You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Mr. Crabs

Established member

- Messages

- 598

- Likes

- 3

There is another side to this and that is to get out of this mess, if nobody bails out the US then for good many considerable years US will need to maintain a low dollar to be competitive with their exports.

Republicans going for this kind of response will really kill of any kind of competitiveness and ultimately mess up the US economy for many years.

In fact imports in contrast will continue to be cheaper and jobs exported else where. Pain will be felt by the many.

They'll then start bitching about the Chinese having a manipulated currency blah blah blah...

Madness imo. :whistling

Personally I think this "crisis" is a stunt. For profit and for sentiment. I expect it will be resolved before things escalate catastrophically. Politicians won't want to lose their standing overnight, GOP or Democrat. And if there is a collapse they surely will. So they will make a last minute deal if they have to. Obama is probably holding Washington by the balls over this stint.

Atilla

Legendary member

- Messages

- 21,037

- Likes

- 4,209

Personally I think this "crisis" is a stunt. For profit and for sentiment. I expect it will be resolved before things escalate catastrophically. Politicians won't want to lose their standing overnight, GOP or Democrat. And if there is a collapse they surely will. So they will make a last minute deal if they have to. Obama is probably holding Washington by the balls over this stint.

Weeheyy good to see you back Mr. Crabs... :clap: 👍

1717 for me this week....

wackypete2

Legendary member

- Messages

- 10,211

- Likes

- 2,058

Sorry, late this week.

1677.5

Peter

1677.5

Peter

mike.

Senior member

- Messages

- 2,101

- Likes

- 709

And me, 1704 please.Sorry, late this week.

1677.5

Peter

Atilla

Legendary member

- Messages

- 21,037

- Likes

- 4,209

Hi Guys,

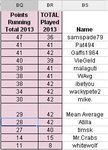

As per usual bulls to bears. Final QTR of 2013 up-on us mighty sly 😎

Make these forecasts count. Samspade in the over-all lead closely followed by Pat and Gaffs and of course me too with an astounding late stride to whizz by you in week 9 :cheesy:

Wishing you all best of luck... 👍

As per usual bulls to bears. Final QTR of 2013 up-on us mighty sly 😎

Make these forecasts count. Samspade in the over-all lead closely followed by Pat and Gaffs and of course me too with an astounding late stride to whizz by you in week 9 :cheesy:

Wishing you all best of luck... 👍

Attachments

Mr. Crabs

Established member

- Messages

- 598

- Likes

- 3

Weeheyy good to see you back Mr. Crabs... :clap: 👍

1717 for me this week....

Good call, markets doing well so far this week. If it takes profits heavily it probably won't even take us down to $1,700 before Fridays' close.

Looks like there's a decent chance you'll be exactly on the money this time. $1,717 would be a perfect platform to send us up to new highs before Halloween.

Atilla

Legendary member

- Messages

- 21,037

- Likes

- 4,209

Good call, markets doing well so far this week. If it takes profits heavily it probably won't even take us down to $1,700 before Fridays' close.

Looks like there's a decent chance you'll be exactly on the money this time. $1,717 would be a perfect platform to send us up to new highs before Halloween.

I wish so as its about time we had the end of year bounce kick in. Onwards and forwards. Having said that I was on the button sametime last week too and that one drifted away. Fingers crossed. 👍

Pat494

Legendary member

- Messages

- 14,614

- Likes

- 1,588

With the reopening of the Federal government, we will begin to see some of the delayed data releases from the past two weeks, including the September Employment report on Tuesday. Other regularly scheduled data releases may be delayed. Statistical agencies are expected to update schedules and indicate how they plan to deal with disruptions in their normal data collection processes during the month of October. As we go to press, we have no official confirmation from Census but believe that the September retail sales figures may also be available next week.

September employment indicators point to 160K nonfarm payroll gain with unchanged unemployment rate at 7.3%. Employment-related information for September was mixed but on balance points to a softer pace of hiring. Survey data points to a slower pace hiring in service-providing sectors. The unemployment rate is expected to remain unchanged at 7.3% with a rebound in both household employment and the labor force. On the positive side, weekly initial claims for unemployment moved lower. The 4-week moving average for initial claims stood at 305K at the end of September, down from the end of August when it was 329K. The employment index in the September Philadelphia Fed Business Outlook Survey moved up almost 7 points to 10.3. The employment component in the ISM manufacturing survey moved higher as well to 55.4 from 53.3. Employment indicators in other surveys, however, were less robust. The employment component in the September Empire State Manufacturing Survey moved down almost 4 points to 3.61, pointing to a slower pace of hiring for the month and that slowdown was mirrored in other Federal Reserve District manufacturing surveys The Beige Book reports for the September to early October period suggested some areas saw slower job growth, and that demand for skilled labour was high but that there had been increasing reports of difficulties finding qualified job candidates.

