You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

SOLIDECN

Senior member

- Messages

- 3,041

- Likes

- 0

USDCAD market update by Solid ECN Securities

The pair is testing 1.2700 for a breakout

Current trend

The US dollar demonstrates active growth in pair with the Canadian currency during the trading in Asia, once again testing the level of 1.27 for a breakout.

The US currency received short-term support on Friday after the publication of a strong report on the labor market for January, which turned out to be much better than investors' forecasts. Strong data reinforced the belief of market participants that the US Fed may act more aggressively in choosing the vector of monetary policy. In particular, it is possible that at the March meeting of the regulator, the rate will be raised immediately by 50 basis points.

In turn, the Canadian report on the labor market, also released last Friday, was extremely disappointing.

Resistance levels: 1.27, 1.275, 1.2786, 1.2812.

Support levels: 1.265, 1.26, 1.2558, 1.25.

The pair is testing 1.2700 for a breakout

Current trend

The US dollar demonstrates active growth in pair with the Canadian currency during the trading in Asia, once again testing the level of 1.27 for a breakout.

The US currency received short-term support on Friday after the publication of a strong report on the labor market for January, which turned out to be much better than investors' forecasts. Strong data reinforced the belief of market participants that the US Fed may act more aggressively in choosing the vector of monetary policy. In particular, it is possible that at the March meeting of the regulator, the rate will be raised immediately by 50 basis points.

In turn, the Canadian report on the labor market, also released last Friday, was extremely disappointing.

Resistance levels: 1.27, 1.275, 1.2786, 1.2812.

Support levels: 1.265, 1.26, 1.2558, 1.25.

SOLIDECN

Senior member

- Messages

- 3,041

- Likes

- 0

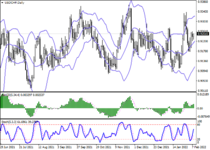

USDCHF Market Analysis by Solid ECN Securities

Consolidation in anticipation of new drivers

Yesterday, the quotes were supported by the publication of data on unemployment. At the end of January, the indicator fell from 2.4% to 2.3%, better than the market's neutral forecasts. The report on the labor market for January also surpassed the preliminary estimates of experts. In particular, Nonfarm Payrolls amounted to 467K, which was more than three times better than market expectations. Wage data also added optimism: hourly wages rose by 0.7% MoM and 5.7% YoY for January, which was better than analysts' forecasts of 0.5% and 5.2%.

On the daily chart, Bollinger bands are steadily growing.

The price range narrows slightly, remaining quite spacious for the current level of activity in the market. The MACD indicator reverses upwards, keeping a relatively strong buy signal. Stochastic shows a more confident upward trend but is rapidly approaching its highs, indicating that the US dollar may become overbought in the ultra-short term.

Resistance levels: 0.926, 0.9276, 0.93, 0.9341.

Support levels: 0.922, 0.92, 0.9177, 0.9157.

Consolidation in anticipation of new drivers

Yesterday, the quotes were supported by the publication of data on unemployment. At the end of January, the indicator fell from 2.4% to 2.3%, better than the market's neutral forecasts. The report on the labor market for January also surpassed the preliminary estimates of experts. In particular, Nonfarm Payrolls amounted to 467K, which was more than three times better than market expectations. Wage data also added optimism: hourly wages rose by 0.7% MoM and 5.7% YoY for January, which was better than analysts' forecasts of 0.5% and 5.2%.

On the daily chart, Bollinger bands are steadily growing.

The price range narrows slightly, remaining quite spacious for the current level of activity in the market. The MACD indicator reverses upwards, keeping a relatively strong buy signal. Stochastic shows a more confident upward trend but is rapidly approaching its highs, indicating that the US dollar may become overbought in the ultra-short term.

Resistance levels: 0.926, 0.9276, 0.93, 0.9341.

Support levels: 0.922, 0.92, 0.9177, 0.9157.

SOLIDECN

Senior member

- Messages

- 3,041

- Likes

- 0

ETHUSD Market Analysis by Solid ECN Securities

upward correction may end

Current trend

This week, the ETHUSD pair continues to add value and has now risen to the area of 3235.00, which corresponds to four-week highs.

Experts do not have a consensus on the drivers of the current upward dynamics, but many of them believe that the growth is caused by the enthusiasm of investors against the background of the release of January data from the American labor market. The indicators turned out to be significantly better than preliminary estimates and confirmed the overall resilience of the American economy to the consequences of the pandemic caused by the COVID-19 Omicron strain. This, in turn, aroused interest in risky assets, including digital ones, on the part of bidders.

As for the ETH positions, in the long term they continue to be supported by the expectation of the merger of the Ethereum and Ethereum 2.0 networks and the transition to the Proof-of-Stake (PoS) algorithm. The main operating network is still experiencing significant problems due to high fees and limited bandwidth, which specialists cannot solve in any way. The other day, Ethereum founder Vitalik Buterin and lead developer Tim Beiko proposed a new improvement option – to use transactions with a large amount of binary data ("blob-carrying transactions"). This measure is seen as temporary, for a period until the Ethereum 2.0 network becomes fully functional. The launch of the new function may take place after the next hard fork.

Resistance levels: 3125, 3437.5, 3750.

