You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

samspade79

Established member

- Messages

- 576

- Likes

- 25

1399

Pat494

Legendary member

- Messages

- 14,614

- Likes

- 1,588

GL2 y'all now...

Funny how bodies at the top have it down and bodies at the bottom have it up (Samspade79 being the exception)...

Going to be very interesting this herd mentality... 👍

Ummm yes - theoretically the top lot predictions should come true including the wt av, but we shall see ?

wackypete2

Legendary member

- Messages

- 10,211

- Likes

- 2,058

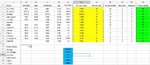

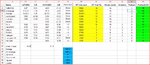

Holy cr@p! The average nailed it right down to the decimal point.

Very scary!

Peter

Very scary!

Peter

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Results...

Well I guess it explains the tops v bottoms :cheesy:

Wackypete's total is wrong. His 1 point needs adding to it I believe, as he should be on 12?

VielGeld

Experienced member

- Messages

- 1,422

- Likes

- 179

I swear I got robbed this week. We were up to 1440 and it still finishes slightly down. 🙁 😆

Still, congrats to the winners. Especially Mr. Average Joe there who has somehow turned out to be psychic. Never underestimate your demiurge brethren, eh?

Still, congrats to the winners. Especially Mr. Average Joe there who has somehow turned out to be psychic. Never underestimate your demiurge brethren, eh?

Atilla

Legendary member

- Messages

- 21,035

- Likes

- 4,207

Wackypete's total is wrong. His 1 point needs adding to it I believe, as he should be on 12?

Strange... the formula in the cell for EoW for WackyPete was missing... Not mi gov.

Thank you - updated now.

wackypete2

Legendary member

- Messages

- 10,211

- Likes

- 2,058

Strange... the formula in the cell for EoW for WackyPete was missing... Not mi gov.

Thank you - updated now.

I see how it is...keep Wacky down 😆

Peter

Pat494

Legendary member

- Messages

- 14,614

- Likes

- 1,588

Holy cr@p! The average nailed it right down to the decimal point.

Very scary!

Peter

Team effort imho

Atilla

Legendary member

- Messages

- 21,035

- Likes

- 4,207

I see how it is...keep Wacky down 😆

Peter

Perks of the job :cheesy:

Attachments

wackypete2

Legendary member

- Messages

- 10,211

- Likes

- 2,058

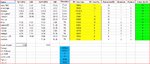

I'm sticking with 1399 again. Fiscal cliff worries will continue to keep the market depressed.

I can't post it. I don't see a new column.

Peter

I can't post it. I don't see a new column.

Peter

Pat494

Legendary member

- Messages

- 14,614

- Likes

- 1,588

Global (Chicago Options: ^RJSGTRUSD - news) shares trend lower on worries over "fiscal cliff"

* Tame U.S. inflation supports Fed easing, pressures dollar

* Surge in Chinese factory activity lifts oil prices

By Wanfeng Zhou and Herbert Lash

NEW YORK (Frankfurt: A0DKRK - news) , Dec 14 (Reuters) - Global shares wavered on Friday as investors fretted about the lack of progress in U.S. fiscal negotiations and signs of a deepening recession in the euro zone, but data indicating strong expansion in Chinese manufacturing helped lift oil prices.

China's vast manufacturing sector expanded in early December at the fastest pace in 14 months as new orders and employment rose, a survey showed, adding to evidence of a pick-up in the Chinese economy.

The dollar fell from a near nine-month high against the yen while the euro surged to its highest level against the greenback since early May as U.S. inflation data affirmed the Federal (SES: E1:F20.SI - news) Reserve's ultra-easy monetary policy.

Talks between President Barack Obama and House of Representatives Speaker John Boehner on budget negotiations designed to avert the "fiscal cliff" were seen at an apparent standstill on Friday. Some $600 billion in tax hikes and spending cuts set to begin in January, unless lawmakers reach a deal, are seen as a threat that could tip the U.S. economy back into recession.

Frustration has mounted over the lack of progress, reflected in a 0.6 percent drop in the S&P 500 (SNP: ^GSPC - news) on Thursday.

"The uncertainty that (the fiscal talks) is creating is basically holding the markets hostage in the short term," said Andres Garcia-Amaya, global market strategist at J.P. Morgan (KOSDAQ: 019990.KQ - news) Funds, in New York.