The employment component of the Dallas Fed’s September Texas Service Sector Outlook survey moved 3.8 points lower to 3.7. This survey shows a strong correlation with private service providing payrolls gains, and performs well our forecasting models, leading us to conclude that we may see a marginally softer pace of hiring in the September employment report, with lacklustre hiring in private service-providing jobs. The ISM non-manufacturing survey for September supported this notion with a 4.3 point decline in its employment index to 52.7.

Existing home sales likely declined 2.4% to a 5.35 million unit annual rate in September. Pending home sales, which typically become completed sales in one to two months, have declined over the past two months. Pending contracts fell by 1.6% in August and by 1.4% in July. Commentary from the National Association of Realtors in the August existing home sales report suggested that sales might be “uneven in the months ahead” as tight inventories in some areas remains a problem for some buyers and as higher interest rates affect affordability for others.

We forecast a small 0.1% decline in September new home sales to a 420K unit rate. Our forecast for new home sales ordinarily relies on data on new housing starts and permits, which was delayed this month due to the government shutdown. Our forecast assumes a slight decline in both September starts and permits. Available data from the National Association of Homebuilders survey for the month suggested a slight pullback in new home sales as well, with the index for current single family home sales falling back to 60 in September from 62.

We expect durable orders excluding transportation rose 0.5%. Boeing received orders for 127 new aircraft in September, up significantly from the 16 orders they received in August, indicating that the change in transportation orders will add significantly from the top-line orders figure. Apart from that, the new orders index in the September ISM manufacturing survey remained strong at 60.5, though slightly lower than in August, while regional Fed surveys were more optimistic about new orders. On balance, indicators for growth in durable goods orders in September point in a positive direction

We look for the final October

University of

Michigan Consumer Sentiment survey to be revised down 2.2 points to 73.0. The government shutdown and debt ceiling battle likely weighed on consumer sentiment for much of October. The weekly Bloomberg Consumer Comfort index hit a two-year low last week, with many Americans’ perception of the economy worsening. This survey covered the period through October 13, and as the Michigan survey will extend through a longer period, the negative impacts from the shutdown may be moderated by surveys completed after the reopening of the government.

We forecast weaker September retail sales with a 0.1% decline in top-line sales, while retail sales excluding autos likely rose just 0.1% Retail Sales (September) 21-25 October ? Motor vehicle sales came in weaker at a 15.3 million unit annual rate in September, down 5% from August, though largely due to a calendar quirk where Labor Day holiday weekend sales were counted as part of the August sales month. Weaker auto sales should subtract from the top-line retail sales figure – excluding motor vehicles, we look for a 0.1% gain in retail sales. Gasoline prices were lower during the month, which will drag down nominal sales receipts, and consumer confidence suffered in September. At the beginning of the month there was somewhat substantial uncertainty about potential U.S. military involvement in Syria, the middle of the month was marked by some financial market volatility around the Fed’s announcement that it would not begin to taper its asset purchases, and the end of the month was topped off with an impasse in Congress over the FY 2014 budget that led to a government shut down. All of these factors weighed on consumer confidence in September and we are likely to see somewhat softer retail sales as a result.

September employment indicators point to 160K nonfarm payroll gain with unchanged unemployment rate at 7.3%. Employment-related information for September was mixed but on balance points to a softer pace of hiring. Survey data points to a slower pace hiring in service-providing sectors. The unemployment rate is expected to remain unchanged at 7.3% with a rebound in both household employment and the labor force. On the positive side, weekly initial claims for unemployment moved lower. The 4-week moving average for initial claims stood at 305K at the end of September, down from the end of August when it was 329K. The employment index in the September Philadelphia Fed Business Outlook Survey moved up almost 7 points to 10.3. The employment component in the ISM manufacturing survey moved higher as well to 55.4 from 53.3. Employment indicators in other surveys, however, were less robust. The employment component in the September Empire State Manufacturing Survey moved down almost 4 points to 3.61, pointing to a slower pace of hiring for the month and that slowdown was mirrored in other Federal Reserve District manufacturing surveys The Beige Book reports for the September to early October period suggested some areas saw slower job growth, and that demand for skilled labour was high but that there had been increasing reports of difficulties finding qualified job candidates.