Support levels: 3000, 2700, 2500.

upward correction may end

Current trend

This week, the ETHUSD pair continues to add value and has now risen to the area of 3235.00, which corresponds to four-week highs.

Experts do not have a consensus on the drivers of the current upward dynamics, but many of them believe that the growth is caused by the enthusiasm of investors against the background of the release of January data from the American labor market. The indicators turned out to be significantly better than preliminary estimates and confirmed the overall resilience of the American economy to the consequences of the pandemic caused by the COVID-19 Omicron strain. This, in turn, aroused interest in risky assets, including digital ones, on the part of bidders.

As for the ETH positions, in the long term they continue to be supported by the expectation of the merger of the Ethereum and Ethereum 2.0 networks and the transition to the Proof-of-Stake (PoS) algorithm. The main operating network is still experiencing significant problems due to high fees and limited bandwidth, which specialists cannot solve in any way. The other day, Ethereum founder Vitalik Buterin and lead developer Tim Beiko proposed a new improvement option – to use transactions with a large amount of binary data ("blob-carrying transactions"). This measure is seen as temporary, for a period until the Ethereum 2.0 network becomes fully functional. The launch of the new function may take place after the next hard fork.

Resistance levels: 3125, 3437.5, 3750.

Support levels: 3000, 2700, 2500.

SOLIDECN

Senior member

- Messages

- 3,041

- Likes

- 0

EURUSD market update by Solid ECN Securities

EURUSD market update by Solid ECN Securities

Comments of the head of the ECB disappointed investors

The European currency came under pressure from yesterday's comments by the head of the European Central Bank (ECB), Christine Lagarde, who tried to reassure investors who are counting on a rate hike at the end of this year. The official said that there is no need for a significant tightening of monetary policy now since, in the foreseeable future, inflation in the EU should decrease, stabilizing at the target level of 2.0%.

She also noted that high energy prices would soon slow down the overall pace of consumer price growth, as they seriously reduce the purchasing power of households. Also, the head of the European department confirmed that any correction of monetary policy would be gradual, and the increase in rates will be possible only after completing the bond purchase program. These statements disappointed the market, indicating that, in general, the ECB intends to stick to the previous wait-and-see policy.

Meanwhile, the US Federal Reserve may start raising rates in March, as both key conditions for this are present in the US economy. Despite the epidemic of the Omicron coronavirus strain, the national labor market is actively recovering, which was confirmed by the January employment data, but inflation remains at high levels. On Thursday, experts expect the publication of January data on the consumer price index. It is forecast to rise 7.0% to 7.3%, strengthening the resolve of regulator officials to cut stimulus to the economy.

Resistance levels: 1.1475, 1.1560, 1.16.

Support levels: 1.1400, 1.1335, 1.123.

The European currency came under pressure from yesterday's comments by the head of the European Central Bank (ECB), Christine Lagarde, who tried to reassure investors who are counting on a rate hike at the end of this year. The official said that there is no need for a significant tightening of monetary policy now since, in the foreseeable future, inflation in the EU should decrease, stabilizing at the target level of 2.0%.

She also noted that high energy prices would soon slow down the overall pace of consumer price growth, as they seriously reduce the purchasing power of households. Also, the head of the European department confirmed that any correction of monetary policy would be gradual, and the increase in rates will be possible only after completing the bond purchase program. These statements disappointed the market, indicating that, in general, the ECB intends to stick to the previous wait-and-see policy.

Meanwhile, the US Federal Reserve may start raising rates in March, as both key conditions for this are present in the US economy. Despite the epidemic of the Omicron coronavirus strain, the national labor market is actively recovering, which was confirmed by the January employment data, but inflation remains at high levels. On Thursday, experts expect the publication of January data on the consumer price index. It is forecast to rise 7.0% to 7.3%, strengthening the resolve of regulator officials to cut stimulus to the economy.

Resistance levels: 1.1475, 1.1560, 1.16.

Support levels: 1.1400, 1.1335, 1.123.

SOLIDECN

Senior member

- Messages

- 3,041

- Likes

- 0

Tesla Inc Market update by Solid ECN Securities

Tesla Inc Market update by Solid ECN Securities

Quotes resumed upward dynamics

Current trend

Currently, Tesla Inc. quotes have broken through the monthly downtrend line and are consolidating around 906.

The positive dynamics was promoted by optimistic forecasts from JPMorgan Chase & Co., according to which the issuer, already a leader in the electric car sector, will increase its share in the US automotive industry market and by 2027 may significantly displace Ford and General Motors. This news allowed the asset to add about 3% in value.

In addition, there are a number of negative news that prevent a more significant growth of the asset. So, the National Highway Traffic Safety Administration of the USA (NHTSA) announced the recall of 54K cars of the company due to a software malfunction. It should be emphasized that recently the manufacturer has already withdrawn 817K electric cars from the market due to the lack of a sound signal that notifies the driver of the need to fasten his seat belt.

Also, the Indian authorities refused to comply with the request of the head of Tesla Inc. Elon Musk on tax benefits for imports, arguing that the automaker already has the opportunity to import its products not fully assembled and refine it on the spot at a lower price. Another important factor is the news about the losses incurred by the issuer due to the decrease in the value of BTC. So, based on the published declaration, Tesla Inc. received a loss of 101M dollars, having invested 1.5B dollars in this asset last year.