The Dow Jones industrial average was down 14.48 points, or 0.11 percent, at 13,156.24. The Standard & Poor's 500 Index was down 3.48 points, or 0.25 percent, at 1,415.97. The Nasdaq Composite Index was down 17.27 points, or 0.58 percent, at 2,974.89.

A 3.8 percent drop in shares of tech giant Apple (NasdaqGS: AAPL - news) after UBS (NYSEArca: SPGH - news) cut its price target to $700 from $780 weighed on Nasdaq (Nasdaq: ^NDX - news) . The stock has tumbled in recent months for several reasons, including investors locking in profits ahead of scheduled capital-gains increases for next year.

The MSCI global stock index traded almost flat at 336.94 points.

European shares slipped as investors banked profits after hitting 18-month highs earlier in the week, and some said the pan-European index was vulnerable to a deeper correction the longer U.S. budget talks remain at an impasse.

The FTSEurofirst 300 closed down 0.1 percent at 1,133.36.

"The bad news is, in large part, we've seen the market ignore relatively good news in the economic data stream as we focus on the fiscal cliff," said Art Hogan, managing director of Lazard Capital Markets in New York.

Data out of China was encouraging for its key trading partners, including the United States, and for the prospects for world economic growth. Oil prices rose as China is the world's second-largest oil consumer.

Brent crude rose $1.29 to $109.20 a barrel, on course to eke out its first weekly gain this month. U.S. crude rose 84 cents to settle at $86.73.

But the outlook for the euro zone economy remains gloomy.

Disappointing German manufacturing sector figures and a rise in euro zone unemployment overshadowed a small pick-up in purchasing manager data.

The German manufacturing purchasing managers index slipped to 46.3 in December from 46.8 the previous month, remaining well below the 50 threshold that divides growth from contraction and missing the consensus Reuters poll forecast for a rise to 47.2.

"All in all, the picture for the(euro zone) economy has not changed much after today's data," said Annalisa Piazza, an economist at Newedge Strategy in London. "GDP is expected to continue to contract in Q4-12, and there are no signs of improvement for the first part of next year."

The euro rose 0.6 percent to $1.3154, while the dollar slipped 0.24 percent to 83.42 yen.

The yen had earlier weakened after Japanese media reported the conservative Liberal Democratic Party is set for a resounding victory in elections on Sunday, cementing speculation that the party's leader, Shinzo Abe, will be in a strong position to push for bold monetary easing.

"Abe has been making pretty strong comments about inflation targeting and if we look at the economy Japan (EUREX: FMJP.EX - news) needs a lower currency without a doubt," said Maurice Pomery, managing director at consultants Strategic Alpha.

"This is going to put pressure on the BoJ. It's the start of a move lower in the yen that has a long way to go."

The benchmark 10-year U.S. Treasury note was up 6/32 in price to yield 1.711 percent.

The U.S. Labor Department said its Consumer Price Index dropped 0.3 percent last month as a sharp decline in gasoline prices offset increases in other areas. It was also the largest drop since May and followed a 0.1 percent gain in October.

"The crux of this report is simply that the inflationary backdrop remains very benign, providing the Fed with considerable breathing room to keep monetary policy accommodative," said Millan Mulraine, a senior economist at TD Securities in New York.

...

.

* Tame U.S. inflation supports Fed easing, pressures dollar

* Surge in Chinese factory activity lifts oil prices

By Wanfeng Zhou and Herbert Lash

NEW YORK (Frankfurt: A0DKRK - news) , Dec 14 (Reuters) - Global shares wavered on Friday as investors fretted about the lack of progress in U.S. fiscal negotiations and signs of a deepening recession in the euro zone, but data indicating strong expansion in Chinese manufacturing helped lift oil prices.

China's vast manufacturing sector expanded in early December at the fastest pace in 14 months as new orders and employment rose, a survey showed, adding to evidence of a pick-up in the Chinese economy.

The dollar fell from a near nine-month high against the yen while the euro surged to its highest level against the greenback since early May as U.S. inflation data affirmed the Federal (SES: E1:F20.SI - news) Reserve's ultra-easy monetary policy.

Talks between President Barack Obama and House of Representatives Speaker John Boehner on budget negotiations designed to avert the "fiscal cliff" were seen at an apparent standstill on Friday. Some $600 billion in tax hikes and spending cuts set to begin in January, unless lawmakers reach a deal, are seen as a threat that could tip the U.S. economy back into recession.

