Z Forex

Established member

- Messages

- 805

- Likes

- 1

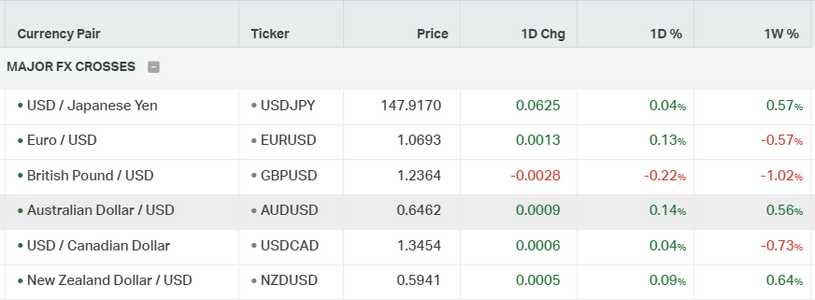

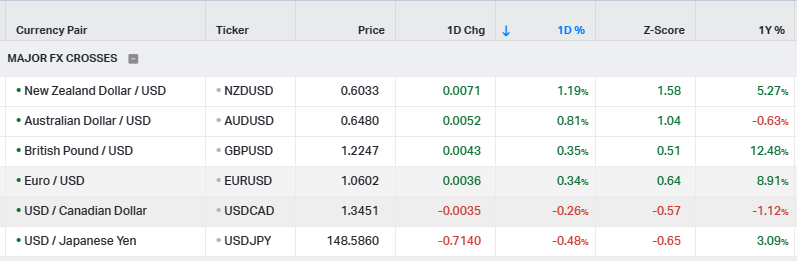

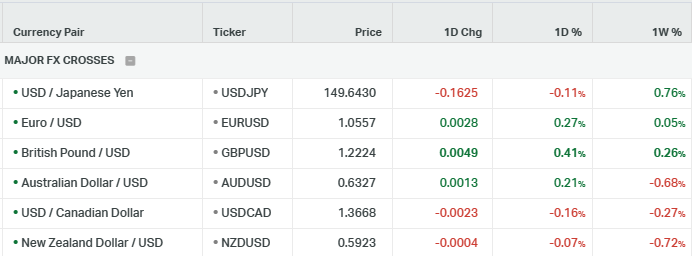

EURUSD Stability Amidst Shifting Global Interest Rate Dynamics

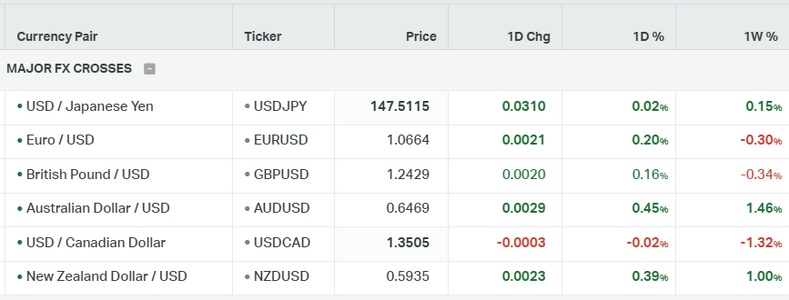

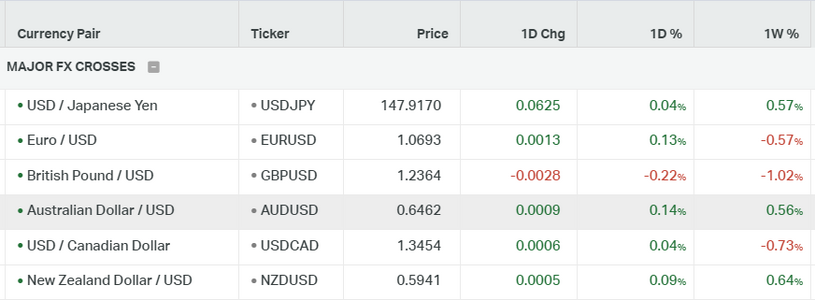

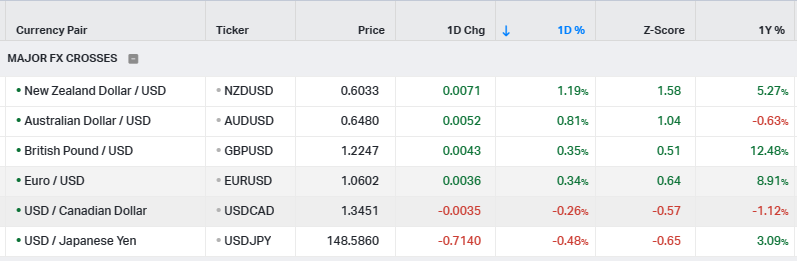

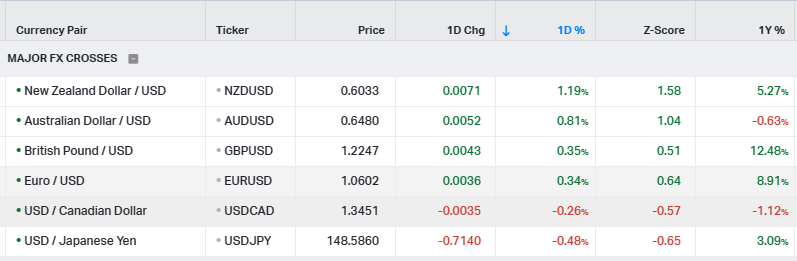

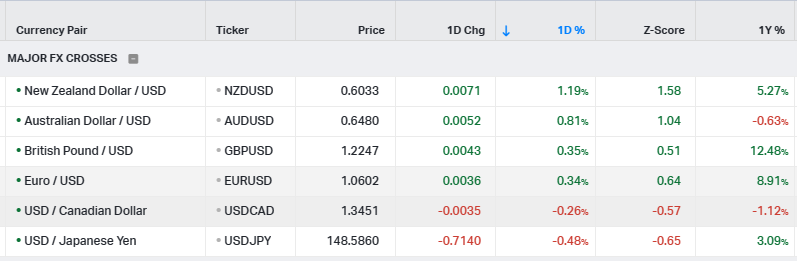