Resistance levels: 992.82, 1070.39, 1127.35, 1200.01.

Support levels: 820.98, 723.77, 659.95, 592.70.

Current trend

Currently, Tesla Inc. quotes have broken through the monthly downtrend line and are consolidating around 906.

The positive dynamics was promoted by optimistic forecasts from JPMorgan Chase & Co., according to which the issuer, already a leader in the electric car sector, will increase its share in the US automotive industry market and by 2027 may significantly displace Ford and General Motors. This news allowed the asset to add about 3% in value.

In addition, there are a number of negative news that prevent a more significant growth of the asset. So, the National Highway Traffic Safety Administration of the USA (NHTSA) announced the recall of 54K cars of the company due to a software malfunction. It should be emphasized that recently the manufacturer has already withdrawn 817K electric cars from the market due to the lack of a sound signal that notifies the driver of the need to fasten his seat belt.

Also, the Indian authorities refused to comply with the request of the head of Tesla Inc. Elon Musk on tax benefits for imports, arguing that the automaker already has the opportunity to import its products not fully assembled and refine it on the spot at a lower price. Another important factor is the news about the losses incurred by the issuer due to the decrease in the value of BTC. So, based on the published declaration, Tesla Inc. received a loss of 101M dollars, having invested 1.5B dollars in this asset last year.

Resistance levels: 992.82, 1070.39, 1127.35, 1200.01.

Support levels: 820.98, 723.77, 659.95, 592.70.

SOLIDECN

Senior member

- Messages

- 3,041

- Likes

- 0

FTSE 100 market update by Solid ECN Securities

FTSE 100 market update by Solid ECN Securities

Growth against the background of positive company reports

First of all, the asset is supported by fairly confident publications of the financial statements of its components.

The FTSE 100 quotes are supported by the bond market, which continues the global uptrend that began in mid-December last year. Thus, the yield on 10-year UK Treasury securities is at 1.4220%, while a week ago it was 1.2550%.

The index quotes are trading within the global ascending channel, still holding near the resistance level. Technical indicators are in a state of an increasing buy signal:

The range of EMA fluctuations on the alligator indicator is expanding, and the histogram of the AO oscillator forms new ascending bars.

Support levels: 7510, 7330.

Resistance levels: 7640, 7800

First of all, the asset is supported by fairly confident publications of the financial statements of its components.

The FTSE 100 quotes are supported by the bond market, which continues the global uptrend that began in mid-December last year. Thus, the yield on 10-year UK Treasury securities is at 1.4220%, while a week ago it was 1.2550%.

The index quotes are trading within the global ascending channel, still holding near the resistance level. Technical indicators are in a state of an increasing buy signal:

The range of EMA fluctuations on the alligator indicator is expanding, and the histogram of the AO oscillator forms new ascending bars.

Support levels: 7510, 7330.

Resistance levels: 7640, 7800

SOLIDECN

Senior member

- Messages

- 3,041

- Likes

- 0

EURUSD signal by Solid ECN Securities

Recovery attempts after a "bearish" start to the week

The European currency shows weak growth against the US dollar during the Asian trading session, trying to recover from the "bearish" start of the week. The instrument is testing 1.1430 for a breakout, waiting for additional growth drivers to appear.

Meanwhile, macroeconomic statistics from Europe, released at the beginning of the week, does not provide any support to the single currency. In particular, on Monday, investors were disappointed by the data from Germany.

The instrument was also influenced by the results of the speech of the head of the European Central Bank (ECB), Christine Lagarde. The official again noted that inflation in the region does not yet threaten economic stability, and therefore does not require an immediate response in the form of tightening monetary policy. So far, the European regulator is following the path of the US Federal Reserve, which for quite a long time refused to recognize systemic inflationary risks, preferring to call the rapid rise in prices only a temporary phenomenon.

Conclusion and trading suggestion

> The economic data is against the Euro signalling a fall

> The pair roams in the ichimoko cloud signalling a fall

> The pair broke the trendline and the level 23.6 of the Fibonacci level

> Sideway warket for the day.

Recovery attempts after a "bearish" start to the week

The European currency shows weak growth against the US dollar during the Asian trading session, trying to recover from the "bearish" start of the week. The instrument is testing 1.1430 for a breakout, waiting for additional growth drivers to appear.

Meanwhile, macroeconomic statistics from Europe, released at the beginning of the week, does not provide any support to the single currency. In particular, on Monday, investors were disappointed by the data from Germany.

The instrument was also influenced by the results of the speech of the head of the European Central Bank (ECB), Christine Lagarde. The official again noted that inflation in the region does not yet threaten economic stability, and therefore does not require an immediate response in the form of tightening monetary policy. So far, the European regulator is following the path of the US Federal Reserve, which for quite a long time refused to recognize systemic inflationary risks, preferring to call the rapid rise in prices only a temporary phenomenon.

