You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Best Thread The 3 Duck's Trading System

- Thread starter Captain Currency

- Start date

- Watchers 259

Captain Currency

Experienced member

- Messages

- 1,093

- Likes

- 681

CC - I know you've always maintained your system is an aid to trading decisions and not a system in its own right. But it's clear some are trading it 'as is' and without, it would seem, due diligence being carried out for current market and instrument dynamics (especially with regard to stops and targets and change of market/instrument mood).

Maybe we could kick around some basic and fundamental considerations for the benefit of those who perhaps haven't either considered them, or haven't taken this thread from post #1 where these issues were first covered. I'm happy to kick this off, but as it's your baby...(arf!).

[On which note, given the nature of the membership, we really should be running some kind of Book on the July 10 target date].

Hello The Brambles,

To all the newbie Ducksters on this thread, as The Brambles and all the other old pros know, I use The 3 Duck's Trading System as a GUIDE in addition to my own market knowledge ie what else is happening in the markets, news, time of the day, sentiment, etc.

The 3 Duck's Trading System is not a black box, EA or auto system. For the record I hate EA's. I dont take every "signal" from the system because it may go against what im thinking. I must prefer to read and watch what is happening in the markets then flip open a chart and see what the ducks are up to. I may prefer to be buying Euro against the US Dollar, if the ducks line up on this pair im on the trade.

Stop losses and targets can also be deciced on market conditions too. If the market is a bit up and down like it has been lately then a wider stop loss may be needed. Previous daily highs or lows are always a decent area for stops and targets. Risk versus reward is not going to be as good in these conditions as it would be in a nice trending market.

In a trending market you can be a bit more agressive with your stop loss placement (30 pip minimum) and in these market conditions you shoul be nailing your risk versus reward ratio.

My view on the market today 18th of June '08 is its flat as a pancake!

There is not much in the way of news today and there does not seem to be much comittment on any currency pairs. (scalpers will do well today :-0 I dont scalp)

The Brambles, sure start the ball rolling with your views on current basics and fundamental considerations.

I'le give you one of mine: I am only looking for selling ops in cable (gbp.usd). I think GBP is going to struggle in the comming months against the USD. I know the 3 ducks gave a signal to sell GBP.USD earlier but it was around the lows and with commitment thin today I didnt think it was worth a punt.

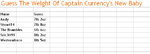

PS: Me and my Mrs are having our first child in a few weeks. For a bit of fun we are going to have a "guess the weight" poll. I reckon the baby with be a bit on the heavy side like the daddy 😀 I reckon the baby will come in a 7lb 2ounces

Feel free to guess the weight in your next post.

Kind Regards,

Thanks CC. I'll go for 7lb 8 ounces.

You said "I'le give you one of mine: I am only looking for selling ops in cable (gbp.usd). I think GBP is going to struggle in the comming months against the USD. I know the 3 ducks gave a signal to sell GBP.USD earlier but it was around the lows and with commitment thin today I didnt think it was worth a punt."

What do you mean by commitment thin today.

Also you said the signal was triggered near the lows. Obviously it would be triggered near the days lows, but are you talking about a wider timeframe. If you feel it is going to go lower longer term would you make you take the trade?

Really appreciate your input.

You said "I'le give you one of mine: I am only looking for selling ops in cable (gbp.usd). I think GBP is going to struggle in the comming months against the USD. I know the 3 ducks gave a signal to sell GBP.USD earlier but it was around the lows and with commitment thin today I didnt think it was worth a punt."

What do you mean by commitment thin today.

Also you said the signal was triggered near the lows. Obviously it would be triggered near the days lows, but are you talking about a wider timeframe. If you feel it is going to go lower longer term would you make you take the trade?

Really appreciate your input.

Captain Currency

Experienced member

- Messages

- 1,093

- Likes

- 681

What do you mean by commitment thin today.

CC: There doesnt seem to be a lot of money/positions flowing into the market today, lot of trader may be on the sidelines. Just looks like gbp.usd is been sold then traders are getting out of their positions so there is some buying going on to get out of those short positions.

Also you said the signal was triggered near the lows. Obviously it would be triggered near the days lows,

CC: not always the case

but are you talking about a wider timeframe. If you feel it is going to go lower longer term would you make you take the trade?

CC: No, I would be looking to get a better price to short it.

Kind Regards,

Captain Currency

Experienced member

- Messages

- 1,093

- Likes

- 681

A better price being still below the 60sma but much higher up, or is that not necessarily the case?

Thanks.

