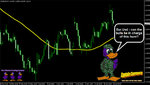

I will try to show how I used the 3 ducks for my trade on Friday. I wanted a quick trade that would hopefully have been done before the NFP came out.

The EUR/JPY was in a clear downtrend so I was looking for places to sell.

It had dropped to 9674 on the 8.15am 5 minute candle and then retraced. An hour later it was coming back down so I set a pending order for 9670. By doing that it takes me out of the decision to trade, it either got triggered or it didn't.

20 pip s/l and a 40 pip target. An hour later trade was finished.

I took into account that we were already below the lows from mid January 2012, you have to go back as far as late 2000 to find any further price resistance, the institutional resistance and psychological resistance points will still be there of course.

I have no idea where price on this one is going next, next week may be a funny week's trading due to the bank holiday here. Personally I would quite like to see a retracement back up to the 9500 level on this one. That may mean the 3 ducks aren't lined up for a while, fair enough. (just to be clear, if it does retrace up to there, this is not advice to then stick in a sell order).

This is not a normal pair to trade for me but given that I was avoiding the USD on Friday it seemed like a good choice. What got me looking at this pair in particular at that time was that it was above my brokers daily opening price, 3 Ducks is a trend following method, the price didn't want to be up there, it wanted to follow the trend.

Please be aware, I have been trading live since mid April 2012 and I know enough about Forex trading to know that I don't know enough.

I am not looking particulalry at how many pips I make per week, as Andy himself says, a pip is a pip, a dollar is a dollar, my first few weeks I made plenty of pips but lost money overall, that is why I have given the % equity increase from the start of the each week.