Conclusion and trading suggestion

> The economic data is against the Euro signalling a fall

> The pair roams in the ichimoko cloud signalling a fall

> The pair broke the trendline and the level 23.6 of the Fibonacci level

> Sideway warket for the day.

sell area ~1.151 | target ~1.135

Last edited:

SOLIDECN

Senior member

- Messages

- 3,041

- Likes

- 0

XAUUSD

Gold renews local highs

During the Asian session, gold prices are rising moderately, developing the "bullish" momentum since the beginning of the month and recovering from a sharp decline at the end of January. Supported by relatively poor positions in the American currency, the instrument approached testing the level of 1830 for a breakout upwards. Also, the "bulls" on the dollar are waiting for the data on consumer inflation in the US for January, hoping that they will become another signal in favor of a faster tightening of monetary policy by the US Federal Reserve. In turn, a further increase in gold quotes is hindered by a noticeable increase in the yield of treasury bonds both in the US and in Europe.

The US macroeconomic statistics released yesterday did not provide any noticeable support to the dollar. Thus, the business optimism index from the NFIB for January fell from 98.9 to 97.1 points. The index of economic optimism from IBD/TIPP retreated from 44.7 to 44.0 points in February, while the forecasts suggested that the indicator would increase to 47.2 points.

Support and resistance

Resistance levels: 1831, 1840, 1847, 1853.

Support levels: 1823, 1814, 1805.5, 1800.

Gold renews local highs

During the Asian session, gold prices are rising moderately, developing the "bullish" momentum since the beginning of the month and recovering from a sharp decline at the end of January. Supported by relatively poor positions in the American currency, the instrument approached testing the level of 1830 for a breakout upwards. Also, the "bulls" on the dollar are waiting for the data on consumer inflation in the US for January, hoping that they will become another signal in favor of a faster tightening of monetary policy by the US Federal Reserve. In turn, a further increase in gold quotes is hindered by a noticeable increase in the yield of treasury bonds both in the US and in Europe.

The US macroeconomic statistics released yesterday did not provide any noticeable support to the dollar. Thus, the business optimism index from the NFIB for January fell from 98.9 to 97.1 points. The index of economic optimism from IBD/TIPP retreated from 44.7 to 44.0 points in February, while the forecasts suggested that the indicator would increase to 47.2 points.

Support and resistance

Resistance levels: 1831, 1840, 1847, 1853.

Support levels: 1823, 1814, 1805.5, 1800.

SOLIDECN

Senior member

- Messages

- 3,041

- Likes

- 0

GBPUSD by Solid ECN Securities

GBPUSD by Solid ECN Securities

The market is waiting for US inflation data

Current trend

The GBPUSD pair is trading around 1.355, waiting for new serious drivers for the movement, which may appear on Thursday after the publication of January inflation data in the USA and comments by the head of the Bank of England Andrew Bailey.

Investors expect the official to hint at further actions of the regulator in relation to the current price increase, exerting increasing pressure on local households. It should be noted that the National Institute of Economic and Social Research of Great Britain (NIESR) has recognized that the cycle of rate increases in the country does not keep pace with the rate of inflation, and the government should support the actions of the Bank of England by postponing tax increases and expanding public spending. Also, the strengthening of the pound's position is hindered by the situation around Prime Minister Boris Johnson, whose resignation is still likely.

Resistance levels: 1.361, 1.3732, 1.3793.

Support levels: 1.3488, 1.3366, 1.33.

Current trend

The GBPUSD pair is trading around 1.355, waiting for new serious drivers for the movement, which may appear on Thursday after the publication of January inflation data in the USA and comments by the head of the Bank of England Andrew Bailey.

Investors expect the official to hint at further actions of the regulator in relation to the current price increase, exerting increasing pressure on local households. It should be noted that the National Institute of Economic and Social Research of Great Britain (NIESR) has recognized that the cycle of rate increases in the country does not keep pace with the rate of inflation, and the government should support the actions of the Bank of England by postponing tax increases and expanding public spending. Also, the strengthening of the pound's position is hindered by the situation around Prime Minister Boris Johnson, whose resignation is still likely.

Resistance levels: 1.361, 1.3732, 1.3793.

Support levels: 1.3488, 1.3366, 1.33.

SOLIDECN

Senior member

- Messages

- 3,041

- Likes

- 0

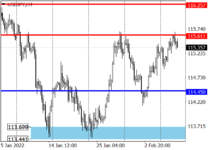

USDJPY insights by Solid ECN Securities

USDJPY insights by Solid ECN Securities

The pair is aiming for the January high

Due to the difference in approaches to regulating monetary processes by the Bank of Japan and the US Federal Reserve, the USDJPY pair is strengthening its position and has now reached the level of 115.4, preparing to continue its upward trend towards 116.10.

The long-term trend is upwards. Yesterday, the price broke through the resistance level of 115.40, and the next growth target was 116.1, which breakout allows the quotes to rise to the 117 area.

The medium-term trend is upwards. Last week, the price reversed at the support level of 114.45. It renewed the local high at 115.60, which breakout will allow the rate to rise to the 116.25 area.

Resistance levels: 116.1, 117.

Support levels: 114.3, 113.5, 112.7.

Due to the difference in approaches to regulating monetary processes by the Bank of Japan and the US Federal Reserve, the USDJPY pair is strengthening its position and has now reached the level of 115.4, preparing to continue its upward trend towards 116.10.

