SOLIDECN

Senior member

- Messages

- 3,041

- Likes

- 0

Gold is consolidating at $1800

Current trend

Gold prices are consolidating near the psychological support at $1800, developing a weak downtrend since the end of last trading week. Demand for the precious metal is moderately declining as investor activity recovers. Traders ignore the difficult epidemiological situation in the world and focus on the prospects for further tightening of monetary policy by leading financial regulators. First of all, one should expect a rate increase from the US Federal Reserve and the Bank of England, while the European Central Bank is in no hurry to take active steps, waiting for more clear signals from the economy.

The macroeconomic statistics from the US released the day before did not have a noticeable impact on the dynamics of the instrument; however, it attracted attention with a sharp drop in the new york Empire State Manufacturing Index. In January, the indicator fell from 31.9 to -0.7 points, while forecasts suggested a decline to only 25.7 points.

Today, investors are focused on the statistics from the US on the dynamics of the construction market and data from Canada on the Consumer Price Index for December. In turn, statistics on inflation in Germany and the UK will be released in Europe.

Gold prices are consolidating near the psychological support at $1800, developing a weak downtrend since the end of last trading week. Demand for the precious metal is moderately declining as investor activity recovers. Traders ignore the difficult epidemiological situation in the world and focus on the prospects for further tightening of monetary policy by leading financial regulators. First of all, one should expect a rate increase from the US Federal Reserve and the Bank of England, while the European Central Bank is in no hurry to take active steps, waiting for more clear signals from the economy.

The macroeconomic statistics from the US released the day before did not have a noticeable impact on the dynamics of the instrument; however, it attracted attention with a sharp drop in the new york Empire State Manufacturing Index. In January, the indicator fell from 31.9 to -0.7 points, while forecasts suggested a decline to only 25.7 points.

Today, investors are focused on the statistics from the US on the dynamics of the construction market and data from Canada on the Consumer Price Index for December. In turn, statistics on inflation in Germany and the UK will be released in Europe.

Support and resistance

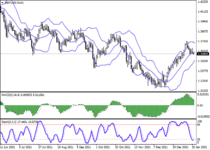

In the daily chart, Bollinger Bands are reversing horizontally. The price range is slightly narrowing from above, reflecting the correctional decline in the short term. MACD is declining keeping a weak sell signal. Stochastic shows a more confident decline, but at the moment it is quickly approaching its lows, indicating growing risks of the instrument being oversold in the ultra-short term.

Resistance levels: $1814, $1823, $1831.

Support levels: $1805, $1800, $1790, $1778.32

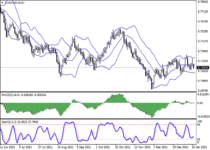

In the daily chart, Bollinger Bands are reversing horizontally. The price range is slightly narrowing from above, reflecting the correctional decline in the short term. MACD is declining keeping a weak sell signal. Stochastic shows a more confident decline, but at the moment it is quickly approaching its lows, indicating growing risks of the instrument being oversold in the ultra-short term.

Resistance levels: $1814, $1823, $1831.

Support levels: $1805, $1800, $1790, $1778.32