4xpipcounter

Experienced member

- Messages

- 1,571

- Likes

- 30

Ichimoku cluod II

First, the charts I post are only from my demo account. There are two basic reasons. Just in case something happens, I don't want my actual personal information showing up on the chart. Secondly, My S&R's are plotted according to the day starting at 6:00 PM EST. On my live account, they are plotted according to calendar day. I call them my "A" S&R's as a backup, and seldom do I need them.

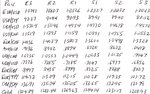

These two charts show why I am so high on the AUD/USD. It's a strong facsimilie on the NZD/USD. It was just today that the tenken cross over the kijun (I'll explain the tenken and kijun in another post.) on the daily. The pair will open on Monday in side the cloud, but will already be at the top. Once entering the cloud, any market will at least hit the opposite side. Notice the stochastics. It has already crossed above 85. When that happens, the objective is hitting both the kijun and tenken, which are currently .8453 and .8388. Another thing about the ichimoku is instead of it being a lagging inidcator, it allows you to look into the future. The future for the cloud is showing it is bearish and dropping. The candle has to catch up. These are overwhelming confluences just on the daily chart to show what we can expect.

I didn't post the weekly chart, but the candle is already inside of a huge cloud. .7827 is the bottom of the cloud, which is the minimum expectation. If price finishes the week under the cloud, then it will be another huge move DOWN.

The thumb up shopws another personality of the ichimoku. Notice price mildly dropping, and then the tenken drops unde the kijun. Eventually price open unde both, then we had the broke into the cloud being followed closely by the TK. Price gets pushed out of the cloud then draws back. It meets massive R with the bottom of the cloud and the TK combo, then crashes. These are easy ichimoku trades.

On the 4-hour, there is a triple divergence in OB condition on the stochastics. Price is also above the 200 MA. This is very uncomfortable elevation in an overall downtrend, with the current technical conditions.

Also notice my S&R's. They are proprietary. I have the software that plots them automatically. It was given to me by MY (Acronym to protect identity.). I'm still very grateful for him doing this for me.

Posts will be coming up that will go in detail and great specificities concerning the tenken, kijun, chinkou, the actual cloud, and some other surprises.

Most of thsoe posts will be a cut and paste from my blog.

First, the charts I post are only from my demo account. There are two basic reasons. Just in case something happens, I don't want my actual personal information showing up on the chart. Secondly, My S&R's are plotted according to the day starting at 6:00 PM EST. On my live account, they are plotted according to calendar day. I call them my "A" S&R's as a backup, and seldom do I need them.

These two charts show why I am so high on the AUD/USD. It's a strong facsimilie on the NZD/USD. It was just today that the tenken cross over the kijun (I'll explain the tenken and kijun in another post.) on the daily. The pair will open on Monday in side the cloud, but will already be at the top. Once entering the cloud, any market will at least hit the opposite side. Notice the stochastics. It has already crossed above 85. When that happens, the objective is hitting both the kijun and tenken, which are currently .8453 and .8388. Another thing about the ichimoku is instead of it being a lagging inidcator, it allows you to look into the future. The future for the cloud is showing it is bearish and dropping. The candle has to catch up. These are overwhelming confluences just on the daily chart to show what we can expect.

I didn't post the weekly chart, but the candle is already inside of a huge cloud. .7827 is the bottom of the cloud, which is the minimum expectation. If price finishes the week under the cloud, then it will be another huge move DOWN.

The thumb up shopws another personality of the ichimoku. Notice price mildly dropping, and then the tenken drops unde the kijun. Eventually price open unde both, then we had the broke into the cloud being followed closely by the TK. Price gets pushed out of the cloud then draws back. It meets massive R with the bottom of the cloud and the TK combo, then crashes. These are easy ichimoku trades.

On the 4-hour, there is a triple divergence in OB condition on the stochastics. Price is also above the 200 MA. This is very uncomfortable elevation in an overall downtrend, with the current technical conditions.

Also notice my S&R's. They are proprietary. I have the software that plots them automatically. It was given to me by MY (Acronym to protect identity.). I'm still very grateful for him doing this for me.

Posts will be coming up that will go in detail and great specificities concerning the tenken, kijun, chinkou, the actual cloud, and some other surprises.

Most of thsoe posts will be a cut and paste from my blog.