The long-term trend is upwards. Yesterday, the price broke through the resistance level of 115.40, and the next growth target was 116.1, which breakout allows the quotes to rise to the 117 area.

The medium-term trend is upwards. Last week, the price reversed at the support level of 114.45. It renewed the local high at 115.60, which breakout will allow the rate to rise to the 116.25 area.

Resistance levels: 116.1, 117.

Support levels: 114.3, 113.5, 112.7.

SOLIDECN

Senior member

- Messages

- 3,041

- Likes

- 0

Brent Crude Oil insights by Solid ECN Securities

Brent Crude Oil insights by Solid ECN Securities

Investors fear Iranian oil entering the market

Brent Crude Oil prices are correcting, trading around 90.20. The day before, the quotes of the trading instrument significantly lost in value against the backdrop of resumed negotiations in Vienna on the "nuclear deal" between Iran and the leading countries of Europe, in addition to which representatives of Russia and China take part. According to analysts' forecasts, it is the current eighth round of negotiations that has the highest chances of success. In the event that sanctions are lifted from the Iranian oil industry, up to 1.6M barrels of cheap oil per day may begin to enter the market, which, as investors fear, will upset the current balance of supply and demand.

The day before, the US Department of Energy published a traditional forecast for the oil market in the near future. Expected energy demand for 2022 rose to 100.6M barrels per day from 100.5M barrels. The forecast for the average oil production in the United States in 2022 was raised to 11.97M barrels per day, and to 12.6M barrels for 2023. The average oil price, according to the agency's expectations, will rise to 82.87 dollars instead of 74.95 dollars.

Support and resistance

On the global chart, the asset continues to rise as part of the global pattern Expanding Formation. Technical indicators are still holding a fairly strong buy signal: the fluctuation range of the Alligator EMA is still quite wide and the histogram of the AO oscillator, being in the buy zone, forms local bars with a downtrend.

Support levels: 88.07, 84.20.

Resistance levels: 92.2, 95.

Brent Crude Oil prices are correcting, trading around 90.20. The day before, the quotes of the trading instrument significantly lost in value against the backdrop of resumed negotiations in Vienna on the "nuclear deal" between Iran and the leading countries of Europe, in addition to which representatives of Russia and China take part. According to analysts' forecasts, it is the current eighth round of negotiations that has the highest chances of success. In the event that sanctions are lifted from the Iranian oil industry, up to 1.6M barrels of cheap oil per day may begin to enter the market, which, as investors fear, will upset the current balance of supply and demand.

The day before, the US Department of Energy published a traditional forecast for the oil market in the near future. Expected energy demand for 2022 rose to 100.6M barrels per day from 100.5M barrels. The forecast for the average oil production in the United States in 2022 was raised to 11.97M barrels per day, and to 12.6M barrels for 2023. The average oil price, according to the agency's expectations, will rise to 82.87 dollars instead of 74.95 dollars.

Support and resistance

On the global chart, the asset continues to rise as part of the global pattern Expanding Formation. Technical indicators are still holding a fairly strong buy signal: the fluctuation range of the Alligator EMA is still quite wide and the histogram of the AO oscillator, being in the buy zone, forms local bars with a downtrend.

Support levels: 88.07, 84.20.

Resistance levels: 92.2, 95.

SOLIDECN

Senior member

- Messages

- 3,041

- Likes

- 0

NZDUSD market insights by Solid ECN Securities

NZDUSD market insights by Solid ECN Securities

The pair is consolidation at local highs

The New Zealand dollar traded flat against the US dollar during the Asian session, holding near 0.668. The day before, NZDUSD showed active growth, updating local highs from January 26, in response to a general improvement in market sentiment.

In addition, the US currency remains under pressure ahead of today's publication of statistics on consumer inflation, as well as the monthly report on the state of the US budget for January. The market expects confirmation of a moderate increase in price pressure in the country, which will become an additional argument for the US Federal Reserve to tighten monetary policy. The start of the interest rate hike cycle is expected in March, but now the main question is how much the rate will be adjusted.

Tomorrow, investors will be focused on a block of statistics from New Zealand. In particular, traders expect January statistics on Electronic Card Retail Sales, as well as Business NZ PMI. The index is projected to moderately increase from 53.7 to 55.3 points.

Resistance levels: 0.67, 0.6732, 0.6761, 0.68.

Support levels: 0.665, 0.66, 0.6528, 0.65.

The New Zealand dollar traded flat against the US dollar during the Asian session, holding near 0.668. The day before, NZDUSD showed active growth, updating local highs from January 26, in response to a general improvement in market sentiment.

In addition, the US currency remains under pressure ahead of today's publication of statistics on consumer inflation, as well as the monthly report on the state of the US budget for January. The market expects confirmation of a moderate increase in price pressure in the country, which will become an additional argument for the US Federal Reserve to tighten monetary policy. The start of the interest rate hike cycle is expected in March, but now the main question is how much the rate will be adjusted.

Tomorrow, investors will be focused on a block of statistics from New Zealand. In particular, traders expect January statistics on Electronic Card Retail Sales, as well as Business NZ PMI. The index is projected to moderately increase from 53.7 to 55.3 points.

