isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Re: Futures Relative Performance

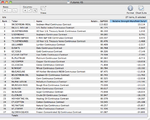

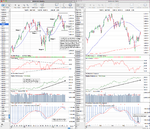

It's been a month since I updated the Futures Relative Performance rankings. Soybean Meal (SM) continues to be the outperformer of the group still by a long way, but the Dollar Index (DX) and 30 year Treasuries (US) have moved into positive territory over the last month, which highlights their largely inverse relationship with equities. The only other outperformer is Soybeans (S) which has mostly held above it's 30 week MA during the pullback and showed good relative strength. All the other futures in the list continue to underperform the S&P 500.

Here's the updated Futures Relative Performance list and attached charts

It's been a month since I updated the Futures Relative Performance rankings. Soybean Meal (SM) continues to be the outperformer of the group still by a long way, but the Dollar Index (DX) and 30 year Treasuries (US) have moved into positive territory over the last month, which highlights their largely inverse relationship with equities. The only other outperformer is Soybeans (S) which has mostly held above it's 30 week MA during the pullback and showed good relative strength. All the other futures in the list continue to underperform the S&P 500.

Here's the updated Futures Relative Performance list and attached charts