You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

trading direct right now a320....it varies

i am in two minds about this market.

in my analysis and on Bloomberg I said I was bearish against the 61.8% in the Dow. I have a few small shorts there but nothing big. I pretty much got what I wanted on the short side today in the Dax and tried to reverse....my stops prevented damage, and tried again....

The darn thing is that the path is pointing higher, and I have made some cash out of it today, but I am sure anyone who reads this will agree with me that a reversal from being down 140 points in the Dow is quite unlikely....

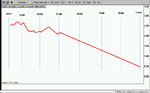

The market looks weak and I have already got the pattern for tomorrow. that should be a trend day down. I just cant gel that unless we are beginning some serious rot in the market, and I feel it is too early.

The cycle chart I showed earlier produced a nice reversal. I think the battle for 9000 has begun.

When the Dow declines like this after an option expiration, it looks to me as if the portfolio managers are buying some more insurance ( puts ) which could be the cause of the smash down this afternoon. In that case we are in for a volatile week with tripple digit gains and losses from day to day.....

just a thought

Sun

i am in two minds about this market.

in my analysis and on Bloomberg I said I was bearish against the 61.8% in the Dow. I have a few small shorts there but nothing big. I pretty much got what I wanted on the short side today in the Dax and tried to reverse....my stops prevented damage, and tried again....

The darn thing is that the path is pointing higher, and I have made some cash out of it today, but I am sure anyone who reads this will agree with me that a reversal from being down 140 points in the Dow is quite unlikely....

The market looks weak and I have already got the pattern for tomorrow. that should be a trend day down. I just cant gel that unless we are beginning some serious rot in the market, and I feel it is too early.

The cycle chart I showed earlier produced a nice reversal. I think the battle for 9000 has begun.

When the Dow declines like this after an option expiration, it looks to me as if the portfolio managers are buying some more insurance ( puts ) which could be the cause of the smash down this afternoon. In that case we are in for a volatile week with tripple digit gains and losses from day to day.....

just a thought

Sun

A very nice consolidation forming on the ES at lows between 977 and 980 for the last few hours as I suggested would happen. We'll probably get a little tester out of the top of the range to catch all the breakout fans before falling back and out the bottom.

Bullish Bear

Member

- Messages

- 64

- Likes

- 0

The Path hasn't been so clear today...

Any thoughts on why?

Any thoughts on why?

Good morning,

It looks to me as if the institutions were putting on sell-programs in the tracker stocks like the Spider and QQQ to protect their profits into month end. The month-end is a crucial event for these funds, as they want to hedge as much profit from a phenomenal quarter as possible.

The low of the day in the Dow and the SP were each significant. The square root of the high in the Dow of 9352 – 1.618 gives the lows of yesterday. The same procedure with the SP 1015.75 squared minus 0.618 will give you yesterdays low. If yesterday’s lows give in, the market could continue down and down. I still think it is too early but we are clearly getting very close to the final high. The institutions are nervous and are looking to protect themselves. The question is if we can stabilise here and move higher.

If the S&P futures trade above 982 I would scalp long. Below 975 would mean trouble for the bulls.

The Bradley model which has pretty much marked every turn in the market over the last 36 months are coming in as a high tonight. It then prints a lower high into the first days of July. It is tricky to time a high precisely, but I will be inclined to put on some more short positions for the expected selling in July. The problem is in my mind there is still a 50/50 chance of a trip back into the 1010 in the SP500.

FED days

Today will see the beginning of the 2-day FOMC meeting in the US. This should not affect stocks too much today. Tomorrow, however, is likely to be a low volume day. The way I play the Fed days are based on observation. The minute the announcement is released you will see a spike. Then you see some kind of counter spike before a third spike. Since 2000 I have followed the Fed days and this is always the pattern. Essentially the first spike is the direction the market will go once the dust settles. The second spike is the fake spike, while the 3rd spike is continuation of the original impulse. This usually takes place over 45 minutes or so.

The Expected Path

I am getting conflicting evidence today. Essentially I am looking for a trend day with continuation all day. There should be a very powerful open and the direction of the open will set the tone for the day. As the 976 area in the SP is crucial for the bulls I will expect a lot of selling if this is taken out. However, I can’t rule out that the cycle inverses and we get a trend day higher. The path for the day is essentially calling for a gap and continuation.

It looks to me as if the institutions were putting on sell-programs in the tracker stocks like the Spider and QQQ to protect their profits into month end. The month-end is a crucial event for these funds, as they want to hedge as much profit from a phenomenal quarter as possible.

The low of the day in the Dow and the SP were each significant. The square root of the high in the Dow of 9352 – 1.618 gives the lows of yesterday. The same procedure with the SP 1015.75 squared minus 0.618 will give you yesterdays low. If yesterday’s lows give in, the market could continue down and down. I still think it is too early but we are clearly getting very close to the final high. The institutions are nervous and are looking to protect themselves. The question is if we can stabilise here and move higher.

