hi all

what is the best time frame to use fibs

It probably depends on the time frame are you using to make entry and exit decisions.

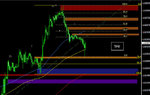

If you are using the daily chart to draw the Fibonnaci plot and then are looking at the 5 minute level for your entry time you may not get a clear signal on the line - you may get a rough period and a number of false starts around it before it goes. However, if you used 30 minutes, you might get a clearer signal at 5 minutes. What is important is that you draw the plot correctly.

Currently I'm going from the wick (high/low) to the close (price low/high). Something I'm still confirming as I've only begun to learn Fibonnaci in the last month or so.