Z Forex

Established member

- Messages

- 805

- Likes

- 1

German CPI at 3.8%, Signals ECB Tightening Cycle Likely Completed

The final reading of the German Consumer Price Index (CPI) revealed an annual rate of 3.8%, the lowest since August 2021, with inflation slowing and the economy teetering on the brink of recession. This suggests that the European Central Bank (ECB) has likely completed its tightening cycle, aligning with market expectations despite recent comments from ECB policymakers like Philip Lane, who cautioned against drawing too much comfort from recent inflation figures. Lane emphasized the need for continued efforts to combat inflationary pressures, urging both companies and governments to contribute to avoiding stricter policies. U.S. Federal Reserve Bank of Philadelphia President Patrick Harker supported the Fed's recent decision to keep interest rates unchanged and cautioned against premature market reactions. Philip Lane of the ECB is also set to address the audience again on Thursday, along with President Lagarde.

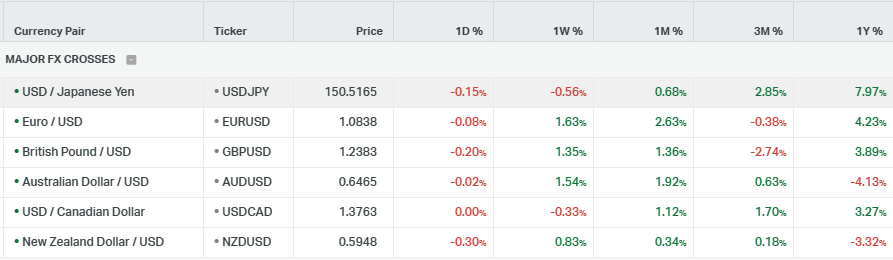

EUR/USD is currently moving with uncertainty, awaiting further guidance. A clear short-term support level is not evident, but the 1.0550 level may provide price support.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 1.1040 | 1.0930 | 1.0800 | 1.0630 | 1.0550 | 1.0450 |

UK's Q3 GDP Data to Influence BoE's December Monetary Policy

Investors are waiting for the release of Q3 Gross Domestic Product (GDP) data on Friday at 07:00 GMT, which will have a significant impact on the Bank of England's (BoE) monetary policy in December. The Pound Sterling (GBP) has been stagnant, and the GBP/USD pair is currently uncertain. The economic performance of the UK in July-September seems to be bleak, with declining consumer spending, poor Services PMI, delayed housing demand, and shrinking hiring. If the GDP report confirms this, it could lead to dovish expectations from BoE policymakers, particularly Swati Dhingra, who supports rate cuts in case of weaker growth. According to the GDP report, employment, and inflation data will be released next week.

Investors are anticipating UK factory data and Q3 GDP figures, and Pound Sterling is consolidating below the 1.2300 resistance level. Factory data is expected to show modest improvements, which could alleviate concerns about a slowdown in the UK economy. However, the key event to watch is the Q3 GDP data. Economists predict a nominal contraction due to underutilized production capacities and reduced consumer spending, especially in the service industry. BoE Chief Economist Huw Pill has suggested rate cuts in mid-2024 if the GDP report is weak.

The GBPUSD continues its downward trend, with the next support levels at 1.2260, followed by 1.2200. The solid support for the price is expected to be at 1.2100.

Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

1.2600 | 1.2550 | 1.2450 | 1.2300 | 1.2260 | 1.2200 |

USD/JPY Pair Surges, Raises Questions About Japanese Intervention

There has been a recent increase in the USD/JPY pair, leading to speculation that Japanese authorities might intervene in the Forex market. This, along with the cautious market mood, is causing the safe-haven Japanese Yen (JPY) to gain some support. Additionally, the recent decline in US Treasury bond yields and the uncertainty over the Federal Reserve's (Fed) rate-hike path has caused a modest US Dollar (USD) downtick, which is further pressuring the major.

However, the dovish stance taken by the Bank of Japan (BoJ) is limiting the downside for the USD/JPY pair. BoJ Governor Kazuo Ueda reiterated on Wednesday that the central bank will continue with ultra-loose policy until cost-push inflation transitions into price rises driven more by strong domestic demand and higher wages. This is a significant divergence from a relatively hawkish Fed.

The USDJPY is continuing its bullish trend beyond 150.00. The BoJ may intervene, creating volatility.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 153.50 | 152.00 | 150.00 | 149.3 | 148.00 | 146.50 |

Gold Prices Hover at $1,950 with Fed Rate Hike Uncertainty

Gold prices experienced a decline on Thursday as it entered a bearish consolidation phase and traded within a narrow range during the early part of the European session. Currently, it's hovering around $1,950, just above its lowest level since October 19, which it reached yesterday. This decline is primarily due to uncertainty about future interest rate hikes by the Federal Reserve. Additionally, concerns about the Israel-Hamas conflict, which had been affecting market sentiment earlier in the week, have somewhat eased.

However, the downside for gold is being supported by the belief that the US central bank is unlikely to raise interest rates further. This expectation has led to a decrease in US Treasury bond yields, putting pressure on the US Dollar (USD) and providing some support for gold. Furthermore, concerns about China's economic situation and overall cautious market sentiment are also helping to limit the decline in the precious metal's price. Traders are awaiting more clarity on the Fed's future policy decisions, with a particular focus on Fed Chair Jerome Powell's upcoming speech during the US session.

Gold is currently undergoing a correction before continuing its upward trend. This correction is important as it can establish the old resistance level as a new support level.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

2040 | 2020 | 2006 | 1963 | 1947 | 1920 |

Oil Prices Show Modest Gains Following Demand and Deflation Concerns

On Thursday, the price of oil slightly increased despite the deflationary signs in China. Investors awaited more information on the demand status from the world's two largest oil consumers. The prices had fallen over 2% on Wednesday, as concerns over the possible supply disruption in the Middle East eased and worries over the US and Chinese demand rose.

Furthermore, inflation data from China, published on Thursday, showed that the CPI for October decreased by 0.2% YoY, while PPI data fell by 2.6% YoY. It was largely in line with Reuters' poll that expected a decline of 0.1% in CPI and 2.7% in PPI. The customs data earlier in the week showed that China's total exports of goods and services contracted faster than anticipated, but its crude imports for October were robust.

On the other hand, Pan Gongsheng, the central bank governor, stated that China is expected to achieve its annual growth target of 5% this year, which is positive news for oil demand. However, inventory data from the US might indicate a weakening in demand. Sources revealed that the US crude oil inventories increased by 11.9 million barrels from the week to November 3. If confirmed, it would represent the largest weekly build since February. The weekly oil inventory data from the US Energy Information Administration (EIA) has been delayed until November 15 due to system upgrade.

WTI had more selloff and breaking solid support at the 87 and now continuing toward the next target at 74.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

90 | 84 | 82 | 77 | 74 | 68 |