isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

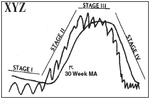

I started this thread for a place for people to discuss Stan Weinstein's method of stage analysis, as I read his book "Secrets for Profiting in Bull and Bear Markets" from 1988 in late 2010 and was very impressed with his four stage breakout method. For those that haven't read the book and are medium to long term position traders, then I recommend that you do, but there's a free article in the T2W archives from 2006 that's a good basic starting point. Here's the link: Articles - Stage Analysis - finding the 'breakout' shares | Trade2Win.

The thread itself has also now developed into a huge free resource, and has links to multiple interviews that Stan Weinstein has done, and has hundreds of examples of the different stages. The discussion has been in-depth at times and has covered a number of the grey areas from the book as well as focusing in detail on all aspects from the book.

I'm interested to see how other people apply his methods and hope for a serious discussion of what's going on the markets and individual stocks using his stage analysis method.

Below is a number of quick links to some of the most useful content in thread, which I will update as the thread develops, so that the best quality information is easily accessible for everyone.

Definitions of the Stages and Sub-stages

Stage 1A Start of a base. Needs much more time.

Stage 1 Basing Phase. May begin accumulation.

Stage 1B Late in base-building phase. Watch for breakout.

Stage 2A Early in uptrend stage. Ideal time to buy aggressively.

Stage 2 Advancing Stage.

Stage 2B Getting late in uptrend.

Stage 3A Looks as if a top is starting to form. Be sure to protect holdings with a close stop.

Stage 3 The Top Area. Start to reduce positions.

Stage 3B Has become increasingly toppy. Use rallies for at least partial selling.

Stage 4A Stock has entered Downtrend Stage. Close out remaining positions.

Stage 4 The Declining Stage. Avoid on the long side.

Stage 4B Late in downtrend. Much too soon to consider buying.

Stage 4B- Although not yet “officially” in Stage 1A, stock has now seen its low for the cycle.

Additional ratings

(A) Early in that Stage.

(B) Late in that Stage.

(+) Outstanding pattern in that Stage.

(–) Unexciting pattern in that Stage.

Examples of the Stages

Over the course of doing this thread there have been multiple examples of the all the stages posted and they can be seen on every page if you take the time to go through the entire thread. However, to view the specific examples created using the Global Trend Alert (GTA) newsletters that Weinstein's firm does for institutional investors. Go to the following pages:

Stage examples from the March 2005 GTA

https://www.trade2win.com/threads/stan-weinsteins-stage-analysis.134944/post-1698054

Stage examples from the March 2012 GTA

https://www.trade2win.com/threads/stan-weinsteins-stage-analysis.134944/post-1804190

Courses:

Udemy – Video Training Course

Learn Stock Trading & Investing Techniques – Stage Analysis

Beginners Guide to Trading Stocks With the Stage Analysis Method – Made Famous in Stan Weinstein’s Classic Book

Stage Analysis Study Guide - Questions and Answers

The purpose of the Study Guide is to help people learn to identify the Stages and to emphasize the importance of a full analysis taking into account the various technical attributes that we look to for guidance in determining the Stages i.e. price action in relation to the 10 and 30 week moving averages, volume, relative performance versus the market and the sector, support and resistance zones etc. Here's the link: https://stageanalysis.net/forum/showthread.php?tid=47

Stage Analysis Breakout Quality Checklist

The checklist is a step by step guide to the technical attributes that you should be looking for when trying to identify a Stage 2A breakout with A+ potential. Here's the link: https://stageanalysis.net/forum/showthread.php?tid=54

Interviews

Audio interviews with Stan Weinstein

Stan Weinstein | FINANCIAL SENSE

Video Interview from the day of the 1987 Stock Market crash

Black Monday - Part 2 - Nightly Business Report Oct.19, 1987 - YouTube

Reading

Global Trend Alert example - March 2005

https://www.trade2win.com/threads/stan-weinsteins-stage-analysis.134944/post-1675626