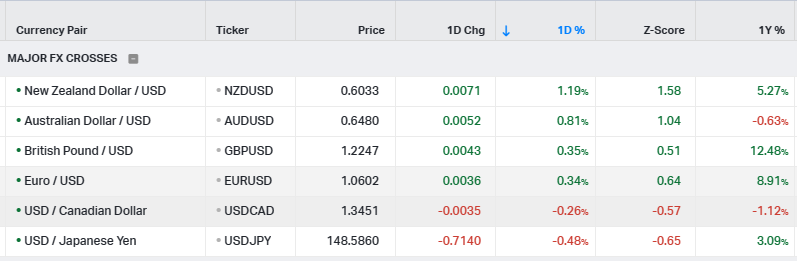

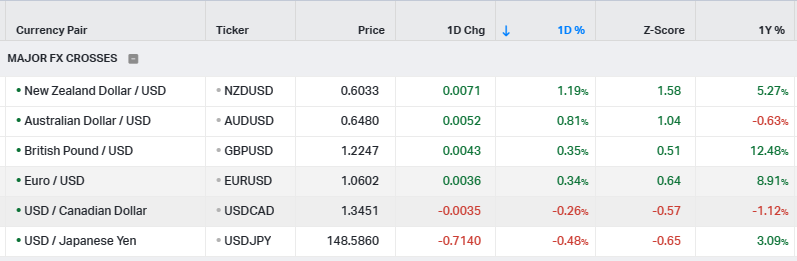

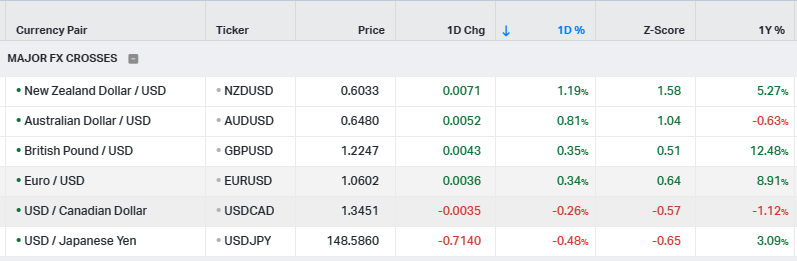

The euro is stabilizing below the 1.07 level following a turbulent week marked by significant announcements and the European Central Bank's decision to raise interest rates by 25 basis points, albeit with a less aggressive tone. Speculation about further rate hikes from the ECB has dwindled, with attention now shifting towards when the first interest rate cut might occur.

