isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

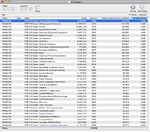

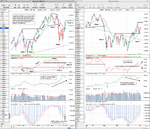

Stage 1A - examples

As a follow up to my previous post outlining the break down of the four stages, I've been going through the Global Trend Alert Newsletter to get some real life examples of the various stages to use as a reference in the future.

Stage 1A - Start of a base. Needs much more time

Key

(+) Outstanding pattern in that Stage.

(–) Unexciting pattern in that Stage.

As a follow up to my previous post outlining the break down of the four stages, I've been going through the Global Trend Alert Newsletter to get some real life examples of the various stages to use as a reference in the future.

Stage 1A - Start of a base. Needs much more time

Key

(+) Outstanding pattern in that Stage.

(–) Unexciting pattern in that Stage.

Attachments

-

AGN_2-25-05.png58.7 KB · Views: 1,724

AGN_2-25-05.png58.7 KB · Views: 1,724 -

AVY_2-25-05.png61.2 KB · Views: 1,532

AVY_2-25-05.png61.2 KB · Views: 1,532 -

BRCM_2-25-05.png55.6 KB · Views: 1,338

BRCM_2-25-05.png55.6 KB · Views: 1,338 -

CCE_2-25-05.png56.5 KB · Views: 1,134

CCE_2-25-05.png56.5 KB · Views: 1,134 -

JBL_2-25-05.png59.4 KB · Views: 1,130

JBL_2-25-05.png59.4 KB · Views: 1,130 -

TER_2-25-05.png59.5 KB · Views: 1,034

TER_2-25-05.png59.5 KB · Views: 1,034 -

PGN_2-25-05.png64.4 KB · Views: 1,021

PGN_2-25-05.png64.4 KB · Views: 1,021 -

MXIM_2-25-05.png62.3 KB · Views: 1,085

MXIM_2-25-05.png62.3 KB · Views: 1,085 -

KSS_2-25-05.png62.1 KB · Views: 1,031

KSS_2-25-05.png62.1 KB · Views: 1,031 -

KO_2-25-05.png59.4 KB · Views: 1,095

KO_2-25-05.png59.4 KB · Views: 1,095 -

THC_2-25-05.png54.6 KB · Views: 1,039

THC_2-25-05.png54.6 KB · Views: 1,039 -

TIF_2-25-05.png56.1 KB · Views: 1,002

TIF_2-25-05.png56.1 KB · Views: 1,002 -

XLNX_2-25-05.png60.3 KB · Views: 1,125

XLNX_2-25-05.png60.3 KB · Views: 1,125