Resistance levels: 0.67, 0.6732, 0.6761, 0.68.

Support levels: 0.665, 0.66, 0.6528, 0.65.

SOLIDECN

Senior member

- Messages

- 3,041

- Likes

- 0

USDJPY insights by Solid ECN Securities

USDJPY insights by Solid ECN Securities

The market is waiting for US inflation data

During the Asian session, the USDJPY pair shows moderate growth, holding near local highs, renewed yesterday. The instrument is testing the level of 115.6 for a breakout, waiting for additional drivers to move.

Today, the focus of American investors is the January statistics on consumer inflation. It is expected that the price pressure in the US will continue to rise moderately and renew the previous 40-year highs. It will be an additional argument in favor of a more rapid tightening of the US Federal Reserve's monetary policy, which counts on launching a rate hike cycle in March.

Resistance levels: 115.67, 116, 116.34, 117.

Support levels: 115, 114.5, 114, 113.5.

During the Asian session, the USDJPY pair shows moderate growth, holding near local highs, renewed yesterday. The instrument is testing the level of 115.6 for a breakout, waiting for additional drivers to move.

Today, the focus of American investors is the January statistics on consumer inflation. It is expected that the price pressure in the US will continue to rise moderately and renew the previous 40-year highs. It will be an additional argument in favor of a more rapid tightening of the US Federal Reserve's monetary policy, which counts on launching a rate hike cycle in March.

Resistance levels: 115.67, 116, 116.34, 117.

Support levels: 115, 114.5, 114, 113.5.

SOLIDECN

Senior member

- Messages

- 3,041

- Likes

- 0

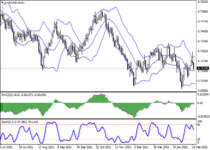

AUDUSD market insights by Solid ECN Securities

Australia's economy is recovering steadily

The Australian currency demonstrates relative stability against the background of the neutrality of the US dollar, currently forming a local uptrend and trading around 0.7172.

Macroeconomic statistics coming from Australia indicate that the country's economy continues to recover from the effects of the coronavirus pandemic confidently.The index of building permits issued for January added 8.2%, which coincided with preliminary market estimates and exceeded the December increase of 2.6%. Thus, the probability that the Australian dollar will end the trading week with positive dynamics is quite high.

The situation in the currency pair may seriously change today after the publication of inflation data in the US. Investors are closely watching the dynamics of consumer prices in light of the possible start of a cycle of interest rate hikes by the US Federal Reserve in March this year. According to analysts, the figure will rise to 7.3%, surpassing the December value of 7.0%. If the forecast is implemented, the probability of a rate increase will increase significantly, locally supporting the US dollar, which has been trading almost neutral since Monday.

On the global chart, the price moves within a long downtrend. Technical indicators are in the state of a sell signal, which is already ready to change to an upward one: the EMA fluctuation range on the Alligator indicator is actively narrowing, and the AO histogram forms upward bars in the sell zone.

Resistance levels: 0.7227, 0.7415.

Support levels: 0.71, 0.698.

Australia's economy is recovering steadily

The Australian currency demonstrates relative stability against the background of the neutrality of the US dollar, currently forming a local uptrend and trading around 0.7172.

Macroeconomic statistics coming from Australia indicate that the country's economy continues to recover from the effects of the coronavirus pandemic confidently.The index of building permits issued for January added 8.2%, which coincided with preliminary market estimates and exceeded the December increase of 2.6%. Thus, the probability that the Australian dollar will end the trading week with positive dynamics is quite high.

The situation in the currency pair may seriously change today after the publication of inflation data in the US. Investors are closely watching the dynamics of consumer prices in light of the possible start of a cycle of interest rate hikes by the US Federal Reserve in March this year. According to analysts, the figure will rise to 7.3%, surpassing the December value of 7.0%. If the forecast is implemented, the probability of a rate increase will increase significantly, locally supporting the US dollar, which has been trading almost neutral since Monday.

On the global chart, the price moves within a long downtrend. Technical indicators are in the state of a sell signal, which is already ready to change to an upward one: the EMA fluctuation range on the Alligator indicator is actively narrowing, and the AO histogram forms upward bars in the sell zone.

Resistance levels: 0.7227, 0.7415.

Support levels: 0.71, 0.698.

SOLIDECN

Senior member

- Messages

- 3,041

- Likes

- 0

EURUSD market insight by Solid ECN Securities

Trading within a new sideways range

The EURUSD pair is correcting within a sideways trend, trading around the level of 1.1426 with low volatility amid the lack of key macroeconomic statistics this week.

The prospects for the actions of the European Central Bank (ECB) are not entirely clear to investors since, at a recent meeting, its head Christine Lagarde made it clear that the regulator did not intend to tighten monetary policy now since the growth of the EU economy was still quite unstable.

The USD Index moves within a very tight range of around 95.5 in anticipation of the key event of this week – today's publication of data on consumer prices. Analysts expect the rate to rise to 7.3% from 7.0%, and yesterday, Atlanta Federal Reserve Bank President Rafael Bostic said he expected at least three rate hikes this year, and the likelihood of a March adjustment was directly dependent on today's macroeconomic statistics.