Inflationary pressures, while showing some signs of easing, still remain uncomfortably high for the European Central Bank, making any rate reduction unlikely until year-end. Consequently, much of the focus has shifted to the upcoming United States Federal Reserve meeting, where decisions regarding further interest rate increases will be made.

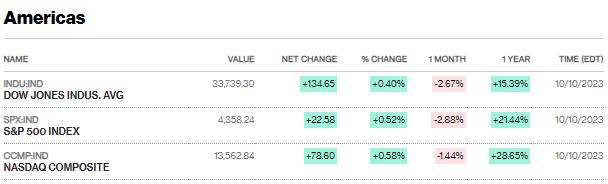

The US economy has responded positively to higher interest rates, with limited impact on growth and a reduced risk of recession. However, there are concerns that continued rate hikes could increase uncertainty in the US banking sector, despite its current stability.

In the short term, these developments may exert pressure on the euro, which has faced scrutiny in recent weeks. Nonetheless, it is expected that the euro's resilience will soon reemerge.

The current agenda lacks significant events that could significantly impact the euro's stability.

The EURUSD found support at the downward parallel of the current bearish long-term trend at 1.0640, which also coincides with a support level from May. A potential correction may occur when considering the DXY (US Dollar Index), which suggests that a possible comeback can be expected especially when touching the 105.50 level is close.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 1.0940 | 1.0850 | 1.0780 | 1.0640 | 1.0600 | 1.0530 |

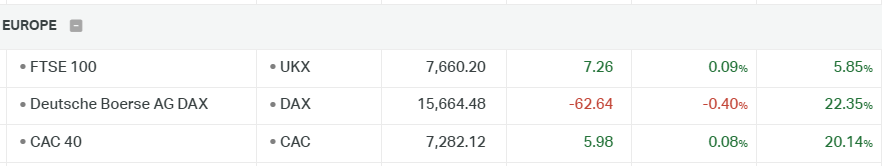

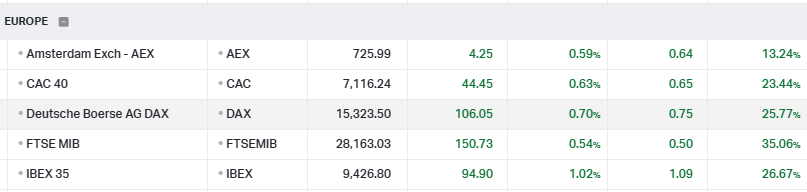

BoE Rate Hike Speculation in Light of Economic Indicators

Cross-currency traders are speculating that the Bank of England (BoE) will implement a 25 basis point interest rate hike during the upcoming Thursday meeting. This potential rate increase by the BoE is part of the central bank's strategy to combat inflationary pressures and stabilize the British economy.

The initial reading of the US Michigan Consumer Sentiment Index for September stands at 67.7, indicating a decrease from the previous figure of 69.5. This reading also falls below the anticipated value of 69.1 for the month.

BoE Governor Andrew Bailey has suggested that the central bank is nearing the conclusion of its series of interest rate hikes. This statement, along with concerns regarding a potential recession and signs of a cooling labor market in the UK, could intensify the pressure on the BoE to temporarily halt its rate-increasing efforts.

Selling pressures on GBP/USD persist, breaching the 1.2400 support level. The subsequent support level to monitor is at 1.2300. There is a potential for a dollar correction in the near future, and if this materializes, it could lead to a correction in the currency pair.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 1.2750 | 1.2650 | 1.2580 | 1.2400 | 1.2300 | 1.2200 |