The employment component of the Dallas Fed’s September Texas Service Sector Outlook survey moved 3.8 points lower to 3.7. This survey shows a strong correlation with private service providing payrolls gains, and performs well our forecasting models, leading us to conclude that we may see a marginally softer pace of hiring in the September employment report, with lacklustre hiring in private service-providing jobs. The ISM non-manufacturing survey for September supported this notion with a 4.3 point decline in its employment index to 52.7.

Existing home sales likely declined 2.4% to a 5.35 million unit annual rate in September. Pending home sales, which typically become completed sales in one to two months, have declined over the past two months. Pending contracts fell by 1.6% in August and by 1.4% in July. Commentary from the National Association of Realtors in the August existing home sales report suggested that sales might be “uneven in the months ahead” as tight inventories in some areas remains a problem for some buyers and as higher interest rates affect affordability for others.

We forecast a small 0.1% decline in September new home sales to a 420K unit rate. Our forecast for new home sales ordinarily relies on data on new housing starts and permits, which was delayed this month due to the government shutdown. Our forecast assumes a slight decline in both September starts and permits. Available data from the National Association of Homebuilders survey for the month suggested a slight pullback in new home sales as well, with the index for current single family home sales falling back to 60 in September from 62.

We expect durable orders excluding transportation rose 0.5%. Boeing received orders for 127 new aircraft in September, up significantly from the 16 orders they received in August, indicating that the change in transportation orders will add significantly from the top-line orders figure. Apart from that, the new orders index in the September ISM manufacturing survey remained strong at 60.5, though slightly lower than in August, while regional Fed surveys were more optimistic about new orders. On balance, indicators for growth in durable goods orders in September point in a positive direction

We look for the final October

University of

Michigan Consumer Sentiment survey to be revised down 2.2 points to 73.0. The government shutdown and debt ceiling battle likely weighed on consumer sentiment for much of October. The weekly Bloomberg Consumer Comfort index hit a two-year low last week, with many Americans’ perception of the economy worsening. This survey covered the period through October 13, and as the Michigan survey will extend through a longer period, the negative impacts from the shutdown may be moderated by surveys completed after the reopening of the government.

We forecast weaker September retail sales with a 0.1% decline in top-line sales, while retail sales excluding autos likely rose just 0.1% Retail Sales (September) 21-25 October ? Motor vehicle sales came in weaker at a 15.3 million unit annual rate in September, down 5% from August, though largely due to a calendar quirk where Labor Day holiday weekend sales were counted as part of the August sales month. Weaker auto sales should subtract from the top-line retail sales figure – excluding motor vehicles, we look for a 0.1% gain in retail sales. Gasoline prices were lower during the month, which will drag down nominal sales receipts, and consumer confidence suffered in September. At the beginning of the month there was somewhat substantial uncertainty about potential U.S. military involvement in Syria, the middle of the month was marked by some financial market volatility around the Fed’s announcement that it would not begin to taper its asset purchases, and the end of the month was topped off with an impasse in Congress over the FY 2014 budget that led to a government shut down. All of these factors weighed on consumer confidence in September and we are likely to see somewhat softer retail sales as a result.

M

malaguti

I'm gonna plump for 1745 next week please

Atilla

Legendary member

- Messages

- 21,037

- Likes

- 4,209

Very sorry guys have had an unusually bad weekend with emergencies... 🙁

Briefly here are the results from last weeks close.

Podium places are;

Malaguti takes gold :clap:

Gaffs takes silver 👍

Atilla takes bronze 🙂

Keep the forecasts coming:!:

Briefly here are the results from last weeks close.

Podium places are;

Malaguti takes gold :clap:

Gaffs takes silver 👍

Atilla takes bronze 🙂

Keep the forecasts coming:!:

Attachments

Last edited:

Atilla

Legendary member

- Messages

- 21,037

- Likes

- 4,209

Mama mia 1761 per favore

What is this - each call trying to out-do the other.

I'd like to make a forecast on Pete's forecast @ 1762 :cheesy:

Timsk sd be here to see everyone using his system. What a sell out 😛

wackypete2

Legendary member

- Messages

- 10,211

- Likes

- 2,058

Very sorry guys have had an unusually bad weekend with emergencies... 🙁

I hope all is well.

Peter

wackypete2

Legendary member

- Messages

- 10,211

- Likes

- 2,058

1731.5 🙂

Peter

Peter

Similar threads

- Replies

- 1K

- Views

- 184K

- Replies

- 1K

- Views

- 158K

- Replies

- 908

- Views

- 133K

- Replies

- 989

- Views

- 133K