isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Re: Gold Stage Analysis

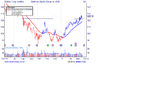

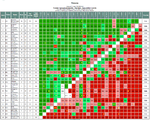

I'd be wary of the commentators that think the correlation with the Dollar since 29 Feb is unusual, as in fact, the normal relationship for Gold and the Dollar is an inverse relationship - which you will see from the long and short term metrics at the bottom on the attached chart. You'll see from the 20 day correlation that it sometimes breaks down and they move together, like in early to mid 2010, but this is not the norm as that's the fear trade. So the fact that the Dollar is rising and Gold is falling is the sign of a more normal market condition.

Commentators have noted the recent breakdown since 29 Feb in the normal correlation of the $, so it is an unusual goldilocks period, suiting Obama, the US, Europe and China quite well. It won't last, I think, as it is based on hot money, so Stage 4 might never be reached. That is why I might sit out any thought of shorting gold and instead it looks more an opportunity to build up a long-term holding.

I'd be wary of the commentators that think the correlation with the Dollar since 29 Feb is unusual, as in fact, the normal relationship for Gold and the Dollar is an inverse relationship - which you will see from the long and short term metrics at the bottom on the attached chart. You'll see from the 20 day correlation that it sometimes breaks down and they move together, like in early to mid 2010, but this is not the norm as that's the fear trade. So the fact that the Dollar is rising and Gold is falling is the sign of a more normal market condition.