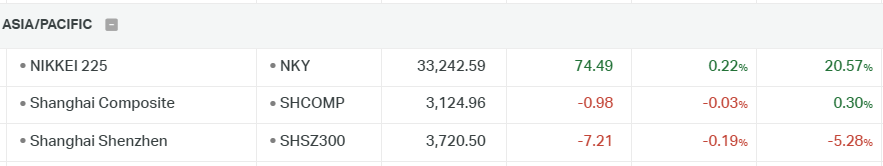

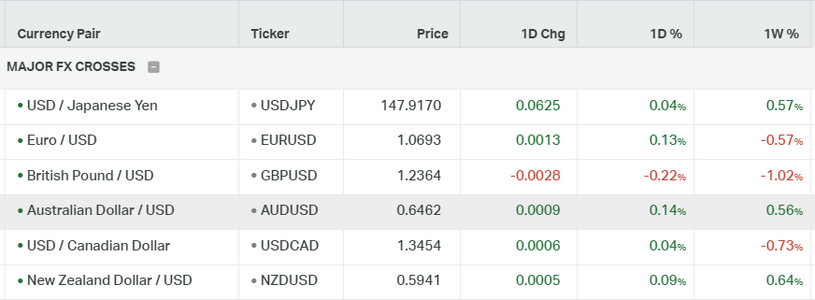

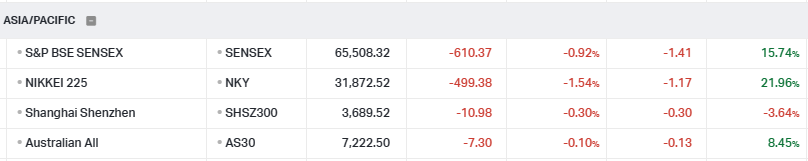

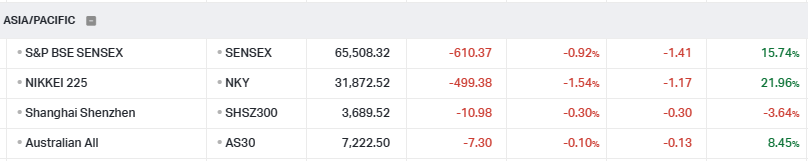

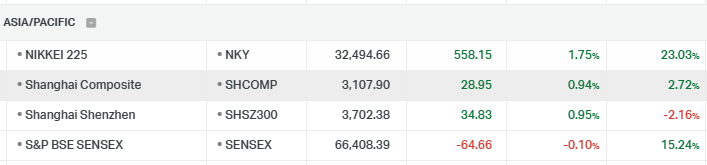

USD/JPY Range-bound Ahead of Key Central Bank Meetings

The USD/JPY pair hovers between 147.68 and 147.88, staying within a narrow trading range. Both the Federal Reserve (Fed) and the Bank of Japan (BoJ) are set to hold key meetings, adding to market caution.

In recent economic data, the Empire State Manufacturing Index for August improved to 1.9 from a previous reading of -19, exceeding expectations. Industrial Production also saw a rise of 0.4% MoM in August, outperforming market forecasts. However, the preliminary Consumer Sentiment Index for September declined from 69.1 to 67.7, and the five-year Consumer Inflation Expectation dropped to 2.7% from 3%.

The market expects the Fed to maintain interest rates during its upcoming meeting, with Fed Chairman Jerome Powell expected to make no significant policy changes in his press conference. However, a dovish stance from the Fed could weaken the US Dollar (USD) and pose challenges for the USD/JPY pair.

Turning to the Japanese Yen (JPY), all eyes are on the BoJ's policy meeting scheduled for Friday. There is growing speculation that the BoJ may be closer to departing from its ultra-loose monetary policy and negative interest rates. Nevertheless, BoJ policymakers have indicated that such a move won't happen until wage and inflation data meet expectations, leaving the JPY susceptible to fluctuations against other currencies.

Investors will closely monitor the Fed's interest rate decision on Wednesday, with expectations of no changes. Subsequently, attention will shift to the Bank of Japan (BoJ) on Friday.

USDJPY's buying pressure continues, while the level of 147.7 is acting as resistance. The most probable scenario is a continuation upwards towards the 150.00 region.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 151.50 | 149.00 | 148.00 | 147.30 | 146.50 | 146.00 |

Gold Prices Rise on Market Caution and USD Weakness

The gold price rose for the third consecutive day on Monday, approaching the $1,930 supply zone in the Asian session. This upward movement is attributed to several factors.