I'le know the price I want to short cable when I see it .... 😛

trendie

Legendary member

- Messages

- 6,875

- Likes

- 1,433

hi Cap'n,

just a general question about the GBPUSD.

the past few days have shown very tight ranges for the US sessions, are there any fundamental reasons for this lack of movement?

(only last Friday did the US have a broader session; rest of the time, most of recent times they have been the "inside bar" of the Euro sesh)

just to get a bigger picture view. thanks.

just a general question about the GBPUSD.

the past few days have shown very tight ranges for the US sessions, are there any fundamental reasons for this lack of movement?

(only last Friday did the US have a broader session; rest of the time, most of recent times they have been the "inside bar" of the Euro sesh)

just to get a bigger picture view. thanks.

Captain Currency

Experienced member

- Messages

- 1,093

- Likes

- 681

hi Cap'n,

just a general question about the GBPUSD.

the past few days have shown very tight ranges for the US sessions, are there any fundamental reasons for this lack of movement?

Hello Trendie,

Havent a clue, trading just seems to be a bit thin lately - could explain the lack of direction.

Kind Regards,

Hi all

I am trying to trade "as is" at the moment as i want to get used to the basics of this sytem. As a complete newbie i have signed up with IG index and can spread bet for .10p at the moment. So my loses won't be large.

Questions

1. TheBramble - What other instruments do you consider when entering a trade?

2 CC - What news should I be listening out for that would affect the market?

3. EUR/USD - seems to be in a 100 point trading range out the moment on the hourly chart - if it was to break on the downside (15,457) would that be a good time to look at the 5 min chart for a sell?

4. has anyone traded today as I couldn't see any opportunities but I am a novice

I have read quite a few books but this forum is the best!!

I am trying to trade "as is" at the moment as i want to get used to the basics of this sytem. As a complete newbie i have signed up with IG index and can spread bet for .10p at the moment. So my loses won't be large.

Questions

1. TheBramble - What other instruments do you consider when entering a trade?

2 CC - What news should I be listening out for that would affect the market?

3. EUR/USD - seems to be in a 100 point trading range out the moment on the hourly chart - if it was to break on the downside (15,457) would that be a good time to look at the 5 min chart for a sell?

4. has anyone traded today as I couldn't see any opportunities but I am a novice

I have read quite a few books but this forum is the best!!

Captain Currency

Experienced member

- Messages

- 1,093

- Likes

- 681

2 CC - What news should I be listening out for that would affect the market?

CC: Pull up an economic calendar, most will have the important news that can move a market highlighted.

3. EUR/USD - seems to be in a 100 point trading range out the moment on the hourly chart - if it was to break on the downside (15,457) would that be a good time to look at the 5 min chart for a sell?

CC: All depends what else is going on at that time in the markets

Kind Regards,

TheBramble

Legendary member

- Messages

- 8,394

- Likes

- 1,171

Sprog Trend Analysis

Taking into account an average Duck is around 2lb in weight when in motion (they’d have to be, wouldn’t they), and there are 3 of them, and an Orange Sauce helping of around 2oz per Duck, I estimate 6lbs 6ozs for forthcoming CC sprog.

I reckon the one who gets closest to the birth weight should have the honour of having said sprog named for their t2w nick…

Taking into account an average Duck is around 2lb in weight when in motion (they’d have to be, wouldn’t they), and there are 3 of them, and an Orange Sauce helping of around 2oz per Duck, I estimate 6lbs 6ozs for forthcoming CC sprog.

I reckon the one who gets closest to the birth weight should have the honour of having said sprog named for their t2w nick…

Thanks CC I am now researching economic factors that affect the forex. So things like Mervyn King announcement yesterday about inflation would possibly have an affect. Mind you the website that I just read about factors affecting the currencies I am suprised the GBP is worth anything (joke).

I also found this Economic calendar | financial calendar | Forex economic calendar which could be useful to anyone.

I also found this Economic calendar | financial calendar | Forex economic calendar which could be useful to anyone.

Captain Currency

Experienced member

- Messages

- 1,093

- Likes

- 681

westernforce

Active member

- Messages

- 246

- Likes

- 44

Captain, You being Irish, my grandad Scottish, and the queen English, I would hazard a guess and say the birth weight to be 3.86 times the sh!te I talk, therefore 3.86Kg of junior currency

Captain Currency

Experienced member

- Messages

- 1,093

- Likes

- 681

trendie

Legendary member

- Messages

- 6,875

- Likes

- 1,433

Keep'em comming, winner takes all!

7lb 10oz.

did anyone take the GBPUSD LONG this morning? (I didnt)

Similar threads

- Replies

- 11

- Views

- 4K