Grey1

Senior member

- Messages

- 2,190

- Likes

- 210

I believe that the real money is made catching the big swing in the market. .

This is the most important issue in trading ,, I have a program trade that scalps for 20-30C perstock and makes lot of $$ how ever the only reason that is making $$ is because it is fully automated and can get in and out of 20 stocks and manage and control the risk at the same time but most traders don't have this facility ( impossible to do this manually ) and I think what TraderDante is saying is well well worth concentrating upon..

Saying that ,, identifying the trend direction is not an easy task and it is far easier said than done. In fact with out proper education not many can identify the trend formation early enough to capitalize on .

Catching the TREND is the first priority in DAY TRADING ,, the rest ( risk managment,money managment ) is secondary.

I am amazed that so many people still arguing about where to put their stops than learning the theoretical / fundamental concepts for the BIRTH of the trend.

Unless you learn to catch the TREND , there is little point in fighting over the stop loss.:smart:

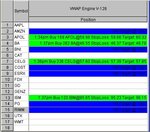

attachment shows some of the trades today

Grey1