Firstly, a more cautious risk sentiment in the market is boosting demand for safe-haven assets like gold. This is partly due to concerns about China's deteriorating economic conditions, which have been exacerbated by developments related to China Evergrande Group. The company's delay in restructuring its debt and the detention of some employees from its wealth management unit in Shenzhen have added to global risk aversion, prompting investors to seek refuge in gold.

Secondly, the US Dollar (USD) has weakened slightly, providing further support to the XAU/USD pair. However, the USD's downside is limited as traders await the upcoming Federal Open Market Committee (FOMC) policy meeting, which starts on Tuesday. While the Federal Reserve (Fed) is expected to keep interest rates unchanged, there is still speculation about a potential rate hike in November or December.

Thirdly, the outlook for elevated US Treasury bond yields, which benefit the USD, may constrain additional gains for gold, as traders await further guidance on the Fed's future rate-hike plans. Key factors to watch include the monetary policy statement and Fed Chair Jerome Powell's post-meeting press conference, which could influence the direction of the USD and, subsequently, gold.

Additionally, investors will be monitoring major central bank rate decisions from the Swiss National Bank (SNB), the Bank of England (BoE), and the Bank of Japan (BoJ) later in the week. Consumer inflation figures from Canada and the United Kingdom (UK) will also be scrutinized for potential trading opportunities involving gold.

On Friday, gold experienced a correction as it retraced toward the 1931 resistance level, coinciding with the upper boundary of the current bearish channel. The resurgence of the DXY and US yields could diminish gold's appeal, potentially leading to further selling pressure on the precious metal.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 1950 | 1942 | 1931 | 1910 | 1900 | 1885 |