Support and resistance

The asset moves within a new sideways range. Technical indicators reversed and gave a signal for local purchases: indicator Alligator's EMA fluctuations range began to expand upwards, and the histogram of the AO oscillator forms ascending bars in the purchase zone.

Resistance levels: 1.1480, 1.1689.

Support levels: 1.1373, 1.1142.

Trading within a new sideways range

The EURUSD pair is correcting within a sideways trend, trading around the level of 1.1426 with low volatility amid the lack of key macroeconomic statistics this week.

The prospects for the actions of the European Central Bank (ECB) are not entirely clear to investors since, at a recent meeting, its head Christine Lagarde made it clear that the regulator did not intend to tighten monetary policy now since the growth of the EU economy was still quite unstable.

The USD Index moves within a very tight range of around 95.5 in anticipation of the key event of this week – today's publication of data on consumer prices. Analysts expect the rate to rise to 7.3% from 7.0%, and yesterday, Atlanta Federal Reserve Bank President Rafael Bostic said he expected at least three rate hikes this year, and the likelihood of a March adjustment was directly dependent on today's macroeconomic statistics.

Support and resistance

The asset moves within a new sideways range. Technical indicators reversed and gave a signal for local purchases: indicator Alligator's EMA fluctuations range began to expand upwards, and the histogram of the AO oscillator forms ascending bars in the purchase zone.

Resistance levels: 1.1480, 1.1689.

Support levels: 1.1373, 1.1142.

SOLIDECN

Senior member

- Messages

- 3,041

- Likes

- 0

ADAUSD Market Insights by Solid ECN Securities

Current trend

Since the beginning of this month, the ADAUSD pair has been growing in line with the general market trend.

At present, the price has risen to the level of 1.1718 but cannot consolidate above it yet. The asset is in consolidation, waiting for more serious movement drivers. The key "bullish" level is 1.27. Its breakout allows growth to the levels of 1.47 and 1.5625 (Murrey [8/8]). The breakdown of 1.0742, supported by the middle line of Bollinger bands, will ensure the resumption of decline to the levels of 0.9675, 0.8789, 0.7812.

Currently, the market is in a state of uncertainty: Bollinger bands narrows, as it happens before a significant price movement, the MACD histogram prepares to move into the positive zone and form a buy signal, but Stochastic reversed downwards.

Support and resistance

Resistance levels: 1.27, 1.47, 1.5625.

Support levels: 1.0742, 0.9675, 0.8789, 0.7812.

Current trend

Since the beginning of this month, the ADAUSD pair has been growing in line with the general market trend.

At present, the price has risen to the level of 1.1718 but cannot consolidate above it yet. The asset is in consolidation, waiting for more serious movement drivers. The key "bullish" level is 1.27. Its breakout allows growth to the levels of 1.47 and 1.5625 (Murrey [8/8]). The breakdown of 1.0742, supported by the middle line of Bollinger bands, will ensure the resumption of decline to the levels of 0.9675, 0.8789, 0.7812.

Currently, the market is in a state of uncertainty: Bollinger bands narrows, as it happens before a significant price movement, the MACD histogram prepares to move into the positive zone and form a buy signal, but Stochastic reversed downwards.

Support and resistance

Resistance levels: 1.27, 1.47, 1.5625.

Support levels: 1.0742, 0.9675, 0.8789, 0.7812.

SOLIDECN

Senior member

- Messages

- 3,041

- Likes

- 0

GBPUSD Market insight by Solid ECN Securities

GBPUSD Market insight by Solid ECN Securities

Consolidation ahead of the release of statistics from the USA

Now the price of the GBPUSD pair is trying to gain a foothold above 1.355, but a serious increase will be possible if the asset leaves the descending channel, breaking through the level of 1.361. At the same time, the targets of the upward dynamics will be 1.3732 and 1.3793. If the level of 1.3488 breaks down, the decline may continue to 1.3366 and 1.3300.

The indicators still do not give a single signal: the Bollinger Bands are horizontal, the MACD histogram is near the zero zone, its volumes are insignificant, and the Stochastic is directed downwards.

Resistance levels: 1.3610, 1.3732, 1.3793.

Support levels: 1.3488, 1.3366, 1.33.

Now the price of the GBPUSD pair is trying to gain a foothold above 1.355, but a serious increase will be possible if the asset leaves the descending channel, breaking through the level of 1.361. At the same time, the targets of the upward dynamics will be 1.3732 and 1.3793. If the level of 1.3488 breaks down, the decline may continue to 1.3366 and 1.3300.

The indicators still do not give a single signal: the Bollinger Bands are horizontal, the MACD histogram is near the zero zone, its volumes are insignificant, and the Stochastic is directed downwards.

Resistance levels: 1.3610, 1.3732, 1.3793.

Support levels: 1.3488, 1.3366, 1.33.

SOLIDECN

Senior member

- Messages

- 3,041

- Likes

- 0

AUDUSD market insight by Solid ECN Securities

AUDUSD market insight by Solid ECN Securities

Australian currency updates local lows

The Australian dollar is developing a strong "bearish" momentum in tandem with the US currency, testing the level of 0.7120 for a breakdown and updating local lows from February 8.