Extract from Stan Weinstein's interview in the "Technically Speaking" book

https://www.trade2win.com/threads/stan-weinsteins-stage-analysis.134944/post-2037672

Stage Analysis Forum

The forum is the place for people who trade or invest in stocks using Stan Weinstein's method of Stage Analysis and has daily watchlists for UK and US stocks, market breadth and multiple stage analysis examples, learning tools and much more. Here's the link: https://stageanalysis.net

Videos

Stage Analysis Videos

There's a Stage Analysis youtube channel with video of the US and Canadian watchlists at youtube.com/channel/UCKzgts1fFoDla4ozJSn1eZQ/

Frequently Asked Questions

FAQ: How to create the Mansfield Relative Strength Indicator:

https://www.trade2win.com/threads/stan-weinsteins-stage-analysis.134944/post-2137398

Beginners Questions

Here's the link: https://stageanalysis.net/forum/showthread.php?tid=11

To be updated.....Chart software; chart set up; 30 week simple moving average or weighted moving average - as on the Mansfield charts in the book; entry points; sub stages; trader or investor approach; stock scanners, importance of volume, sector analysis, using the method with products other than stocks; weight of evidence approach, momentum index, advance decline, new high new low, head and shoulders patterns in Stage 1 and Stage 3; swing target method; drawing trendlines; theory of contrary opinion; forest to the trees approach; ....I will write this section properly with links to the appropriate posts when I have some free time.

Miscellaneous

Buying Reference - https://www.trade2win.com/threads/stan-weinsteins-stage-analysis.134944/post-1692514

Point and Figure Charts - Free resources to help learn P&F charting

Point & Figure Charting - ChartSchool

Dorsey PnF University

ISA's Charts

Precious Metals

(GC) Gold (13 Dec 2012 - Stage 1) - http://www.trade2win.com/boards/tec...weinsteins-stage-analysis-86.html#post2033926

(SI) Silver (22 Dec 2012 - Stage 4 continuation within major Stage 1 range) - http://www.trade2win.com/boards/tec...weinsteins-stage-analysis-91.html#post2040102

(PA) Palladium (21 Jan 2013 - Stage 2A) - http://www.trade2win.com/boards/tec...einsteins-stage-analysis-101.html#post2057256

Commodities

(CCI) Continuous Commodities Index (21 Jan 2013 - Stage 1) - http://www.trade2win.com/boards/tec...einsteins-stage-analysis-101.html#post2057492

US Treasuries

Latest stage analysis

US 30 Year Treasuries (8 Apr 2013 - Stage 1A) - http://www.trade2win.com/boards/tec...einsteins-stage-analysis-119.html#post2109046

Archive

US 30 Year Treasuries (22 Nov 2011 - Stage 2B) - http://www.trade2win.com/boards/tec...-weinsteins-stage-analysis-5.html#post1727942

US 30 Year Treasuries (16 Sep 2012 - Stage 3A) - http://www.trade2win.com/boards/tec...weinsteins-stage-analysis-67.html#post1967674

US 10 Year Treasuries (16 Sep 2012 - Stage 3)- http://www.trade2win.com/boards/tec...weinsteins-stage-analysis-67.html#post1967674

US 30 Year Treasuries (1 Feb 2013 - Stage 4) - http://www.trade2win.com/boards/tec...einsteins-stage-analysis-107.html#post2066920

Stocks and ETFs

Apple (AAPL) - http://www.trade2win.com/boards/tec...weinsteins-stage-analysis-83.html#post2030646

AIG (AIG) - http://www.trade2win.com/boards/tec...weinsteins-stage-analysis-68.html#post1969468

Reynolds American Inc (RAI) (26 Nov 2011 - Stage 2 Continuation) - http://www.trade2win.com/boards/tec...-weinsteins-stage-analysis-6.html#post1730724

Indexes

Archive

S&P 500 (6 Nov 2011 - Stage 1A) - http://www.trade2win.com/boards/tec...-weinsteins-stage-analysis-5.html#post1716128

Forex

EURGBP (26 Nov 2011 - Stage 4A) - http://www.trade2win.com/boards/tec...-weinsteins-stage-analysis-6.html#post1730478

I hope you enjoy the thread and please participate if you are using Stan Weinstein's method.