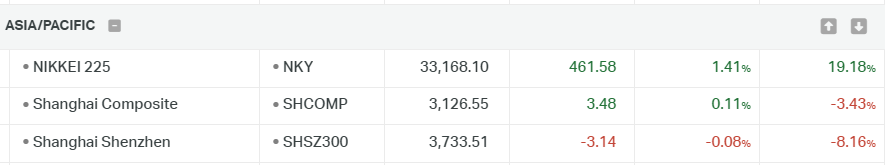

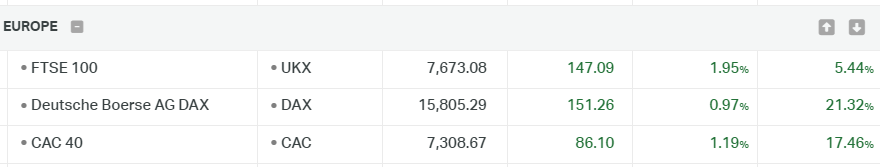

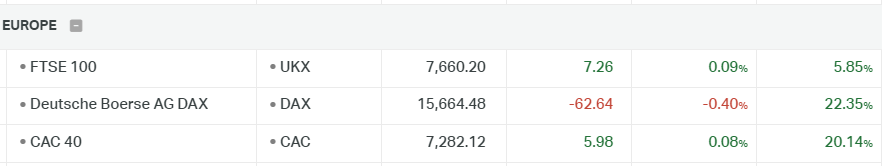

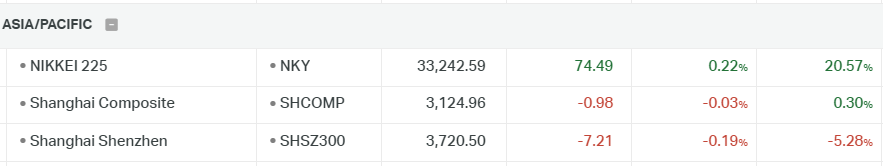

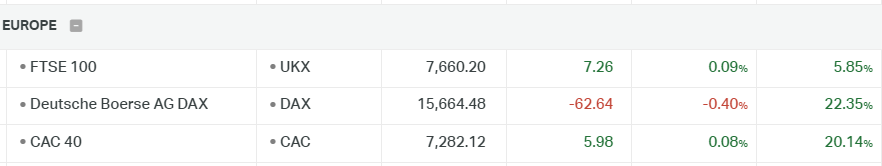

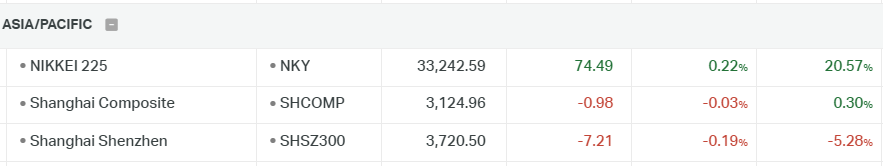

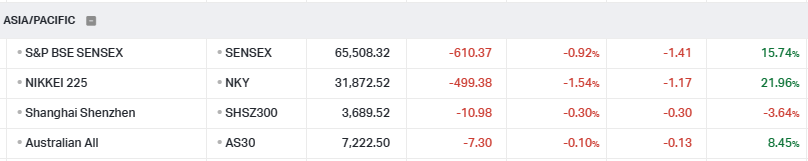

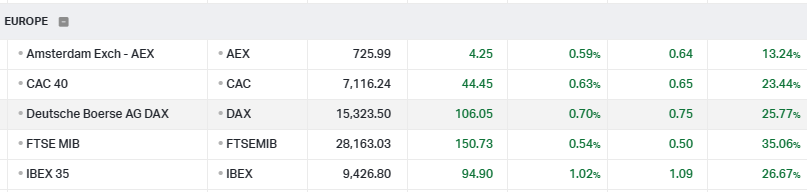

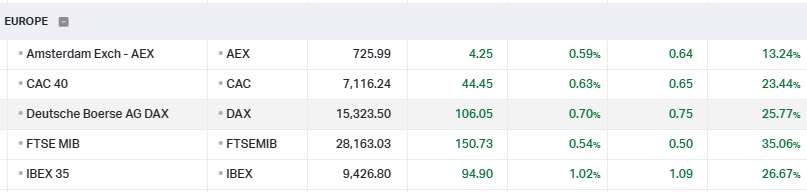

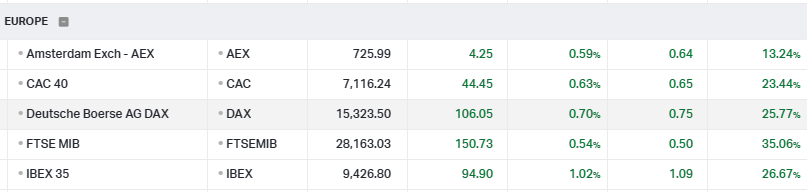

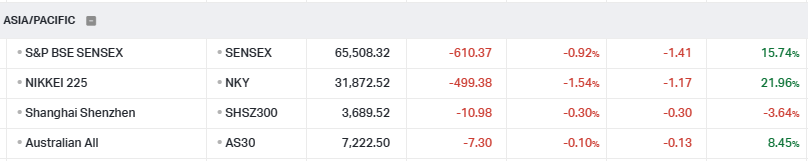

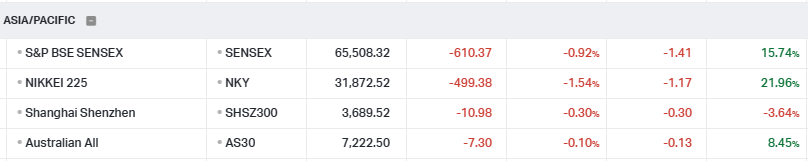

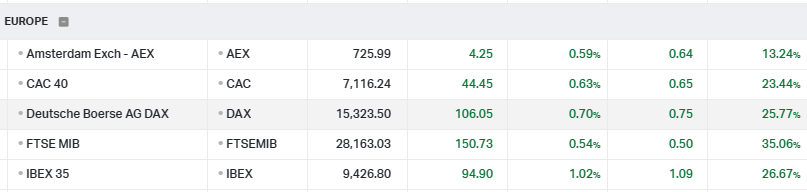

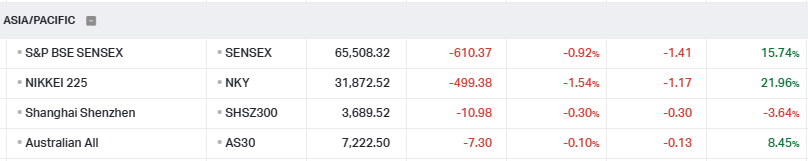

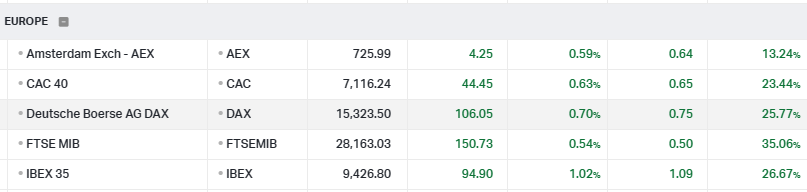

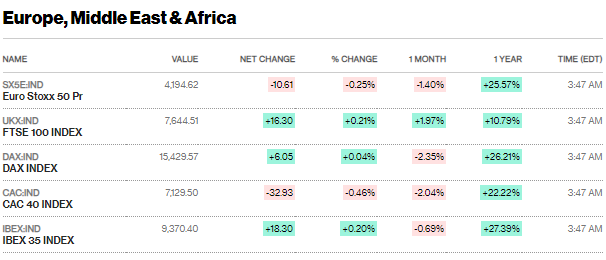

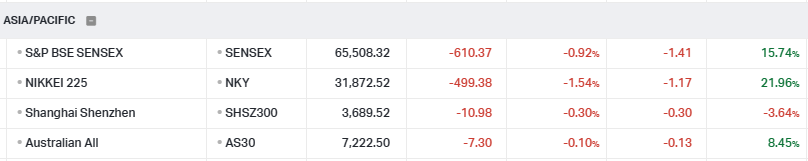

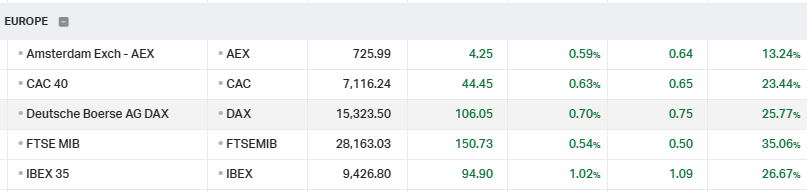

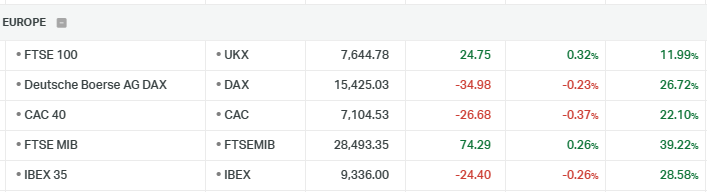

European Stocks Dip Ahead of Central Bank Meetings

European stocks experienced a slight decline on Monday, following substantial gains last week. Investors were preparing for a busy week filled with global central bank meetings, including interest rate decisions from Norway, Sweden, Switzerland, the UK, and the United States.

The spotlight this week is on global central banks, especially after the European Central Bank (ECB) signaled the end of rate hikes last week. The Bank of England (BoE) is expected to raise rates for the 15th time later in the week, while the Federal Reserve appears poised for a more cautious stance.

Market sentiment remained cautious as Eurozone bond yields inched higher following hawkish remarks from some ECB officials after their rate decision.

ECB Governing Council member Yannis Stournaras stressed that governments must play their part in controlling consumer prices, given that borrowing costs have possibly reached their peak.

In stock-specific news, Nordic Semiconductor ASA (NOD) tumbled 13.2% after revising its revenue guidance for the third quarter, and Fingerprint Cards (FING_B) declined by 5.8%.

Societe Generale (GLE) saw a 6.3% drop after the third-largest bank in France projected minimal to no growth in annual sales over the upcoming years, as revealed in a highly anticipated strategic plan from its new CEO.

S4 Capital (SFOR), Martin Sorrell's advertising group, experienced a substantial 22% decrease as it lowered its annual forecast for the second time in as many months, citing client caution driven by recession fears.

DAX continues inside the range of 15500 and 16000. The wider price range encompasses support at 15,500 and resistance at 16,400. In the short term, DAX went back toward the 15600 level after finding resistance at the 16000.

| Resi Level 3 | Resi Level 2 | Resi Level 1 | Suppo level 1 | Suppo level 2 | Suppo level 3 |

| 16600 | 16400 | 16000 | 15550 | 15400 | 15200 |