident trend on a pair - YOU DONT HAVE TO TRADE IT, look for a pair that is moving in a trend.

I think what prompted me to write my previous post was the "feedback" I was getting off some of the ducksters who where trying to use a system (the 3 ducks) that works best in a trendie market on a range market. You will get frustrated because the moves on eur.usd for example are NOT following through as Stuart14 found out this am when he longed eur.usd and then it sold off. Dont feel too bad Stuart as always with trading it will either work or it wont, you would have been a hero if it had worked this am! 😉

If you want to trade a range bound market thats cool, my post on using the 3 ducks in range market may help you. As always I would prefer to be using it in a trendie market as the payoffs (rewards) are much nicer.

Probably what I should be saying and as The Brambles correctly pointed out, If the market is in a range then The 3 Ducks wont be much use to you 😢

But Hey, the good news is there will always be some currency pairs moving in a trend so the ducks will be your best friend :clap:

Keep those guess coming in ....

Great advice and thanks for taking the time to school the young ducklings.

There was one point in your post which reminded me that I had forgot something in my previous post re: Idea for the 3 Ducks in a range market. That is, If there is no evident trend on a pair - YOU DONT HAVE TO TRADE IT, look for a pair that is moving in a trend.

I think what prompted me to write my previous post was the "feedback" I was getting off some of the ducksters who where trying to use a system (the 3 ducks) that works best in a trendie market on a range market. You will get frustrated because the moves on eur.usd for example are NOT following through as Stuart14 found out this am when he longed eur.usd and then it sold off. Dont feel too bad Stuart as always with trading it will either work or it wont, you would have been a hero if it had worked this am! 😉

If you want to trade a range bound market thats cool, my post on using the 3 ducks in range market may help you. As always I would prefer to be using it in a trendie market as the payoffs (rewards) are much nicer.

Probably what I should be saying and as The Brambles correctly pointed out, If the market is in a range then The 3 Ducks wont be much use to you 😢

But Hey, the good news is there will always be some currency pairs moving in a trend so the ducks will be your best friend :clap:

Keep those guess coming in ....

Attachments

CC no worries. Ironically I wasn't using the 3 Ducks when I made the Long move EUR/USD this morning. I'm trying to learn a system that works on longer time frames and that came up as a long entry.

Tweaking that system slightly, I think going forward if it gives a trade indication, I'll then double check with the ducks to make sure a trend it in place and will trade from there. I took 6 trades this morning which is probably too much. Stopped out on 2, 4 still running. 2 losing, 2 profiting.

Tweaking that system slightly, I think going forward if it gives a trade indication, I'll then double check with the ducks to make sure a trend it in place and will trade from there. I took 6 trades this morning which is probably too much. Stopped out on 2, 4 still running. 2 losing, 2 profiting.

Captain Currency

Experienced member

- Messages

- 1,093

- Likes

- 681

I took 6 trades this morning which is probably too much. Stopped out on 2, 4 still running. 2 losing, 2 profiting.

Junkie 😛

CC, just to help me differentiate between a trending market and a range bound market. Can you pull up a 1 month daily chart for USD/CAD. Would I be right in saying that was range bound up to the 4th June, then trending till the 17th June, and now range bound again, or is my timescale too small?

Or, would you look at a 1 year chart, and see the trend from March 2007 to Nov 2007 and then the reverse from Nov 2007 to Mid Dec, with the range being in place ever since?

Or, would you look at a 1 year chart, and see the trend from March 2007 to Nov 2007 and then the reverse from Nov 2007 to Mid Dec, with the range being in place ever since?

Captain Currency

Experienced member

- Messages

- 1,093

- Likes

- 681

Hello all,

Eur.Usd givin some lovin this am. German PPI coming in a bit better this am for the Euro and not much else on the news front this friday.

Nice straight forward set up for The 3 ducks this am on Eur.Usd. We talked yesterday about markets been in a range, but all your ducks where lined up in the same direction for a buy this am. (chart 20.6.08)

Back to what we where talking about yesterday RE: playing the range market with the 3 Ducks here

The entry I fancied yesterday on Eur.Usd was a cross above the 5min sma AFTER it had help the previous days support. Have a look at the chart (potential set up)

and then have a look at the actual entry point for that trade (range trade).

Remember The 3 Ducks will always work best in a trendie market, use it as a guide and you dont have to take every signal.

Kind Regards,

Eur.Usd givin some lovin this am. German PPI coming in a bit better this am for the Euro and not much else on the news front this friday.

Nice straight forward set up for The 3 ducks this am on Eur.Usd. We talked yesterday about markets been in a range, but all your ducks where lined up in the same direction for a buy this am. (chart 20.6.08)

Back to what we where talking about yesterday RE: playing the range market with the 3 Ducks here

The entry I fancied yesterday on Eur.Usd was a cross above the 5min sma AFTER it had help the previous days support. Have a look at the chart (potential set up)

and then have a look at the actual entry point for that trade (range trade).

Remember The 3 Ducks will always work best in a trendie market, use it as a guide and you dont have to take every signal.

Kind Regards,

Attachments

I went long EUR/USD this morning. All my indicators had it as a buy. Clearly my indicators ate ****e!!

Even 3 ducks had a buy about 6:40 this morning.

You still in this Stu? You should be smiling if u are 👍

Similar threads

- Replies

- 11

- Views

- 4K