The thread itself has also now developed into a huge free resource, and has links to multiple interviews that Stan Weinstein has done, and has hundreds of examples of the different stages. The discussion has been in-depth at times and has covered a number of the grey areas from the book as well as focusing in detail on all aspects from the book.

I'm interested to see how other people apply his methods and hope for a serious discussion of what's going on the markets and individual stocks using his stage analysis method.

Below is a number of quick links to some of the most useful content in thread, which I will update as the thread develops, so that the best quality information is easily accessible for everyone.

Definitions of the Stages and Sub-stages

Stage 1A Start of a base. Needs much more time.

Stage 1 Basing Phase. May begin accumulation.

Stage 1B Late in base-building phase. Watch for breakout.

Stage 2A Early in uptrend stage. Ideal time to buy aggressively.

Stage 2 Advancing Stage.

Stage 2B Getting late in uptrend.

Stage 3A Looks as if a top is starting to form. Be sure to protect holdings with a close stop.

Stage 3 The Top Area. Start to reduce positions.

Stage 3B Has become increasingly toppy. Use rallies for at least partial selling.

Stage 4A Stock has entered Downtrend Stage. Close out remaining positions.

Stage 4 The Declining Stage. Avoid on the long side.

Stage 4B Late in downtrend. Much too soon to consider buying.

Stage 4B- Although not yet “officially” in Stage 1A, stock has now seen its low for the cycle.

Additional ratings

(A) Early in that Stage.

(B) Late in that Stage.

(+) Outstanding pattern in that Stage.

(–) Unexciting pattern in that Stage.

Examples of the Stages

Over the course of doing this thread there have been multiple examples of the all the stages posted and they can be seen on every page if you take the time to go through the entire thread. However, to view the specific examples created using the Global Trend Alert (GTA) newsletters that Weinstein's firm does for institutional investors. Go to the following pages:

Stage examples from the March 2005 GTA

https://www.trade2win.com/threads/stan-weinsteins-stage-analysis.134944/post-1698054

Stage examples from the March 2012 GTA

https://www.trade2win.com/threads/stan-weinsteins-stage-analysis.134944/post-1804190

Courses:

Udemy – Video Training Course

Learn Stock Trading & Investing Techniques – Stage Analysis

Beginners Guide to Trading Stocks With the Stage Analysis Method – Made Famous in Stan Weinstein’s Classic Book

Stage Analysis Study Guide - Questions and Answers

The purpose of the Study Guide is to help people learn to identify the Stages and to emphasize the importance of a full analysis taking into account the various technical attributes that we look to for guidance in determining the Stages i.e. price action in relation to the 10 and 30 week moving averages, volume, relative performance versus the market and the sector, support and resistance zones etc. Here's the link: https://stageanalysis.net/forum/showthread.php?tid=47

Stage Analysis Breakout Quality Checklist

The checklist is a step by step guide to the technical attributes that you should be looking for when trying to identify a Stage 2A breakout with A+ potential. Here's the link: https://stageanalysis.net/forum/showthread.php?tid=54

Interviews

Audio interviews with Stan Weinstein

Stan Weinstein | FINANCIAL SENSE

Video Interview from the day of the 1987 Stock Market crash

Black Monday - Part 2 - Nightly Business Report Oct.19, 1987 - YouTube

Reading

Global Trend Alert example - March 2005

https://www.trade2win.com/threads/stan-weinsteins-stage-analysis.134944/post-1675626

Extract from Stan Weinstein's interview in the "Technically Speaking" book

https://www.trade2win.com/threads/stan-weinsteins-stage-analysis.134944/post-2037672

