Since you gave my such bad marks (feels like I am in a trading skool), I just had to gamble some more to improve the situation. Is my ratio improving ?

I’m afraid, mate, it’s getting worse.

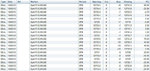

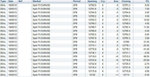

11 winning with 22.6 average winner and 21.41 average loser. It makes nearly one loser for one winner. This time you have 2 winners doing the trades profitable. But the ratio is 1.2 winner for 1 loser. This is near flipping the coin. Almost 50/50.

So, 3 considerations:

- Somehow your strategy does not allow you see when the trade is winner or loser, at least until certain time. Your average loser still 25, meaning until that you can’t determine if you stay in the trade or not. I really can’t tell you, you must know what’s wrong. I have same problems and for me there was my inability to see when the entry was wrong, and my incapacity of cutting the losers fast and (!!!!) I was unable to exit at scratch. Just so focused on the money I will make. And when things are going wrong, unable to exit quick at loss. Always hope it gona come back. But it never do. So, you exit with stop. At the end it adds. The same stuff with the exit of the winning trades, sometimes I was expecting they will go till “target price – non-sense” and I was still in the trade then. The momentum fade, you still wait, and few minutes ago winner smash you back and become loser.

- There is only 2 really profitably trades, the rest is a very low ratio. I can’t tell you if you stay in the trade too long, if your entry is wrong or you just let your winners become losers. You should know that. I'm personally, too greedy. Apart my English. Even if I hugely improved my entry points with the webinar (thanks John again), I’m too greedy and always try to stay in a winning position too long. Say, I see a pullback. I play it well, and jump on board. The previous level was some 6-7 ticks away and I expect it pulls back at least 5. I wait. It makes 4 ticks, slows and fall. Here, I must exit at scratch, but I don’t. And when it passes through 3 ticks, I exit at loss. So, I have had a 4 ticks winner and I exit 3 ticks loss. F…ng greedy idiot. I never said I’m intelligent, by the way.

- Timeframe. I don’t mean the timeframe you are trading, but the timeframe of you trading decisions. Sometimes you are really late, sometimes you are too early. I have a problem with hesitation. Sometimes you just know things but you still wait for conformation. And the price leave. You are late, trying to catch it. Or, worse, when I hesitate I look for some other confirmations and so focused on the confirmation that “I’m right”, I don’t even see that the situation changed already, momentum gone. And now, you are fading the price. Cool.

So, mate, I don’t know what makes your losers big and winners small, I can just share my bad experience but you probably know where you are wrong. As I see in your statement 2, is not a trading, it's a gambling, no offence. Cheers

Someone on this thread sure is going to be brought back down to earth with a huge bump before very long.

You mean you want to post your statement too?