In addition to technical correction factors at the end of the week, the downtrend was facilitated by strong macroeconomic statistics on inflation in the US, published the day before. The data showed a further acceleration in domestic consumer inflation to 7.5%, which is likely to require the US Federal Reserve to tighten monetary policy sooner during 2022. The start of the interest rate hike cycle is expected in March, when the quantitative easing (QE) program comes to an end.

The focus of investors today will also be on the Fed Monetary Policy Report and data on Michigan Consumer Sentiment Index for February.

Support and resistance

In the D1 chart, Bollinger Bands are reversing horizontally. The price range is almost unchanged, but it remains rather spacious for the current level of activity in the market. MACD is reversing downwards preserving the previous weak buy signal. Stochastic, having rebounded from the level of "80" is declining, signaling in favor of the development of correctional dynamics in the ultra-short term.

Current showings of the indicators do not contradict the further development of the "bearish" trend in the short term.

Resistance levels: 0.716, 0.72, 0.7250, 0.73.

Support levels: 0.71, 0.705, 0.7, 0.695.

The Australian dollar is developing a strong "bearish" momentum in tandem with the US currency, testing the level of 0.7120 for a breakdown and updating local lows from February 8.

In addition to technical correction factors at the end of the week, the downtrend was facilitated by strong macroeconomic statistics on inflation in the US, published the day before. The data showed a further acceleration in domestic consumer inflation to 7.5%, which is likely to require the US Federal Reserve to tighten monetary policy sooner during 2022. The start of the interest rate hike cycle is expected in March, when the quantitative easing (QE) program comes to an end.

The focus of investors today will also be on the Fed Monetary Policy Report and data on Michigan Consumer Sentiment Index for February.

Support and resistance

In the D1 chart, Bollinger Bands are reversing horizontally. The price range is almost unchanged, but it remains rather spacious for the current level of activity in the market. MACD is reversing downwards preserving the previous weak buy signal. Stochastic, having rebounded from the level of "80" is declining, signaling in favor of the development of correctional dynamics in the ultra-short term.

Current showings of the indicators do not contradict the further development of the "bearish" trend in the short term.

Resistance levels: 0.716, 0.72, 0.7250, 0.73.

Support levels: 0.71, 0.705, 0.7, 0.695.

SOLIDECN

Senior member

- Messages

- 3,041

- Likes

- 0

GBPUSD market insights by Solid ECN Securities

Correction after the publication of US inflation data

Current trend

During the Asian session, the GBPUSD pair is falling, testing the level of 1.352 for a breakdown.

The development of corrective dynamics at the end of the week is due to the appearance of strong US statistics on inflation, which forces investors to act ahead of the curve. There is practically no doubt that the US Federal Reserve will start a cycle of raising interest rates during the March meeting. Now the whole question is how fast the US regulator will tighten its monetary policy and whether the risks of rising consumer prices were correctly assessed from the very beginning.

Meanwhile, British investors expect on Friday a block of macroeconomic statistics from the UK on GDP dynamics for the fourth quarter. Forecasts suggest some slowdown in the indicator from 6.8% to 6.4%. Also, December data on the dynamics of industrial production and an estimate of GDP growth rates from NIESR for January 2022 will be published during the day.

Support and resistance

On the daily chart, Bollinger Bands move flat. The price range narrows slightly, remaining quite spacious for the observed trading dynamics for the instrument. MACD falls, keeping a poor sell signal (the histogram is below the signal line). Stochastic shows a more confident decline, quickly approaching its lows, indicating that the pound may become oversold in the ultra-short term.

Resistance levels: 1.3550, 1.3600, 1.3650, 1.3700.

Support levels: 1.3500, 1.3460, 1.3435, 1.3400.

Correction after the publication of US inflation data

Current trend

During the Asian session, the GBPUSD pair is falling, testing the level of 1.352 for a breakdown.

The development of corrective dynamics at the end of the week is due to the appearance of strong US statistics on inflation, which forces investors to act ahead of the curve. There is practically no doubt that the US Federal Reserve will start a cycle of raising interest rates during the March meeting. Now the whole question is how fast the US regulator will tighten its monetary policy and whether the risks of rising consumer prices were correctly assessed from the very beginning.

Meanwhile, British investors expect on Friday a block of macroeconomic statistics from the UK on GDP dynamics for the fourth quarter. Forecasts suggest some slowdown in the indicator from 6.8% to 6.4%. Also, December data on the dynamics of industrial production and an estimate of GDP growth rates from NIESR for January 2022 will be published during the day.

Support and resistance

On the daily chart, Bollinger Bands move flat. The price range narrows slightly, remaining quite spacious for the observed trading dynamics for the instrument. MACD falls, keeping a poor sell signal (the histogram is below the signal line). Stochastic shows a more confident decline, quickly approaching its lows, indicating that the pound may become oversold in the ultra-short term.

Resistance levels: 1.3550, 1.3600, 1.3650, 1.3700.

Support levels: 1.3500, 1.3460, 1.3435, 1.3400.

Similar threads

- Replies

- 68

- Views

- 9K

- Replies

- 3

- Views

- 1K

F