Stage Analysis Forum

The forum is the place for people who trade or invest in stocks using Stan Weinstein's method of Stage Analysis and has daily watchlists for UK and US stocks, market breadth and multiple stage analysis examples, learning tools and much more. Here's the link: https://stageanalysis.net

Videos

Stage Analysis Videos

There's a Stage Analysis youtube channel with video of the US and Canadian watchlists at youtube.com/channel/UCKzgts1fFoDla4ozJSn1eZQ/

Frequently Asked Questions

FAQ: How to create the Mansfield Relative Strength Indicator:

https://www.trade2win.com/threads/stan-weinsteins-stage-analysis.134944/post-2137398

Beginners Questions

Here's the link: https://stageanalysis.net/forum/showthread.php?tid=11

To be updated.....Chart software; chart set up; 30 week simple moving average or weighted moving average - as on the Mansfield charts in the book; entry points; sub stages; trader or investor approach; stock scanners, importance of volume, sector analysis, using the method with products other than stocks; weight of evidence approach, momentum index, advance decline, new high new low, head and shoulders patterns in Stage 1 and Stage 3; swing target method; drawing trendlines; theory of contrary opinion; forest to the trees approach; ....I will write this section properly with links to the appropriate posts when I have some free time.

Miscellaneous

Buying Reference - https://www.trade2win.com/threads/stan-weinsteins-stage-analysis.134944/post-1692514

Point and Figure Charts - Free resources to help learn P&F charting

Point & Figure Charting - ChartSchool

Dorsey PnF University

ISA's Charts

Precious Metals

(GC) Gold (13 Dec 2012 - Stage 1) - http://www.trade2win.com/boards/tec...weinsteins-stage-analysis-86.html#post2033926

(SI) Silver (22 Dec 2012 - Stage 4 continuation within major Stage 1 range) - http://www.trade2win.com/boards/tec...weinsteins-stage-analysis-91.html#post2040102

(PA) Palladium (21 Jan 2013 - Stage 2A) - http://www.trade2win.com/boards/tec...einsteins-stage-analysis-101.html#post2057256

Commodities

(CCI) Continuous Commodities Index (21 Jan 2013 - Stage 1) - http://www.trade2win.com/boards/tec...einsteins-stage-analysis-101.html#post2057492

US Treasuries

Latest stage analysis

US 30 Year Treasuries (8 Apr 2013 - Stage 1A) - http://www.trade2win.com/boards/tec...einsteins-stage-analysis-119.html#post2109046

Archive

US 30 Year Treasuries (22 Nov 2011 - Stage 2B) - http://www.trade2win.com/boards/tec...-weinsteins-stage-analysis-5.html#post1727942

US 30 Year Treasuries (16 Sep 2012 - Stage 3A) - http://www.trade2win.com/boards/tec...weinsteins-stage-analysis-67.html#post1967674

US 10 Year Treasuries (16 Sep 2012 - Stage 3)- http://www.trade2win.com/boards/tec...weinsteins-stage-analysis-67.html#post1967674

US 30 Year Treasuries (1 Feb 2013 - Stage 4) - http://www.trade2win.com/boards/tec...einsteins-stage-analysis-107.html#post2066920

Stocks and ETFs

Apple (AAPL) - http://www.trade2win.com/boards/tec...weinsteins-stage-analysis-83.html#post2030646

AIG (AIG) - http://www.trade2win.com/boards/tec...weinsteins-stage-analysis-68.html#post1969468

Reynolds American Inc (RAI) (26 Nov 2011 - Stage 2 Continuation) - http://www.trade2win.com/boards/tec...-weinsteins-stage-analysis-6.html#post1730724

Indexes

Archive

S&P 500 (6 Nov 2011 - Stage 1A) - http://www.trade2win.com/boards/tec...-weinsteins-stage-analysis-5.html#post1716128

Forex

EURGBP (26 Nov 2011 - Stage 4A) - http://www.trade2win.com/boards/tec...-weinsteins-stage-analysis-6.html#post1730478

I hope you enjoy the thread and please participate if you are using Stan Weinstein's method.

Last edited: