The later you enter, the higher your price risk, and any entry around here is very late.

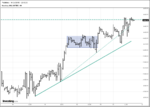

By focusing on drawing the right DL, I missed this important fact completely. 😎

Therefore, where and how will the market tell you that longs are in trouble? At what point or level is it more prudent to exit, stand aside, and let everybody work things out before you make another entry decision, and what can you do to ensure that you're focusing on the market and not on your own fears?

I think a good time to stand aside is if/when price stops trending and moves back into a range/chop. With that in mind, 4392 seems like an important level. A break (decisive?) below that level might be a good time to get out.

I realize price could drop into the middle of this range/chop and shoot back up, so exiting at 4392 may represent a risk averse approach. If we had entered into the current week-long uptrend sooner, then perhaps letting price fall back to the middle of the range/chop (at around our entry) would seem more palatable. Here, my instinct would be to take the profit.

By Monday, barring a significant disruption, the intersection will be about 30-40pts higher.

If we reach that point, I’d rely on the DL for an exit -- while keeping an eye on 4455 with the idea that a failure to get above it would be a bearish signal.

Thanks again.

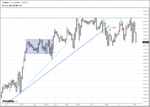

By focusing on drawing the right DL, I missed this important fact completely. 😎

Therefore, where and how will the market tell you that longs are in trouble? At what point or level is it more prudent to exit, stand aside, and let everybody work things out before you make another entry decision, and what can you do to ensure that you're focusing on the market and not on your own fears?

I think a good time to stand aside is if/when price stops trending and moves back into a range/chop. With that in mind, 4392 seems like an important level. A break (decisive?) below that level might be a good time to get out.

I realize price could drop into the middle of this range/chop and shoot back up, so exiting at 4392 may represent a risk averse approach. If we had entered into the current week-long uptrend sooner, then perhaps letting price fall back to the middle of the range/chop (at around our entry) would seem more palatable. Here, my instinct would be to take the profit.

By Monday, barring a significant disruption, the intersection will be about 30-40pts higher.

If we reach that point, I’d rely on the DL for an exit -- while keeping an eye on 4455 with the idea that a failure to get above it would be a bearish signal.

Thanks again.