Frustration has mounted over the lack of progress, reflected in a 0.6 percent drop in the S&P 500 (SNP: ^GSPC - news) on Thursday.

"The uncertainty that (the fiscal talks) is creating is basically holding the markets hostage in the short term," said Andres Garcia-Amaya, global market strategist at J.P. Morgan (KOSDAQ: 019990.KQ - news) Funds, in New York.

The Dow Jones industrial average was down 14.48 points, or 0.11 percent, at 13,156.24. The Standard & Poor's 500 Index was down 3.48 points, or 0.25 percent, at 1,415.97. The Nasdaq Composite Index was down 17.27 points, or 0.58 percent, at 2,974.89.

A 3.8 percent drop in shares of tech giant Apple (NasdaqGS: AAPL - news) after UBS (NYSEArca: SPGH - news) cut its price target to $700 from $780 weighed on Nasdaq (Nasdaq: ^NDX - news) . The stock has tumbled in recent months for several reasons, including investors locking in profits ahead of scheduled capital-gains increases for next year.

The MSCI global stock index traded almost flat at 336.94 points.

European shares slipped as investors banked profits after hitting 18-month highs earlier in the week, and some said the pan-European index was vulnerable to a deeper correction the longer U.S. budget talks remain at an impasse.

The FTSEurofirst 300 closed down 0.1 percent at 1,133.36.

"The bad news is, in large part, we've seen the market ignore relatively good news in the economic data stream as we focus on the fiscal cliff," said Art Hogan, managing director of Lazard Capital Markets in New York.

Data out of China was encouraging for its key trading partners, including the United States, and for the prospects for world economic growth. Oil prices rose as China is the world's second-largest oil consumer.

Brent crude rose $1.29 to $109.20 a barrel, on course to eke out its first weekly gain this month. U.S. crude rose 84 cents to settle at $86.73.

But the outlook for the euro zone economy remains gloomy.

Disappointing German manufacturing sector figures and a rise in euro zone unemployment overshadowed a small pick-up in purchasing manager data.

The German manufacturing purchasing managers index slipped to 46.3 in December from 46.8 the previous month, remaining well below the 50 threshold that divides growth from contraction and missing the consensus Reuters poll forecast for a rise to 47.2.

"All in all, the picture for the(euro zone) economy has not changed much after today's data," said Annalisa Piazza, an economist at Newedge Strategy in London. "GDP is expected to continue to contract in Q4-12, and there are no signs of improvement for the first part of next year."

The euro rose 0.6 percent to $1.3154, while the dollar slipped 0.24 percent to 83.42 yen.

The yen had earlier weakened after Japanese media reported the conservative Liberal Democratic Party is set for a resounding victory in elections on Sunday, cementing speculation that the party's leader, Shinzo Abe, will be in a strong position to push for bold monetary easing.

"Abe has been making pretty strong comments about inflation targeting and if we look at the economy Japan (EUREX: FMJP.EX - news) needs a lower currency without a doubt," said Maurice Pomery, managing director at consultants Strategic Alpha.

"This is going to put pressure on the BoJ. It's the start of a move lower in the yen that has a long way to go."

The benchmark 10-year U.S. Treasury note was up 6/32 in price to yield 1.711 percent.

The U.S. Labor Department said its Consumer Price Index dropped 0.3 percent last month as a sharp decline in gasoline prices offset increases in other areas. It was also the largest drop since May and followed a 0.1 percent gain in October.

"The crux of this report is simply that the inflationary backdrop remains very benign, providing the Fed with considerable breathing room to keep monetary policy accommodative," said Millan Mulraine, a senior economist at TD Securities in New York.

...

.

Atilla

Legendary member

- Messages

- 21,035

- Likes

- 4,207

1398 for me this week. Mixed up with what my Moving Averages are saying compared to what I think.

MAs are down so following system. However, I'm thinking the bounce and break out into the new year to the upside is likely to continue.

Can't be bovered to give much credence to the Cliff discussions. Either way to me it is a lot of noise which will turn out to be inconsequential next year.

MAs are down so following system. However, I'm thinking the bounce and break out into the new year to the upside is likely to continue.

Can't be bovered to give much credence to the Cliff discussions. Either way to me it is a lot of noise which will turn out to be inconsequential next year.

Similar threads

- Replies

- 1K

- Views

- 158K

- Replies

- 1K

- Views

- 184K

- Replies

- 908

- Views

- 132K

- Replies

- 989

- Views

- 133K