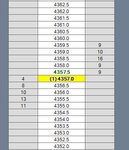

This is pretty much impossible to answer consistently - it varies from second to second. I've attached a screenshot of the FTSE ladder - I don't normally watch it, so no idea how typical it is, but the important thing is knowing how this all works.

Basically, the numbers in the right hand column are limit sell orders from other traders, which are the contracts you'd be buying if you put in a market buy order. Currently 9 contracts are available to buy at 4357.5, 16 at 4358.5 etc. The other side of the ladder is the reverse - if you want to sell, someone will buy 8 of your contracts at 4356.5, 10 at 4356.0 etc.

So if you try to buy 20 contracts at market, you'll get 9 at 4357.5, 9 at 4358.0, and 2 at 4358.5 - make sense?

The problem in giving a definitive answer is that all these numbers are changing constantly, so if you aren't watching, you've got no real way of knowing how much is available. Even if you are watching, it's possible that someone else could get a big order in just before you, taking out a couple price levels, and slipping you much further than you could've expected.

edit: should also note that this screenshot only shows 5 levels on each side - in reality there are orders at higher/lower levels, which will become visible as price moves towards them.

edit2: dante makes another good point below