Hi ERA - thanks for the post and for the margin detail.

I am trying to understand the mechanics of actually placing, monitoring and exiting a spread trade the information was very useful.

I have also learnt that some exchanges will offer the facility to enter simultaneous legs thereby eliminating the leg-in/out risk. I imagine that intra-market and intra-exchange trades would require full margin for each leg + leg-in/out risk.

For now I shall stick to seasonal inter-contract spreads. If they offer a packaged spread trade even better (sorry I know this is lay speak but I'm not familiar with the technical lingo).

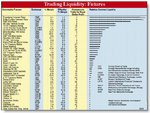

I shall try and chose markets that are reasonably liquid to avoid excessive bid/ask on either leg but, more importantly, avoid leg-in/out risk as far as possible.

ERA - you mention an initial and maintenance margin. I imagine that you need to add these? So for SM = 338 + 250 = $588. Plus, aren't these exchange margins? I imagine a broker would require more again?

Thanks again for yr advice - I'm slowly piecing this puzzle together. Who knows one day I might even make a trade!!

Regards, FN

I am trying to understand the mechanics of actually placing, monitoring and exiting a spread trade the information was very useful.

I have also learnt that some exchanges will offer the facility to enter simultaneous legs thereby eliminating the leg-in/out risk. I imagine that intra-market and intra-exchange trades would require full margin for each leg + leg-in/out risk.

For now I shall stick to seasonal inter-contract spreads. If they offer a packaged spread trade even better (sorry I know this is lay speak but I'm not familiar with the technical lingo).

I shall try and chose markets that are reasonably liquid to avoid excessive bid/ask on either leg but, more importantly, avoid leg-in/out risk as far as possible.

ERA - you mention an initial and maintenance margin. I imagine that you need to add these? So for SM = 338 + 250 = $588. Plus, aren't these exchange margins? I imagine a broker would require more again?

Thanks again for yr advice - I'm slowly piecing this puzzle together. Who knows one day I might even make a trade!!

Regards, FN