If the S&P futures trade above 982 I would scalp long. Below 975 would mean trouble for the bulls.

The Bradley model which has pretty much marked every turn in the market over the last 36 months are coming in as a high tonight. It then prints a lower high into the first days of July. It is tricky to time a high precisely, but I will be inclined to put on some more short positions for the expected selling in July. The problem is in my mind there is still a 50/50 chance of a trip back into the 1010 in the SP500.

FED days

Today will see the beginning of the 2-day FOMC meeting in the US. This should not affect stocks too much today. Tomorrow, however, is likely to be a low volume day. The way I play the Fed days are based on observation. The minute the announcement is released you will see a spike. Then you see some kind of counter spike before a third spike. Since 2000 I have followed the Fed days and this is always the pattern. Essentially the first spike is the direction the market will go once the dust settles. The second spike is the fake spike, while the 3rd spike is continuation of the original impulse. This usually takes place over 45 minutes or so.

The Expected Path

I am getting conflicting evidence today. Essentially I am looking for a trend day with continuation all day. There should be a very powerful open and the direction of the open will set the tone for the day. As the 976 area in the SP is crucial for the bulls I will expect a lot of selling if this is taken out. However, I can’t rule out that the cycle inverses and we get a trend day higher. The path for the day is essentially calling for a gap and continuation.

Attachments

Sun,

Dow made consolidation at low of range,and is now developing down trend.Possible big move today also,although up or down not sure.Will follow break 9045 down or 9080 up.

9600 looking more unllikely now,top may be limited to downtrend line at 9400/50.

Cheers

Dow made consolidation at low of range,and is now developing down trend.Possible big move today also,although up or down not sure.Will follow break 9045 down or 9080 up.

9600 looking more unllikely now,top may be limited to downtrend line at 9400/50.

Cheers

Steve,

Looking at the 55 ema and 200 ma the trend is still very much up, but the 3-day swing chart shows the trend is down....the 20 day MA which has held most of the declines so far was pierced last night and held. I dont think we will see more than 1 one more downday until the bulls are back to support the market. The big boys will defend the 9000 area in the Dow. So maybe a down opening and a bounce....

this does of course not tie in with my expected path for the day

Looking at the 55 ema and 200 ma the trend is still very much up, but the 3-day swing chart shows the trend is down....the 20 day MA which has held most of the declines so far was pierced last night and held. I dont think we will see more than 1 one more downday until the bulls are back to support the market. The big boys will defend the 9000 area in the Dow. So maybe a down opening and a bounce....

this does of course not tie in with my expected path for the day

Tom,

I have analysed the last 18 months of intra-day data and the day after a reasonable move is more often than not choppy. Not always of course, sometimes you get follow through and sometimes you get a nice reversal.

The way that I trade favours nice smooth trending days. I like to get in close to the open when the trend is established then close the trade at the close for lots of points! On big move days the market usually feeds itself as people jump on board in fear of losing out and the market will end close to the extreme for the day. When that happens the next day normally brings a little indecision and the market gets choppy. Of course yesterday did close off the lows with strength going into the close so today could see an upside reversal. For me though there is not a high enough probability of a good trend lasting the day, therefore I won't trade at all. I only like to trade when I feel the odds really favour a nice smooth ride.

Check the charts for 4/5 June 03 and 16/17 june 03 for examples of what I mean.

I don't try to predict the market at all and I don't care if it goes up or down. I trade when, based on my own analysis, the market offers me the best odds of a good move. Today, in my book is not one of those days, that's not to say that it won't go up 200 points though, just the probability of it happening is not high enough for me.

I have analysed the last 18 months of intra-day data and the day after a reasonable move is more often than not choppy. Not always of course, sometimes you get follow through and sometimes you get a nice reversal.

The way that I trade favours nice smooth trending days. I like to get in close to the open when the trend is established then close the trade at the close for lots of points! On big move days the market usually feeds itself as people jump on board in fear of losing out and the market will end close to the extreme for the day. When that happens the next day normally brings a little indecision and the market gets choppy. Of course yesterday did close off the lows with strength going into the close so today could see an upside reversal. For me though there is not a high enough probability of a good trend lasting the day, therefore I won't trade at all. I only like to trade when I feel the odds really favour a nice smooth ride.

Check the charts for 4/5 June 03 and 16/17 june 03 for examples of what I mean.

I don't try to predict the market at all and I don't care if it goes up or down. I trade when, based on my own analysis, the market offers me the best odds of a good move. Today, in my book is not one of those days, that's not to say that it won't go up 200 points though, just the probability of it happening is not high enough for me.

Last edited: